As a researcher with extensive experience in cryptocurrency analysis, I’m excited to see Bitcoin’s price showing signs of recovery after a prolonged correction. However, it’s crucial to assess whether this recent downturn is truly over and if new all-time highs are still within reach.

Bitcoin‘s price is exhibiting promising signs of a rebound. The significant price drop we’ve seen recently raises two essential questions: has the correction ended, and can we expect additional record-breaking highs? Let us delve deeper into this topic.

Technical Analysis

By TradingRage

The Daily Chart

As a crypto investor, I’ve noticed that the daily chart shows a declining trend for the price since it fell short of breaking through the $75K resistance in early June. Yet, the $60K support has been steadfast, effectively halting any further descent below this level.

Based on the bullish candle formation we witnessed yesterday, it appears that the crypto market may be in the process of establishing a bottom around the $60,000 level. If this holds true, we can expect an imminent new rally, which is sure to rekindle the enthusiasm and curiosity within the community once more.

As a crypto investor, I’d interpret this situation as follows: The current price trend can hold up until the $60,000 resistance level and the 200-day moving average, approximately at $58,000, keep their ground.

The 4-Hour Chart

On the 4-hour timeframe, Bitcoin’s price has made progress, surpassing the bearish trendline that had held firm for nearly a month.

Although this may represent the initial sign of a bullish turnaround, it’s crucial that the price stays above the trendline for further confirmation.

Additionally, the Relative Strength Index (RSI) is registering readings above 50%, implying that bullish momentum has returned. Consequently, provided the price stays above the trendline and the $60K mark, investors can look forward to the correction having run its course.

On-Chain Analysis

By TradingRage

Bitcoin Exchange Reserve

Bitcoins price appears to have hit rock bottom after a prolonged period of downward trends in the market. However, delving into on-chain data provides valuable perspectives to determine if this is indeed the case.

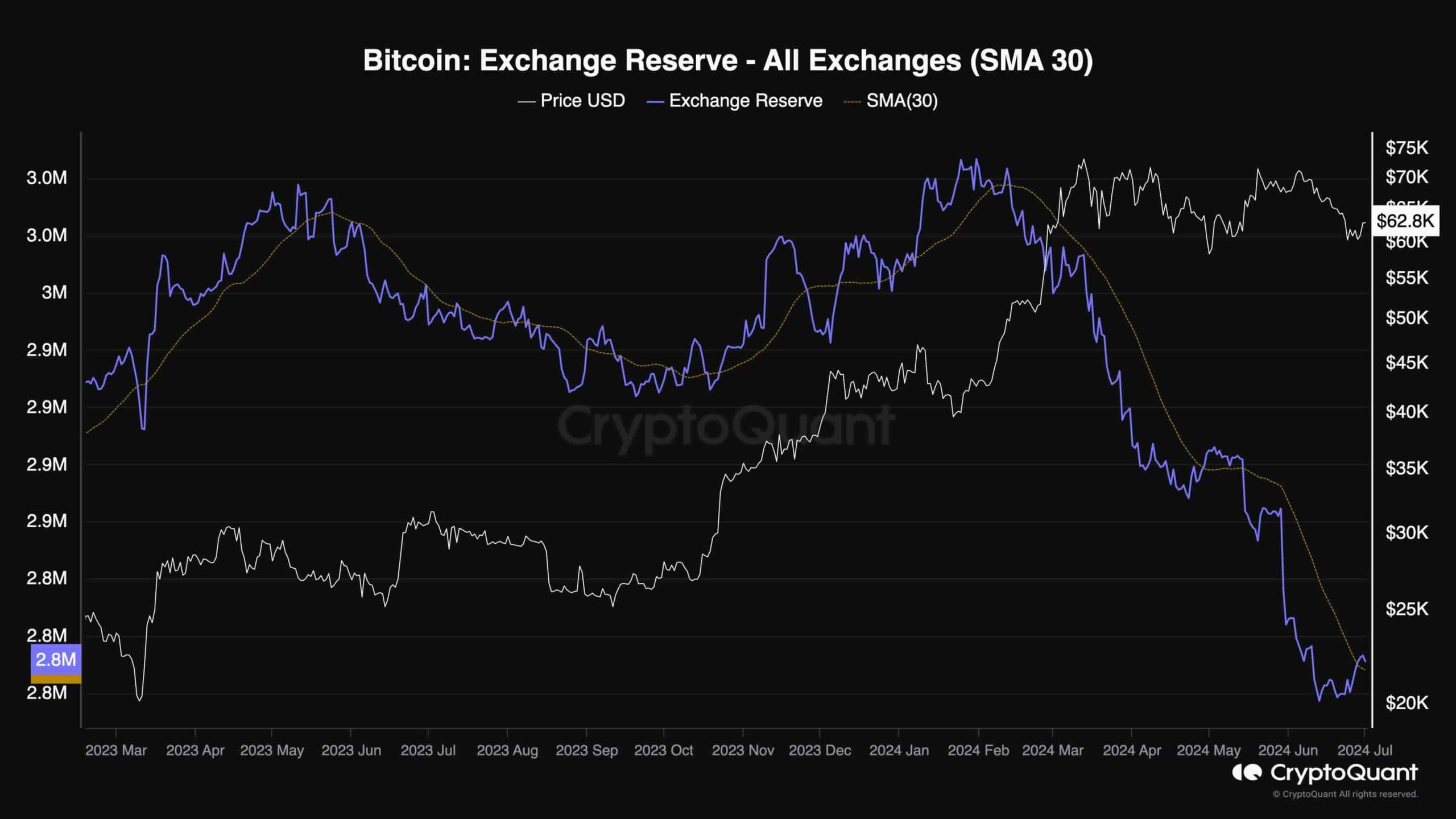

This chart illustrates the Bitcoin Exchange Reservoir, representing the quantity of Bitcoins kept in exchange wallets. A rise signifies investors transferring their coins to exchanges for trading purposes. Conversely, a decrease indicates holders withdrawing their coins from exchanges and moving them to their private wallets.

Over the last several months, the Exchange reserve metric for the cryptocurrency has noticeably decreased. Lately, however, there’s been a slight increase in this metric, indicating that numerous investors may have recently sold their coins during the latter phases of the recent price downturn.

A increase in supply may be detrimental to prices, but it could signal a capitulation stage, typically occurring towards the end of downtrends. Consequently, if the Exchange Reserve indicator reverts to its downward trajectory, we can expect the market to reach a new record high shortly.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- FIO PREDICTION. FIO cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- BONE PREDICTION. BONE cryptocurrency

- WALV PREDICTION. WALV cryptocurrency

- Bitcoin’s Unreliable Death Cross Is Looming Again

- Did the Megalopolis Trailer Make Up All Those Movie-Critic Quotes?

- Ethereum Suffers $61M Outflows, Worst Performance Since August 2022

- Decoding the Cosmic Conundrum in Honkai: Star Rail – Why So Serious?

2024-07-01 15:48