As a seasoned researcher with years of trading experience under my belt, I must admit that the recent price action of Bitcoin has piqued my interest. The breakthrough of the 200-day moving average and the resistance level at $64K on the daily chart suggests that the consolidation period may indeed be over.

It appears that Bitcoin‘s price could be indicating a sustained upward trend, but it remains unclear whether we have moved past the consolidation phase or if this is simply a short-term surge.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

For a while now, Bitcoin’s day-to-day graph shows it holding steady just under its 200-day moving average, which is roughly at the $64K level.

Today’s market behavior seems to indicate that the consolidation phase has ended, given that the daily price movement has surpassed the 200-day moving average and breached the $64K mark, a previous resistance level.

Should the daily candle finish higher than the current resistance points, investors might feel encouraged that the market could experience a short-term surge towards the $68,000 mark.

The 4-Hour Chart

Within a four-hour span, the market exhibits a fully optimistic setup, with the price successfully breaching the substantial bullish pennant it had been confined within over the past couple of weeks.

A breakout from a flag pattern is a clear continuation signal based on classical price action.

If the breakout is verified as genuine and the price maintains itself above the $64K mark, it’s likely that the $68K resistance area could serve as a potential target.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Bitcoin Funding Rates

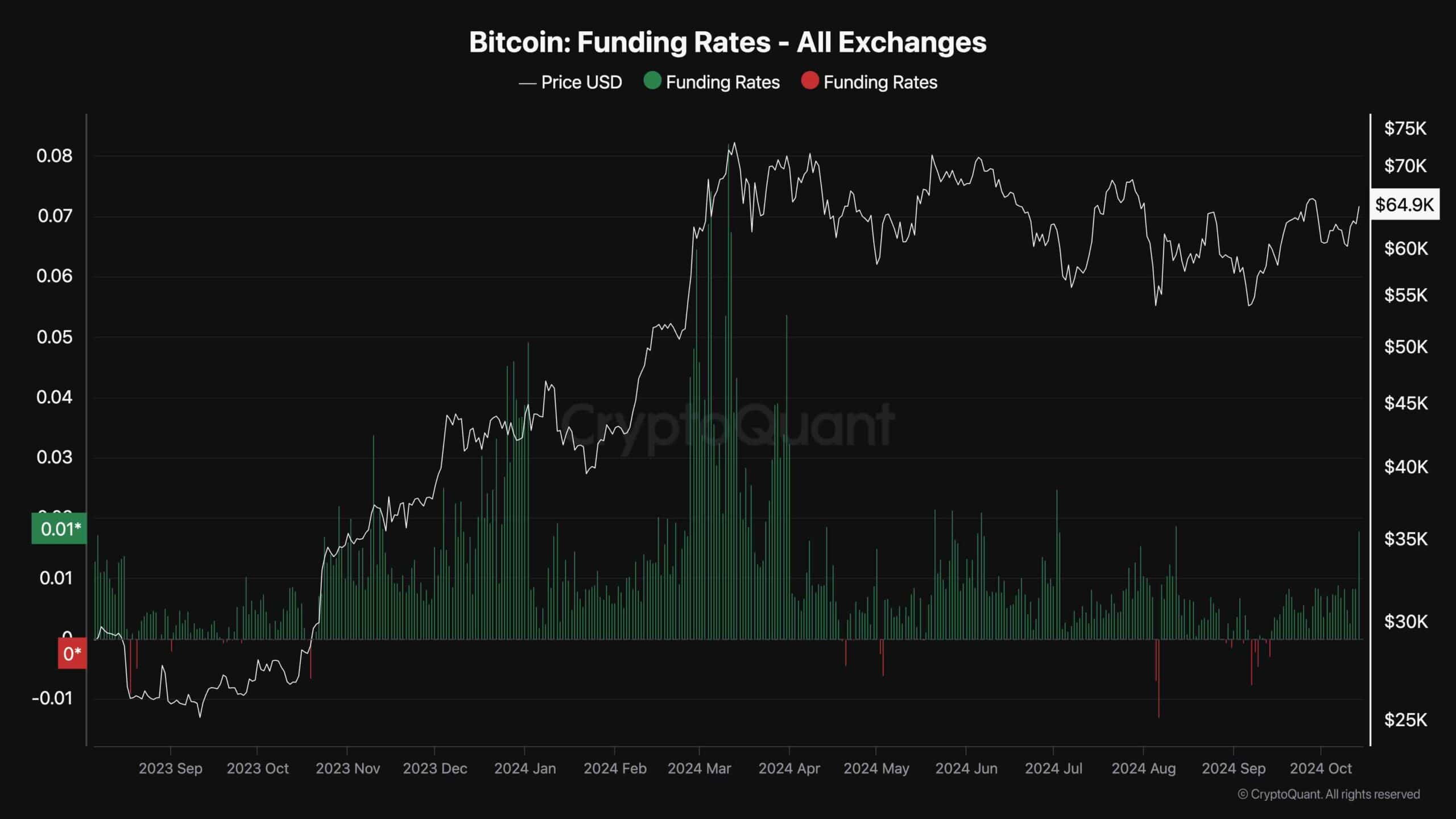

As Bitcoin’s price indicates a willingness to persist in its prolonged upward trajectory, so too does the mood in the futures market suggest that traders are becoming more hopeful.

As a researcher, I’ve created this graph to illustrate the BTC funding rates metric, a tool that shows if traders are placing buy or sell orders for perpetual futures contracts more actively. When the values are positive, it suggests a bullish attitude among traders, indicating they believe Bitcoin will rise. On the flip side, negative values point towards bearish sentiments, suggesting traders anticipate a decrease in Bitcoin’s price.

Based on the graph’s indication, funding rates experienced a substantial increase today, hinting that the market might surpass a crucial resistance point soon.

Yet, while it might seem natural, investors should still be cautious. A sudden surge in funding rates might lead to a long liquidation cascade, which could halt the market’s rally.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- GBP CNY PREDICTION

- DAO PREDICTION. DAO cryptocurrency

- PERP PREDICTION. PERP cryptocurrency

- PIP PREDICTION. PIP cryptocurrency

- CGO PREDICTION. CGO cryptocurrency

- GBP CHF PREDICTION

- PAW PREDICTION. PAW cryptocurrency

2024-10-14 15:34