As a seasoned researcher with over two decades of market analysis under my belt, I’ve seen trends come and go, but none quite like the unpredictable rollercoaster that is Bitcoin. The current consolidation below the $100K milestone has left investors on tenterhooks, eagerly waiting for the six-figure BTC price to materialize.

The cost of Bitcoin is gathering strength just shy of the $100,000 landmark, as investors remain patient for the sight of a six-digit Bitcoin rate.

Despite a sharp decline in the asset’s value today, it still remains uncertain if the set goal can be reached promptly.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the last few weeks, the asset has been pushing past multiple barriers indicated on its daily graph, indicating a potential rise towards $100,000. Nevertheless, it hasn’t hit this figure yet, as the market is currently moving horizontally. With the $90,000 support holding strong, investors might anticipate an upward surge and breakthrough above $100,000.

If the price falls below $90,000, it might lead to a substantial decline that could take us towards the $80,000 region.

The 4-Hour Chart

The 4-hour chart illustrates the recent BTC price action, as the market has been consolidating inside a symmetrical triangle pattern. These patterns can either be continuation or reversal ones, depending on the direction of the breakout. Therefore, if the market can break above the triangle, a bullish continuation toward and above the $100K mark would be likely.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

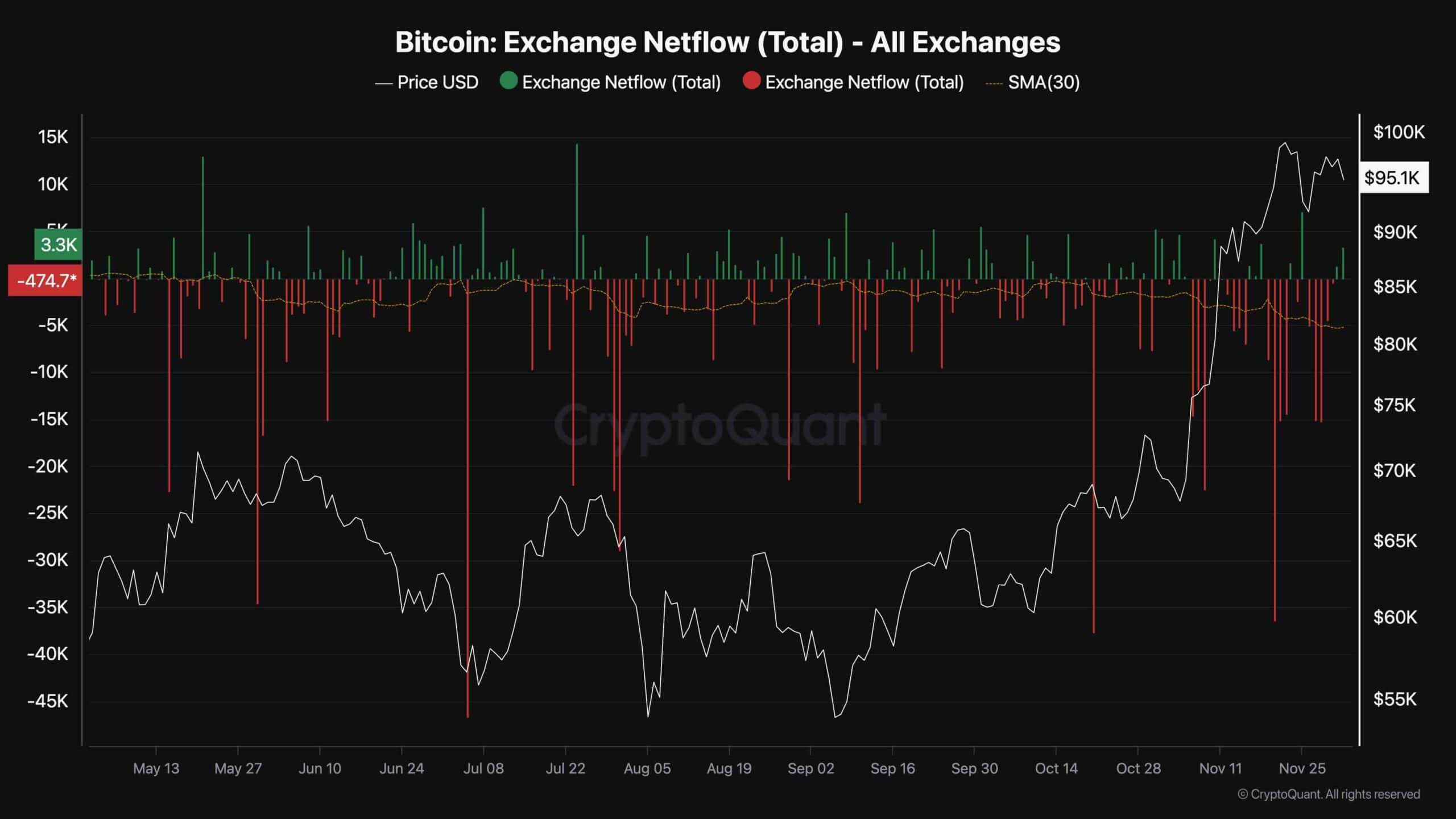

Exchange Netflow (30-Day Moving Average)

You can examine how Bitcoin is collected and dispersed in the main trading market by using the exchange netflow indicator. This tool calculates the total amount of Bitcoin entering and leaving centralized exchanges, with deposits subtracting withdrawals. If the value is positive, it means Bitcoin is being distributed; negative values suggest it’s being accumulated.

As the chart suggests, there have been substantial negative netflows recently, as investors are rapidly accumulating BTC in the hopes of a rally above $100K soon. The 30-day moving average of the BTC netflows has also consistently shown negative values over the past six months. As a result, if the derivatives market does not create an obstacle, the demand in the spot market will likely push the price higher in the coming months.

Read More

- SUI PREDICTION. SUI cryptocurrency

- COW PREDICTION. COW cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- WLD PREDICTION. WLD cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- Starseed Asnia Trigger Tier List & Reroll Guide

- What Persona Fans Hope to See in Persona 6 and What Might Disappoint

- GBP CAD PREDICTION

2024-12-02 15:22