As a seasoned analyst with over two decades of trading experience under my belt, I find myself closely monitoring Bitcoin’s current market situation. With my finger on the pulse of the crypto world, I can confidently say that the recent price recovery is indeed intriguing. However, the market is at a critical juncture, and the next move could potentially shape Bitcoin’s mid-term future.

Over the last fortnight, Bitcoin‘s value has been on an upward trend. We’re at a crucial stage now, and this may influence Bitcoin’s trajectory for the next few months.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the past few days, the graph demonstrates that Bitcoin’s price has increased after bouncing off the support of $52,500 earlier this month. In the last few weeks, BTC has managed to regain the $57,000 and $60,000 thresholds. However, it’s worth noting that the significant resistance at $64,000, reinforced by the 200-day moving average, still stands strong, as the market has been repeatedly testing this level recently.

In simple terms, if we experience a strong upward movement (bullish breakout), it’s quite probable that a fresh record high will be reached within the upcoming weeks. Furthermore, there’s a good chance this trend will persist, as the Relative Strength Index (RSI) is currently above 50%, indicating generally positive momentum.

The 4-Hour Chart

On the 4-hour timeframe, we see a distinct upward trajectory, with the price fluctuating both up and down. But as the market steadily climbs within an ascending channel, there’s a potential indication of a future drop.

Should the $64,000 resistance level push back the price and the trend shifts downwards, a potential fall could occur, reaching approximately $60,000 or even dipping to $57,000. However, based on the daily timeframe analysis, there remains a substantial chance for the prices to keep rising as well.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

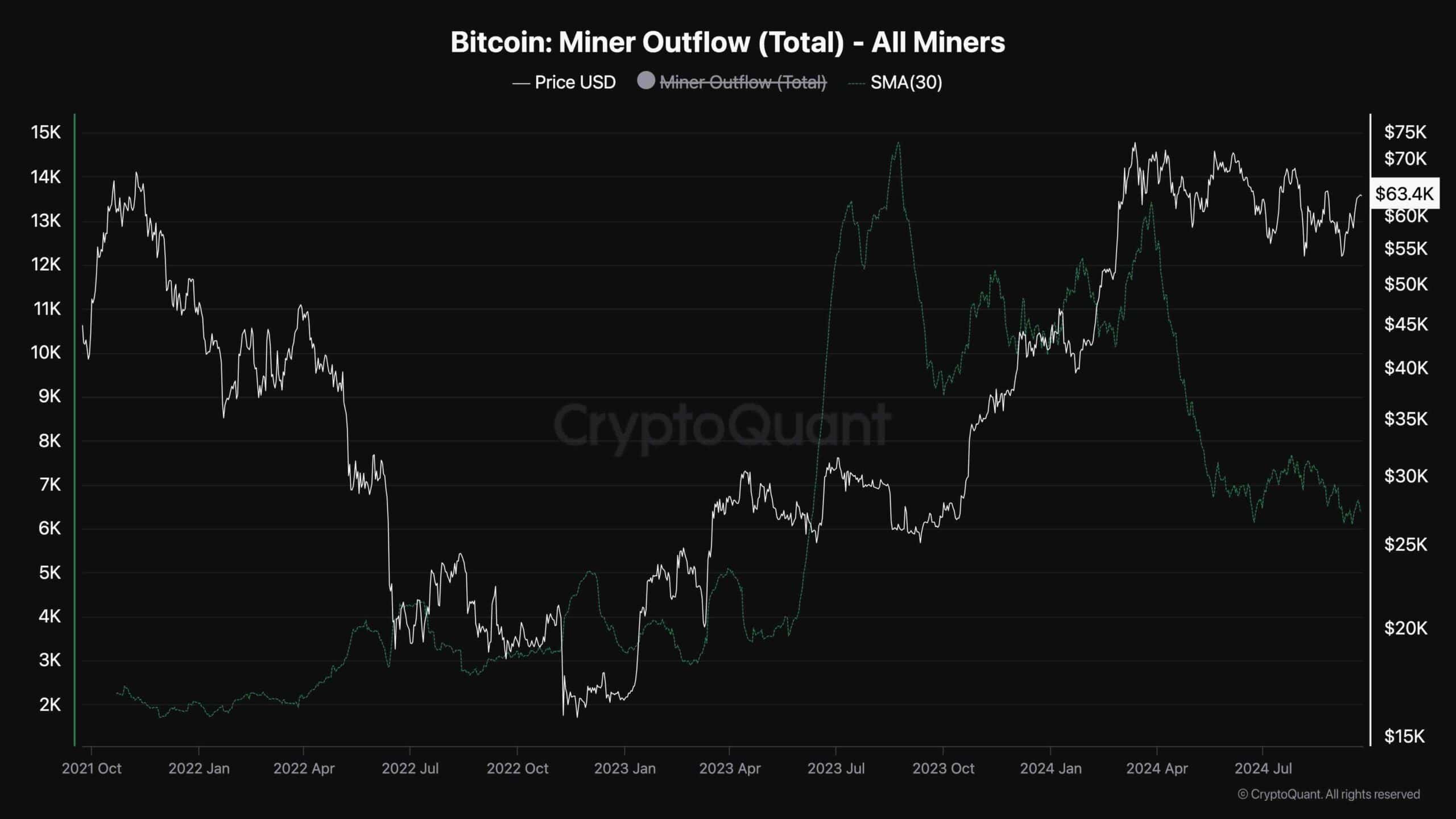

Bitcoin Miner Outflow (30-day moving average)

Over the past few months, following Bitcoin’s record peak in price, mining activity has noticeably altered. The enclosed graph illustrates the 30-day moving average for the BTC miner outflow indicator, which quantifies the amount of Bitcoin being withdrawn from miners’ digital wallets.

Based on the graph, it seems they’ve lessened their urge to sell during this period of price stabilization. This could imply that the miners are now prepared to maintain their positions for increased prices. Over time, this reduction in supply might trigger a price surge in the upcoming months.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AEVO PREDICTION. AEVO cryptocurrency

- BRISE PREDICTION. BRISE cryptocurrency

- GBP CAD PREDICTION

- WOO PREDICTION. WOO cryptocurrency

- WELT PREDICTION. WELT cryptocurrency

2024-09-23 16:30