As a seasoned researcher with years of experience in the cryptocurrency market, I must admit that this week has been nothing short of exhilarating. The surge in total market capitalization to almost $3.8 trillion and Bitcoin breaking the $100,000 barrier for the first time were moments that will undoubtedly go down in history books.

Describing the last seven days as merely exciting would be a significant understatement. As per CoinGecko’s data, the overall cryptocurrency market capitalization skyrocketed nearly $300 billion and reached a staggering $3.8 trillion at its peak. This surge follows a notable achievement for Bitcoin and robust showings by numerous altcoins, so let’s delve into the price movements.

All eyes were turned on Bitcoin this week. To be completely honest, the price action was relatively dull and rather depressing for the first part of the week. BTC was chopping between $98,000 and $96,000, even dropping to a low below $94,000 at one point. The bulls weren’t active. This all changed on Wednesday when the price shot up toward $99,000.

Most of the community were convinced that the price would once again be stopped there, but the buyers had something else in mind. On Thursday morning (Central European Time), the price exploded above $100,000 for the first time in history, thus completing one of the most iconic milestones in Bitcoin’s history. And it didn’t stop there, either. It charted a new all-time high at around $104,000, but that’s where the sellers stepped in, picking up a huge amount of overleveraged long positions and causing a massive drawdown extended all the way to $92,000 (on Bitstamp).

Indeed, an overwhelming number of overextended long positions in the market can lead to a drop in price due to intense selling pressure. Thankfully, Bitcoin has since rebounded and is now trading near $98,000.

It turns out that it wasn’t just Bitcoin climbing in value. In fact, Ripple‘s XRP was the clear standout among the top 10 cryptocurrencies. At one point, XRP surged as high as 60%, but has since dipped slightly and is now being traded at roughly $2.30. Ethereum also saw a rise of approximately 7.6%, Binance Coin (BNB) experienced an increase of 8.5%, Cardano (ADA) went up by 8%, and so on.

Bitcoin’s rally above $100K came on the back of a major announcement from President-elect Donald Trump. He has made his pick for the new Chairman of the United States Securities and Exchange Commission and it’s former commissioner Paul Atkins. In the words of Trump himself, Atkins is well-known for his balanced and understanding approach toward digital assets and innovations.

Keeping that thought in mind, I find it quite intriguing to keep an eye on the cryptocurrency market over the next few weeks. Will Bitcoin reach its previous high of $104,000 again, or is a more significant drop on the horizon? Only time will tell.

Market Data

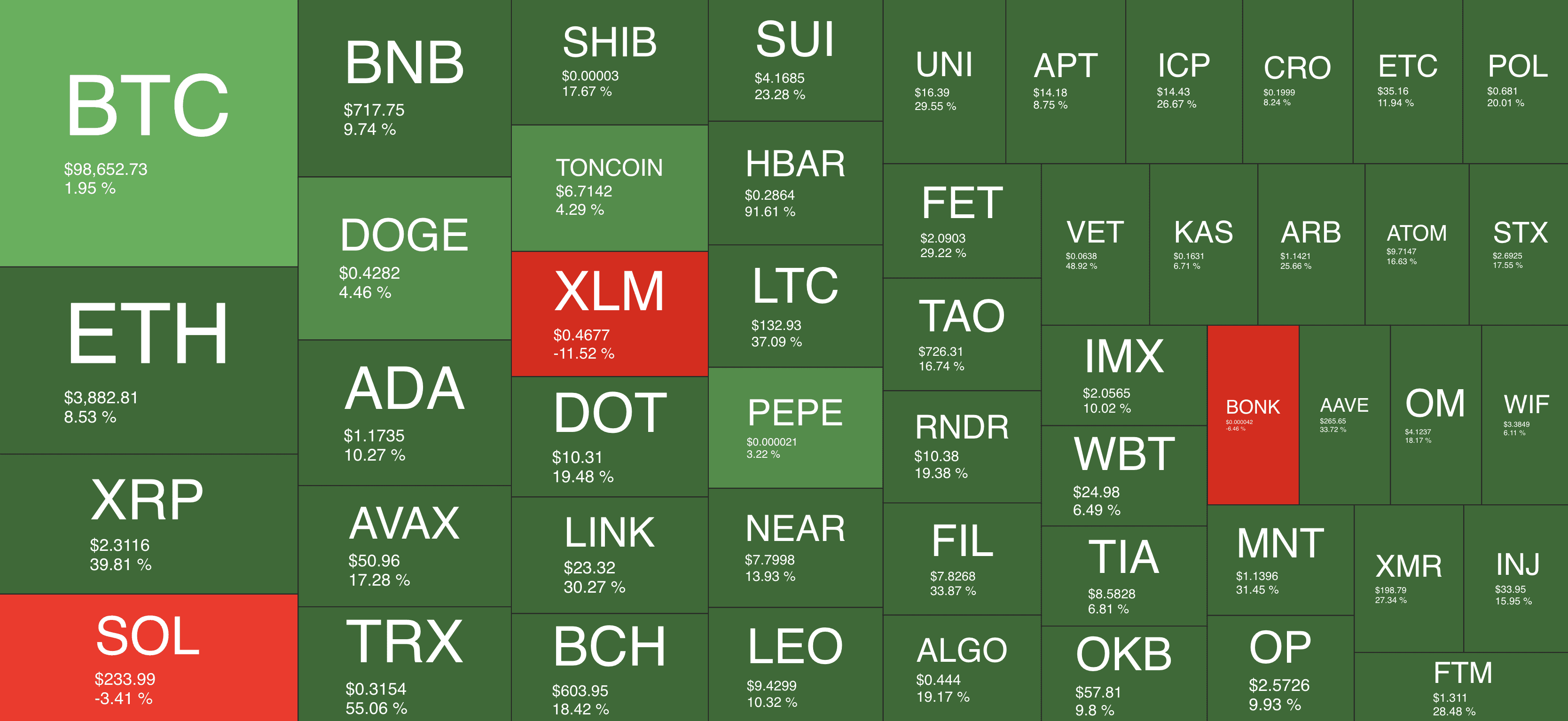

Market Cap: $3.73T | 24H Vol: $406B | BTC Dominance: 51.9%

BTC: $98,939 (+1%) | ETH: $3,895 ( +7.6% ) | XRP: $2.30 (+37.9%)

This Week’s Crypto Headlines You Can’t Miss

Today marks a new purchase by MicroStrategy: 15,400 more Bitcoins for approximately $1.5 billion, which averages out to around $95,976 per coin. Now, they hold a total of about 402,100 Bitcoins, making up roughly 1.9% of the entire Bitcoin supply.

MARA Holdings, a major public Bitcoin mining company, completes a $850 million offering of convertible senior notes to enhance its Bitcoin reserves.

Jerome Powell, the head of the U.S. Federal Reserve, downplayed worries about trust in the American dollar. He drew a comparison between Bitcoin and commodities like gold, stating that its high volatility makes it unsuitable for widespread use.

BlackRock’s Innovative Bitcoin Investment Trust (IBIT) sets new records as the swiftest Exchange Traded Fund (ETF) to amass $50 billion in Assets Under Management (AUM).

27,871 Bitcoins, worth approximately $3 billion, were transferred from the Mt. Gox wallet to an unknown account on December 4th. This action may indicate that the trustee is making preparations for the upcoming distribution phase to the wallet’s creditors, coinciding with Bitcoin reaching a new milestone of $100,000 in value.

Large investors, known as whales, are starting to stockpile Solana tokens at a rapid pace, fueled by speculation that its price could potentially surge up to $600 in the short term.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-06 17:20