What to know:

- Coins worth $10 million or more continue to leave exchanges at a rapid pace since the U.S. election.

- Bitcoin is currently fighting to maintain a $2 trillion market cap and a $100,000 price.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market trends and shifts. The current surge in Bitcoin (BTC) is nothing short of captivating, especially considering its relentless pursuit to breach $100,000 and maintain a $2 trillion market cap.

Bitcoin, the dominant cryptocurrency by market value, is making a significant effort to maintain a market valuation of $2 trillion and a price point at around $100,000 each coin.

If Bitcoin manages to surpass these significant thresholds, it could pave the way for smooth sailing ahead. Since Donald Trump’s victory in the U.S. election in November, Bitcoin has soared above $30,000, and this surge has been particularly noticeable as a large amount of Bitcoin has been withdrawn from exchanges.

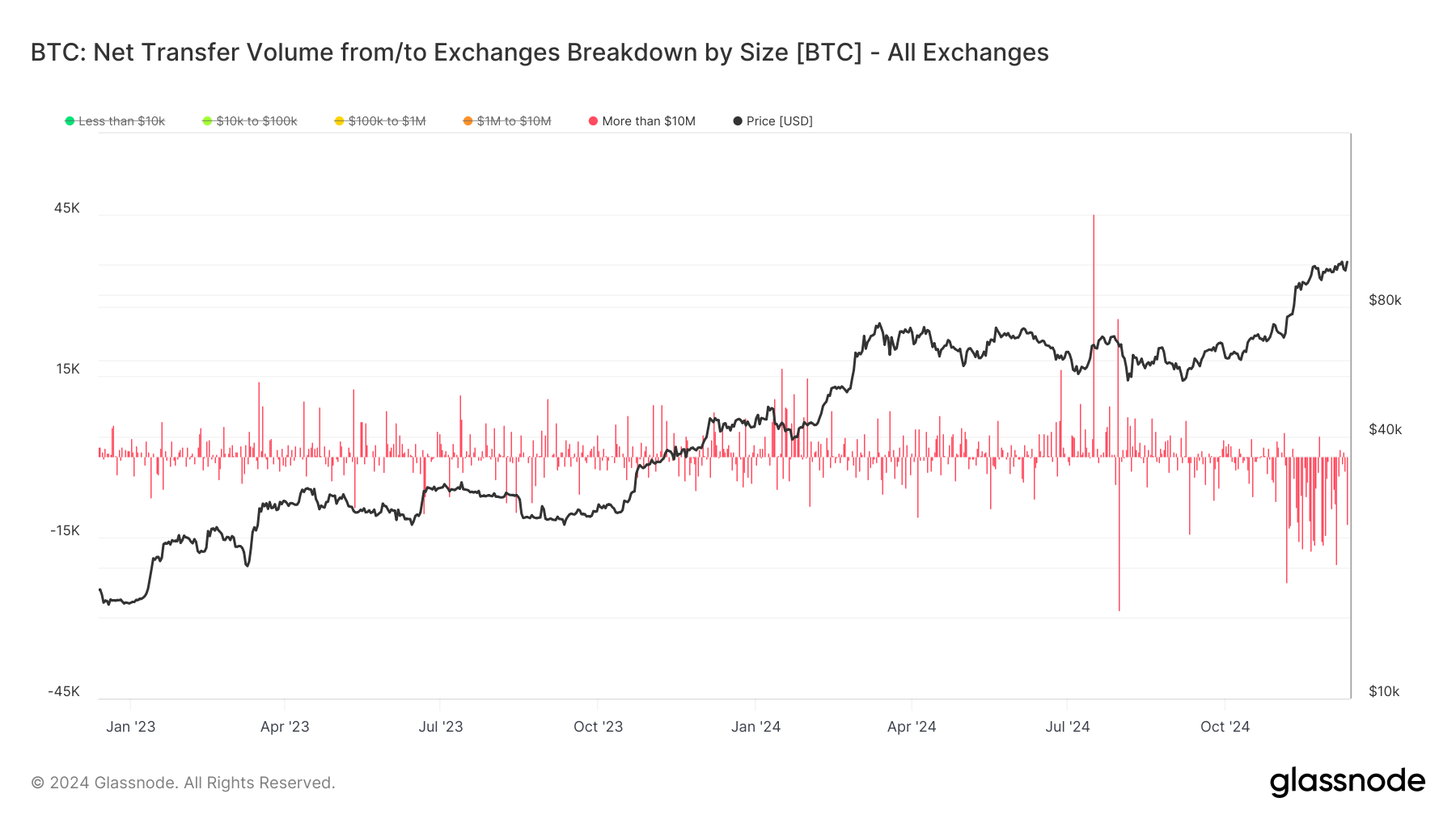

Data from Glassnode indicates a surge in large-value Bitcoin transactions departing from exchanges, suggesting significant institutional purchases. Notably, many of these transactions seem to originate from the platform Coinbase, leading to the observed increase in its price relative to other platforms (Coinbase premium) over the past few weeks.

Based on Glassnode’s data, approximately 12,500 Bitcoins worth around $1.3 billion were withdrawn from cryptocurrency exchanges as of yesterday, with about half of that amount being taken out from Coinbase.

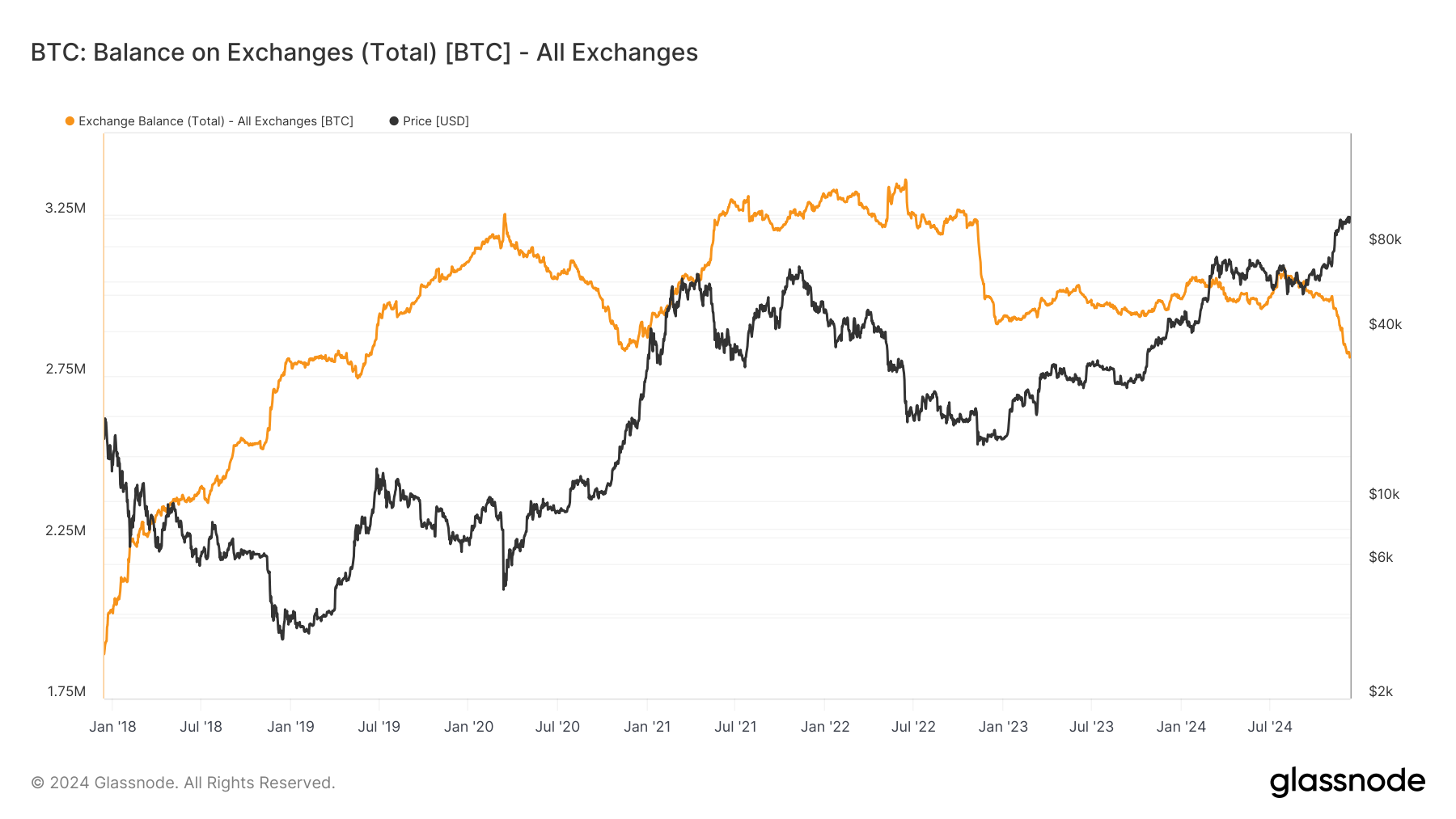

Over the past few months since the U.S. elections, Glassnode data indicates that around 200,000 Bitcoins have been withdrawn from exchanges. As a result, there are now approximately 2.8 million Bitcoins still on these platforms – the smallest amount in the last seven years.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-12 14:13