What to know:

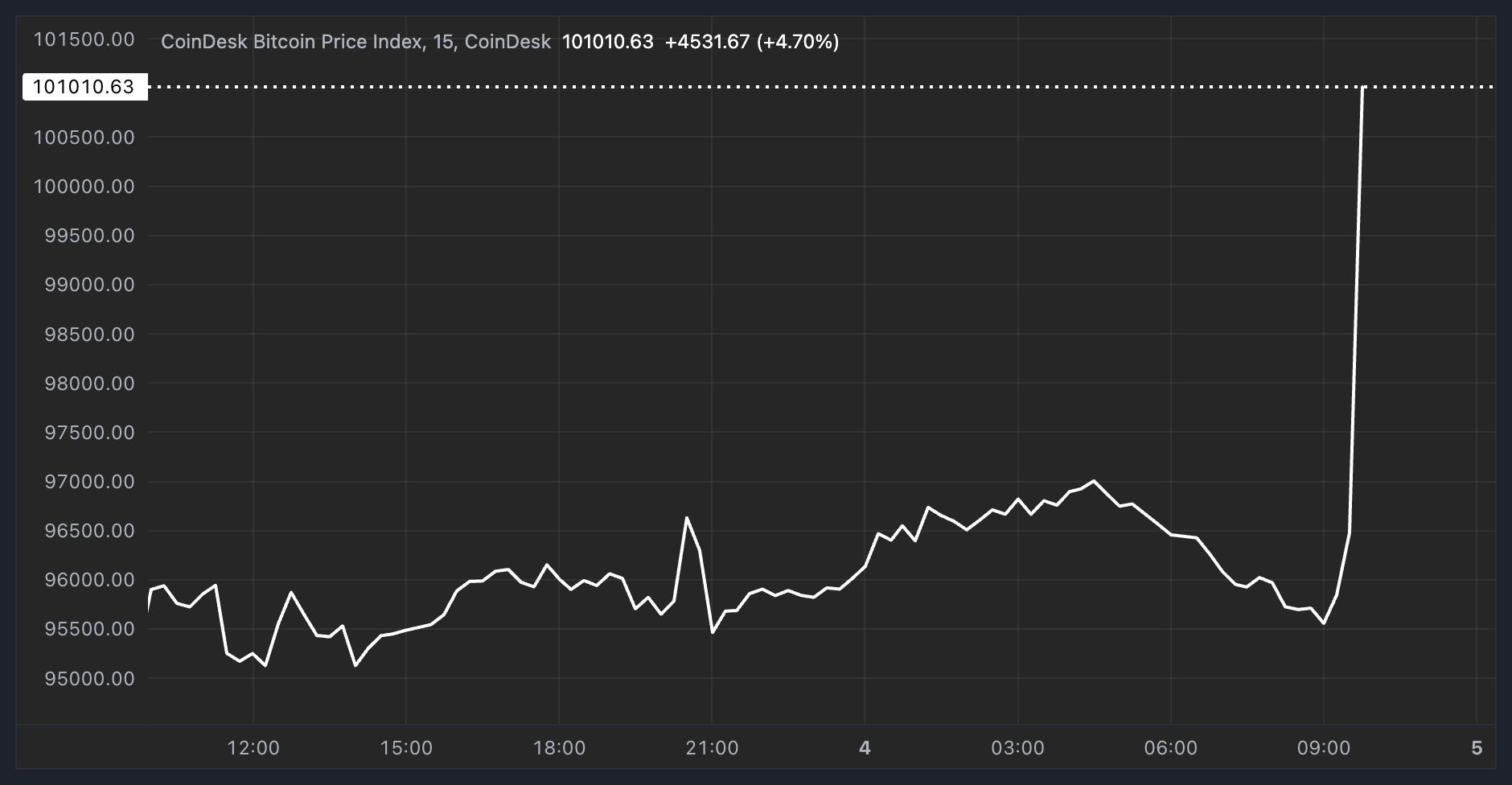

- The price of bitcoin has risen above $100,000 for the first time.

- The highly successful introduction of U.S.-based spot ETFs combined with the election of Donald Trump to spearhead the rally.

- Corporate adoption also played a role, with a growing number of companies following MicroStrategy’s lead in accumulating bitcoin.

As a seasoned crypto investor with a decade of experience under my belt, I must say that watching the meteoric rise of Bitcoin above $100,000 for the first time feels like witnessing the birth of a new digital gold rush. The convergence of institutional demand, corporate accumulation, and political favorability under President Trump has created an unstoppable force driving this market forward.

For the very first time ever, the value of Bitcoin has soared above the $100,000 threshold, propelled by increased interest from institutions, large-scale purchases by companies, and optimism about favorable cryptocurrency regulations during President Donald Trump’s term in office.

In simple terms, after being introduced 15 years ago, Bitcoin’s market value has reached nearly $2 trillion this year, an increase of around 130%. For comparison, companies like Nvidia and Apple boast market caps of approximately $3.5 trillion each, Microsoft stands at $3 trillion, while Google and Amazon are valued at about $2.2 trillion. It’s worth noting that the total market value of all the world’s gold is roughly $17.7 trillion.

Leading the charge at this rally is the planned launch of bitcoin exchange-traded funds (ETF) by prominent asset managers like BlackRock and Fidelity, set for early 2024. These financial products have achieved remarkable success since their introduction, amassing over $30 billion in managed assets within a year’s span.

Although Exchange-Traded Funds (ETFs) have achieved significant success this year, the upward trend of bitcoin appears to have slowed down for much of it, partly due to uncertainties about U.S. regulations surrounding the presidential election. However, Donald Trump’s early November victory, known for his friendly stance towards cryptocurrencies, ignited a new surge in the rally. In quick succession, bitcoin surpassed its March high of $73,500, moved past $80,000, and then $90,000, and just moments ago, it reached $100,000.

Corporate adoption

A significant aspect of the bullish narrative surrounding bitcoin involves an increasing number of corporations adopting it, spearheaded by MicroStrategy (MSTR) and its Chairman Michael Saylor. This company started buying bitcoin in August 2020, and has since invested billions more, amassing a total of 386,700 tokens worth over $38 billion. This move has sparked interest among other publicly traded companies like Semler Scientific (US-listed) and Metaplanet (Japan-listed), who are also considering similar strategies. In fact, tech titan Microsoft is currently deliberating whether to adopt a bitcoin-centric treasury strategy as well.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-05 05:50