As a seasoned crypto investor with years of experience in the market, I have seen my fair share of bull and bear markets. The recent price action of Bitcoin has left me cautiously optimistic. According to the technical analysis provided by TradingRage, the daily chart shows Bitcoin trapped inside a large descending channel pattern. However, the recent support at $60K and the potential breakout above the pattern could indicate a new bullish trend. On the other hand, a drop below this level could lead to a devastating crash toward the $52K support.

The price of Bitcoin has stopped climbing after dipping from the $75,000 mark. However, there are signs that a fresh surge in buying could start shortly.

Technical Analysis

By TradingRage

The Daily Chart

The Bitcoin price on the daily chart is currently confined within a large descending channel, marked by successive lower peaks and troughs. Despite this appearance, the downward trend may not be as strong as it seems based on the lackluster momentum.

The price has repeatedly been halted by the $60,000 support level, while the market appears to be aiming for the upper limit of the channel.

A rise above the established pattern could serve as a powerful indication of an emerging bull market, whereas a decline beneath it might signal impending doom, potentially triggering a swift descent to the $52K safety net.

The 4-Hour Chart

On the 4-hour chart, the findings derived from analyzing the daily timeframe are validated. Lately, Bitcoin’s price has bounced back from the $60,000 support area and is currently encountering a near-term resistance at approximately $63,500.

As an analyst, I’ve noticed that the Relative Strength Index (RSI) has surpassed the 50% threshold, signaling a bullish momentum. Consequently, the $63,500 resistance level might be breached imminently. Subsequently, the price could surge toward and potentially exceed the midline of the channel, paving the way for a potential price rally towards new all-time highs.

Sentiment Analysis

By TradingRage

Bitcoin Coinbase Premium Gap

As a researcher studying the recent corrections in Bitcoin’s price, I believe examining the US market could offer essential insights into the cause of these declines. While it’s important to note that no single factor is solely responsible for the downturn, analyzing trends and events in the US market might help us better understand this phenomenon.

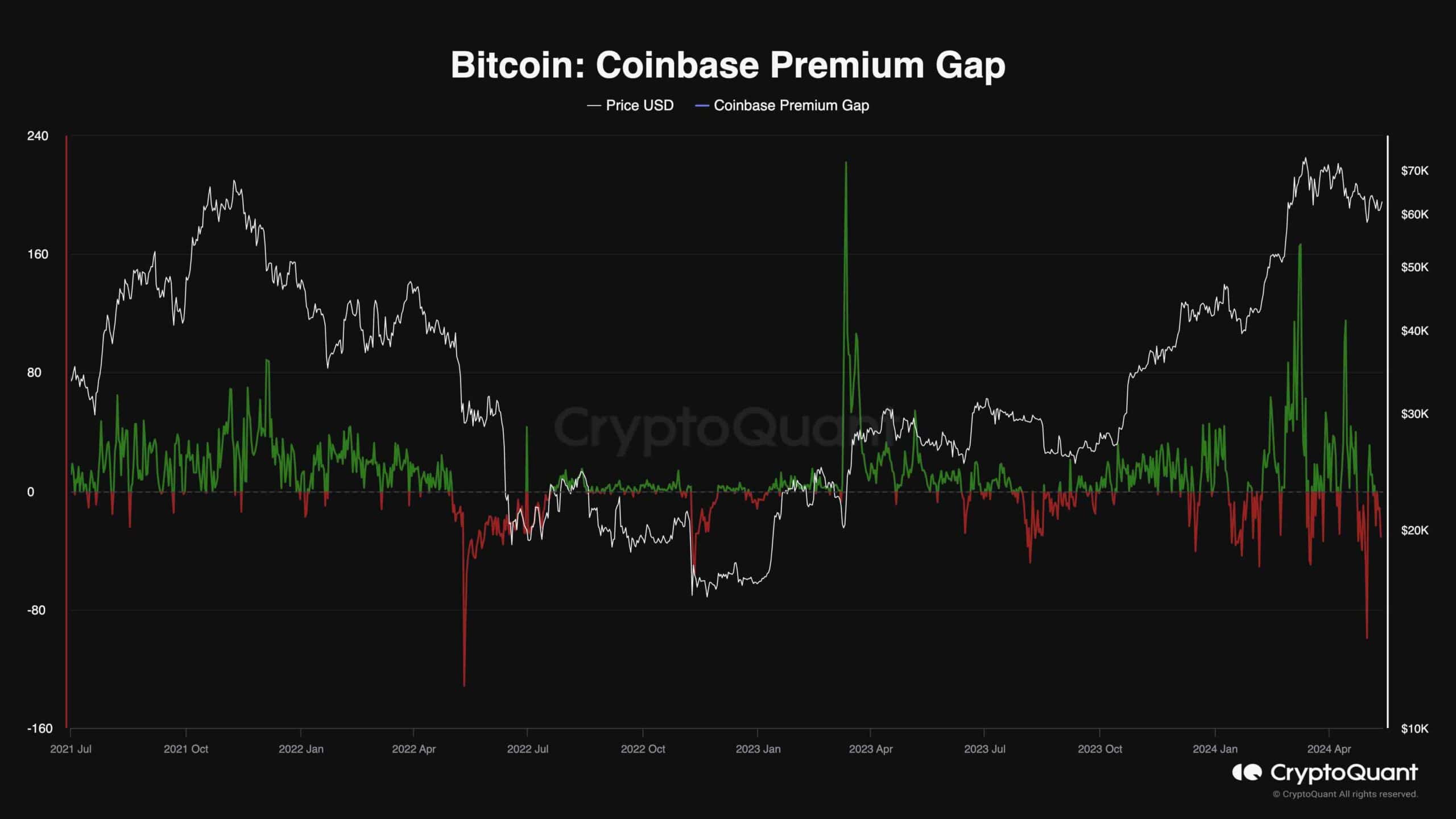

This chart illustrates the disparity in pricing for Bitcoin (BTC) between Coinbase’s BTC-USD market and Binance‘s BTC-USDT market, providing insight into the demand and supply dynamics of the US market versus other international markets.

The volatility of the Coinbase premium gap is clear to see, with particularly low values observed on the downside recently. This selling pressure, primarily driven by US investors who are typically wealthy individuals and institutions, is a significant contributor to the recent price decline. Consequently, unless this trend reverses, a bullish market recovery seems unlikely.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-05-13 16:16