As a seasoned crypto investor with a keen interest in technical and on-chain analysis, I’ve witnessed the rollercoaster ride that is Bitcoin’s price action over the past few weeks. The bulls have put up a valiant fight to regain control above $60K, but the question remains: will it last?

As a crypto investor, I’ve noticed Bitcoin‘s price undergoing significant fluctuations over the past few weeks. The bulls have been putting up a strong fight to regain control and push the price above the $60,000 mark. However, the question remains: will this uptrend sustain?

Technical Analysis

By TradingRage

The Daily Chart

As a researcher studying the market trends, I’ve noticed that the price has been bouncing around within a descending channel on the daily chart over the last few months. Recently, this channel was momentarily breached to the downside for a few days.

Despite an initial drop that suggested a bearish trend for Bitcoin (BTC), the cryptocurrency swiftly bounced back and regained its position within the price channel. The $60,000 support level proved effective as well, making it likely for BTC to challenge the $68,000 resistance in the near future.

The 4-Hour Chart

Based on the 4-hour chart analysis, it’s clear that the price bounced back swiftly from dipping beneath the channel and the $60K mark. Next up, the midline of the descending channel serves as our potential new objective.

As the Relative Strength Index (RSI) nears overbought levels, there’s a likelihood that the price could retreat shortly. However, the bullish momentum will persist if the price manages to surpass the resistance level and move upward beyond the established channel.

On-Chain Analysis

By TradingRage

Bitcoin Miners Position Index

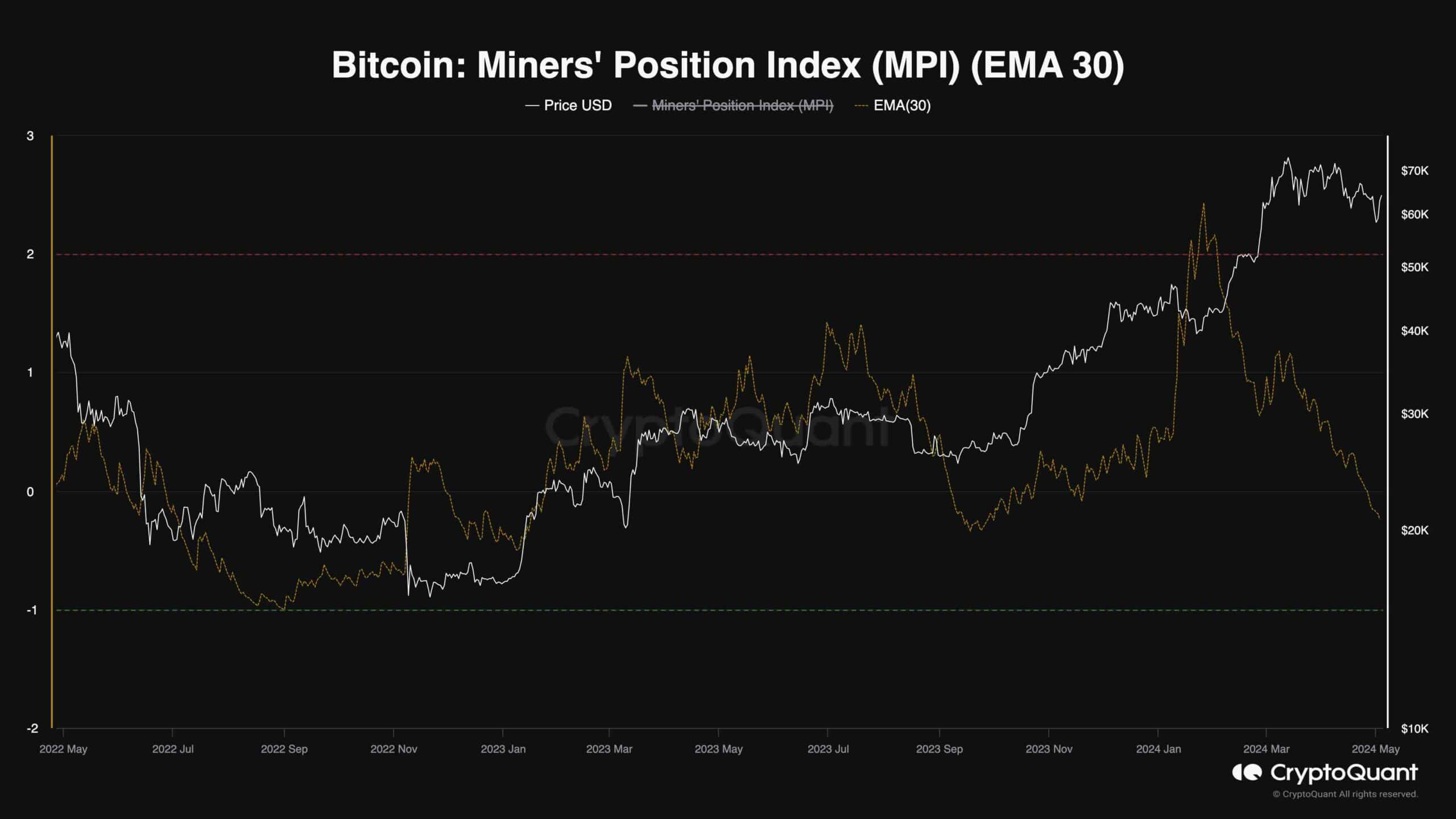

With Bitcoin’s price hovering around the $75K mark, some investors and traders have been selling off their coins, fearing that the bull market may have ended or a more significant correction could be on the horizon. In contrast, miners remain unfazed by these developments.

this chart illustrates the Miners Position Index (MPI), which quantifies mining sector investors’ selling propensity. Values greater than 2 indicate heightened selling activity among miners, signaling potential peril.

I’ve observed an intriguing trend in the MPI chart – it has been steadily decreasing over the past few months. This is a promising development since it indicates that miners’ selling pressure is waning. With robust buying demand, Bitcoin’s price could potentially rebound and head towards $80K, even reaching new heights beyond that.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- How to Handle Smurfs in Valorant: A Guide from the Community

- PENDLE PREDICTION. PENDLE cryptocurrency

- Dead by Daylight: All Taurie Cain Perks

2024-05-04 16:55