What to know:

- Bitcoin (BTC) fell more than 4% with major altcoins including ETH and SOL dropping 6%-9%.

- Behind the move were renewed cycle highs in U.S. bond yields following stronger than expected economic data.

- Investors continued to roll back their hopes for further Federal Reserve rate cuts, now pricing in only one rate reduction for the entire year.

The cryptocurrency market experienced a setback yesterday morning in the United States as bitcoin (BTC) fell below the $100,000 mark. This was due to two unexpectedly strong U.S. economic reports that dampened the positive momentum crypto had been showing at the start of the year.

The number of job openings in November went up more than expected, reaching 8.1 million, contrary to forecasts suggesting a decrease to 7.7 million, which was the figure for the preceding month.

In December, the ISM Services Purchasing Managers Index, which measures the health of the services sector economy, was published simultaneously. The reading for December was 54.1, exceeding the predicted 53.3 and higher than November’s 52.1. Moreover, the Prices Paid subindex surprised with a significant increase to 64.4, compared to the anticipated 57.5 and last month’s 58.2.

Despite not significantly impacting the market usually, these reports collectively intensified an anxious bond market even further. This led to a rise in the 10-year U.S. Treasury yield by 0.05%, reaching 4.68%, just shy of its multi-year peak. Consequently, U.S. stocks dipped, with the Nasdaq falling more than 1% during late trading hours and the S&P 500 decreasing by 0.4%.

During the European afternoon, Bitcoin (BTC) was trading slightly below $101,000 but later dropped to approximately $97,800 after the release of the data, erasing its gains from the previous day and falling about 4% over a 24-hour period. The major altcoins saw steeper declines, with Ethereum’s ether (ETH) and Solana’s SOL losing around 6% to 7%, while Avalanche’s AVAX and Chainlink’s LINK experienced drops of 8% to 9%.

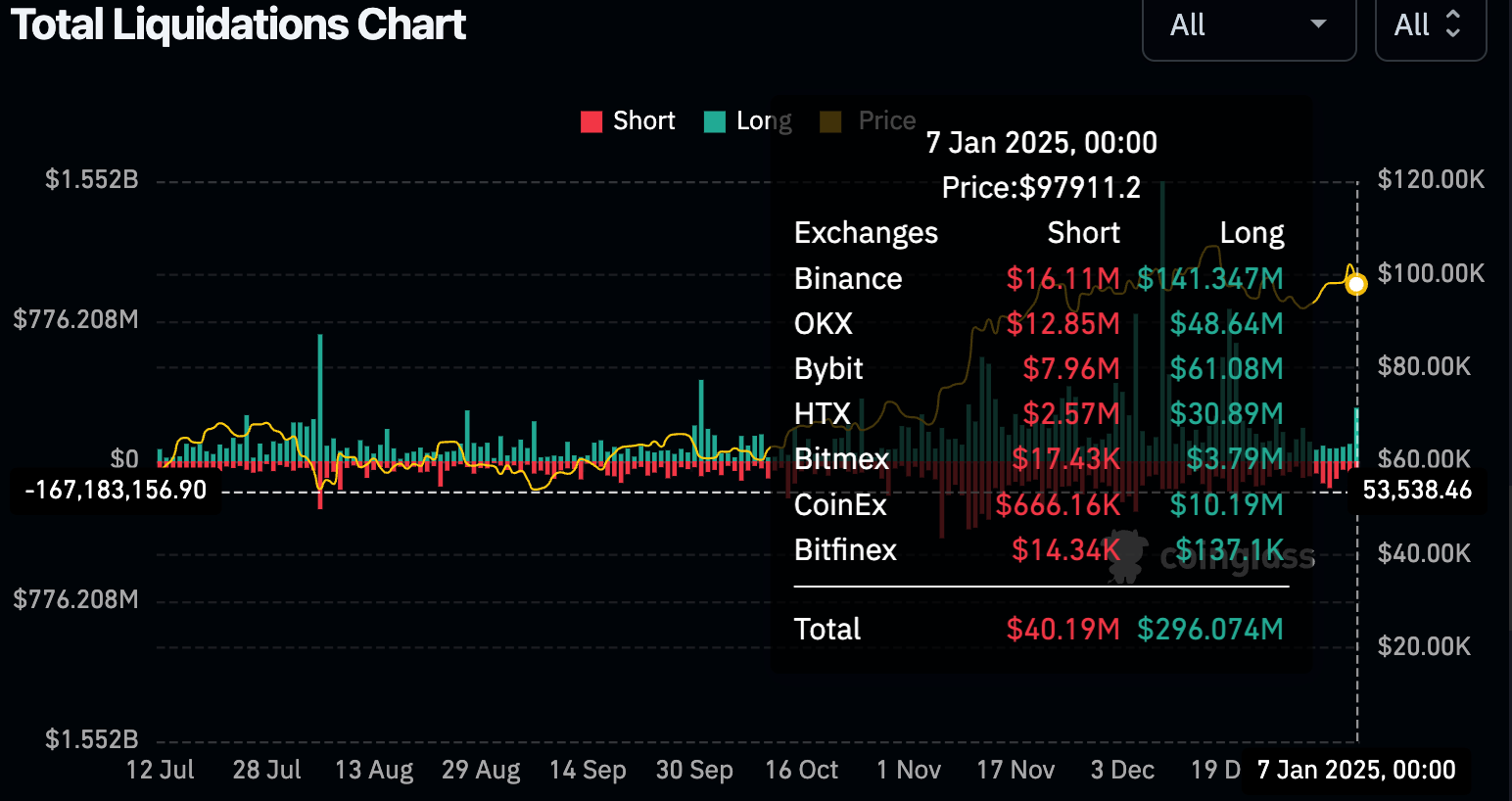

A significant drop in prices caused by a rapid selloff worth around $300 million in long positions held in derivative markets that had wagered on price increases, as reported by CoinGlass, signifies the first major reduction of leveraged positions this year.

The strong data also has investors further rolling back their expectations of rate cuts in 2025.

Initially, there was a belief that the Federal Reserve would not lower interest rates at their January meeting. However, recent developments have led market participants to believe that there is only a 37% chance of a rate cut at the Fed’s March meeting, which is significantly less than the nearly 50% probability just a week ago, as indicated by the CME FedWatch tool. Furthermore, the likelihood of a rate cut in May is also quite low. When looking ahead to 2025, Kyle Chapman from Ballinger Group points out that investors are only predicting around one 25 basis point rate cut for the entire year.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-07 20:05