As a seasoned crypto investor with battle-hardened instincts, I find myself torn between the bullish and bearish signals surrounding Bitcoin’s current market position. On one hand, the optimistic outlook presented by industry analysts such as Satoshi Flipper, Elja, Mags, and Titan of Crypto is indeed enticing. The potential for a massive breakout and the biggest bull run in history is certainly appealing to my risk-taking nature. However, I am not one to ignore the bearish signals that may lurk around the corner.

TL;DR

- Bitcoin shows signs of a potential rally, with some analysts predicting a jump to a new all-time high.

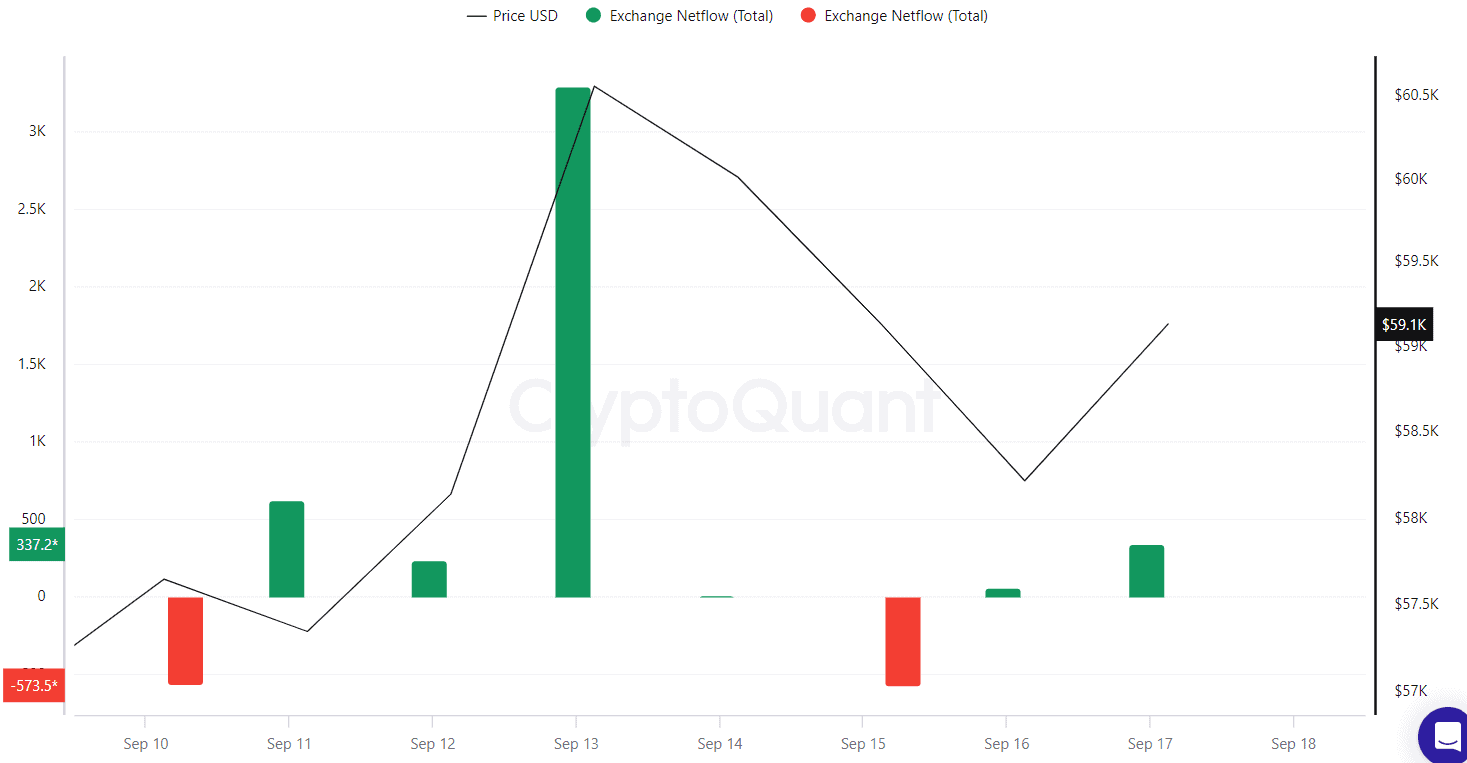

- Conversely, increased exchange inflows suggest possible short-term selling pressure.

Good News for the Bulls?

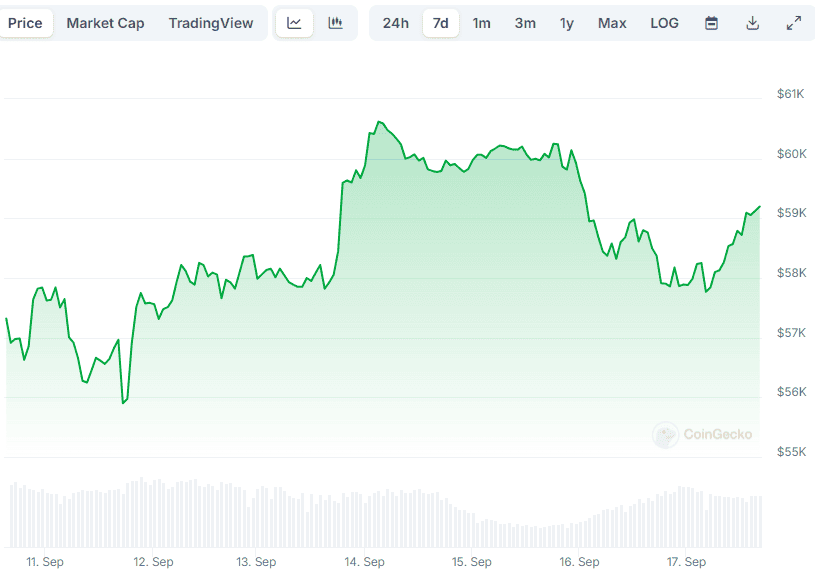

Over the past week, I’ve observed some significant fluctuations in the price of Bitcoin, with its value dipping as low as $56,000 and soaring above $60,500. At present, it’s trading at roughly $59,200, which represents a 1% gain compared to yesterday’s figures.

Regardless of its shaky performance recently, many industry insiders are optimistic that a significant surge might be imminent. User Satoshi Flipper, in particular, pointed out Bitcoin’s recent spike above $59K, stating that the predictions for it to reach as high as $64,000 are growing increasingly loud.

User Elja, who has nearly 700,000 followers on platform X, foresees a significant surge, or as he puts it, a “massive breakout,” drawing near. On the other hand, Mags anticipates what he calls “the greatest bull run ever,” predicting that the price of Bitcoin could reach an astounding $325,000 per coin by next year.

The crypto giant shared a positive outlook, suggesting that the main digital currency tends to thrive when its Relative Strength Index (RSI) hovers around 50. The analyst believes this trend holds true in historical data.

This measurement gauges speed and price fluctuations, ranging from 0 to 100. A value exceeding 70 generally indicates potential overbuying and could be a warning for a possible correction. On the contrary, readings under 30 are perceived as bullish because they suggest the asset may be undervalued. At present, the Relative Strength Index (RSI) is approximately 55.

A key factor that could lead to increased volatility for Bitcoin this week is the Federal Open Market Committee (FOMC) meeting scheduled for September 18. This gathering is anticipated to mark the first interest rate reduction in years, making borrowing money more accessible and potentially fueling investor enthusiasm for riskier assets like cryptocurrencies. As per Polymarket, there’s a 54% chance of a 0.5% cut, while a 0.25% reduction has a 46% probability.

The Bearish Signal

Although the general market sentiment is optimistic, there are signs suggesting that Bitcoin may face a temporary dip in the near future.

An illustration is the Bitcoin trading platform, specifically netflow, that has predominantly shown a positive trend over the past week. A significant ‘green candle’ was spotted on September 13th. This trend seems to imply a transition from individual storage methods towards centralized services, possibly suggesting increased selling pressure.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-09-17 22:08