As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market trends and shifts, and the recent surge in demand for Spot Bitcoin ETFs is no exception. The influx of over $360 million into these financial vehicles in just one day is a clear indication that institutional investors are increasingly bullish on Bitcoin.

Investing in Bitcoin Exchange-Traded Funds (ETFs) linked to spot Bitcoin has been shown to significantly influence the price fluctuations of the original asset, potentially indicating forthcoming increases in Bitcoin’s value.

Yesterday saw a significant increase in investments as over $360 million flowed into U.S.-based ETFs, marking the highest level of net inflows in more than two months.

Demand for Spot BTC ETFs Rises

Previously, CryptoPotato has often shared that investor attitudes and actions towards Bitcoin Spot ETFs have significantly influenced BTC‘s price movements, either causing surges or significant drops. In periods where there is an increase in investments, Bitcoin’s value tends to rise, while decreasing investments lead to a fall in its price.

Over the last couple of weeks, investors have been quite active buyers rather than sellers. In fact, on all but two days since September 6, there have been more investments flowing into the markets compared to withdrawals. Yesterday saw a record high for this period, with approximately $365.7 million pouring into financial instruments, which is the most since July 22.

In this scenario, Ark Invest’s ARKB fund raised the most with approximately $113.8 million, while BlackRock’s IBIT followed closely behind with around $93.4 million. Fidelity’s FBTC came in third with about $74 million, and Bitwise’s BITB took fourth place with roughly $50.4 million. However, Grayscale’s GBTC experienced slight outflows totaling $7.7 million. As a result, the total assets under management (AUM) for IBIT, the world’s largest Bitcoin ETF, has surpassed $21.3 billion.

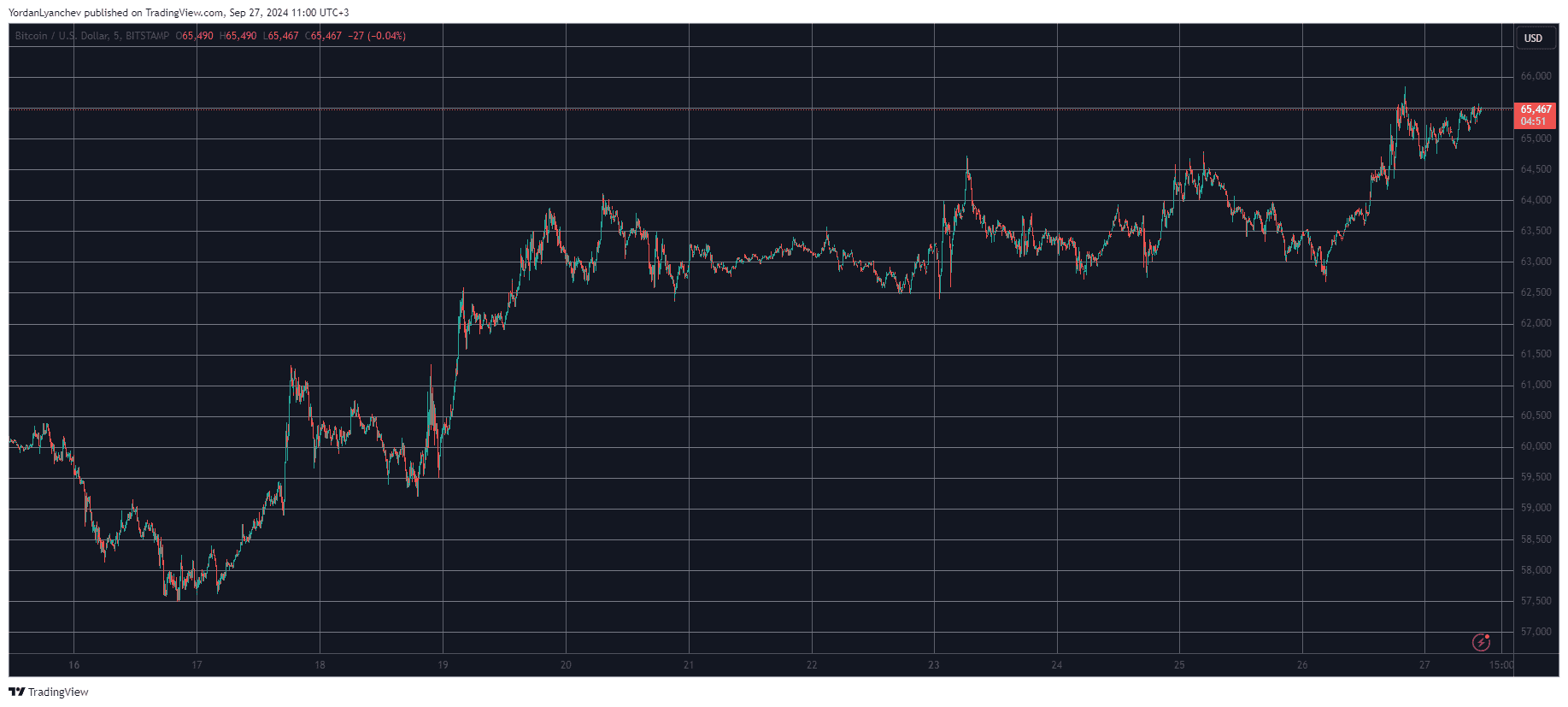

Over these periods, an increase in BTC‘s price has mirrored the inflows of funds. It’s worth noting that starting from last Wednesday, when the U.S. Federal Reserve announced a decrease of 0.5% in their primary interest rates, there has been a significant surge in investments into Bitcoin ETFs.

Over the past week or so, Bitcoin’s value has climbed significantly, rising from approximately $59,300 to around $66,000 as of today. This increase amounts to about 11%.

Ethereum ETFs’ Situation

ETH-based Exchange Traded Funds (ETFs) haven’t had the same successful run as Bitcoin ETFs on U.S. stock markets so far. However, there are promising indicators emerging.

Following the Fed’s rate cuts earlier in the week that triggered significant withdrawals, things took a turn for the worse on September 23, as nearly $80 million exited the funds. Remarkably, there were net inflows of approximately $62.5 million and $43.2 million on September 24 and 25 respectively, which helped to reverse the trend for the week.

Despite experiencing minor outflows totaling $0.1 million yesterday, the significant withdrawal was mainly from Grayscale’s fund ($36 million). The contributions from Blackrock’s ETHE ($15.3 million) and Fidelity’s FETH ($15.9 million) were not sufficient to counterbalance the losses incurred.

Concurrently, it’s worth noting that the value of Ethereum (ETH) has surged by over 14% in weekly terms, currently standing at around $2,660.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- How to repair weapons & gear in Stalker 2

- Unlocking the Mystery of Brawl Stars’ China Skins: Community Reactions

- SOLO PREDICTION. SOLO cryptocurrency

- How to Use the Abiotic Factor for Permanent Power in Your Fish Tank Setup

- Smite 2: Overcoming the Fear of Your First Match in the MOBA Universe

- Understanding the Constant Rain in Pacific Drive: A Reddit Discussion

- REVIEW: “The Piano Lesson” (2024)

- Dragon Quest III HD-2D Remake Review: History Repeats

2024-09-27 11:16