This text provides an overview of Spot Bitcoin ETFs, their benefits, and alternatives for gaining exposure to Bitcoin’s price. It starts by comparing several popular Spot Bitcoin ETFs based on their expense ratios and liquidity. Then it discusses the advantages of investing in a Spot Bitcoin ETF, such as legitimacy, accessibility, market liquidity, accurate price tracking, daily creation and redemption, regulation, and portfolio diversification.

As a researcher looking back on financial market history in 2030, I can share that in the year 2024, I witnessed a groundbreaking development when the United States Securities and Exchange Commission (SEC) made the momentous decision to greenlight the trading of spot Bitcoin exchange-traded funds (ETFs). This approval marked a significant milestone for the digital currency industry as it opened up new avenues for institutional investors to gain exposure to Bitcoin through regulated investment vehicles.

As a crypto investor, I’ve witnessed the opening of a fresh and significant phase in the world of digital currencies. This development has lent even more credibility to Bitcoin as a legitimate investment choice for the average investor, earning its place among options that regulators deem fit for their constituents.

Despite the complexities involved in purchasing and trading spot Bitcoin Exchange-Traded Funds (ETFs), we’ve compiled a comprehensive guide covering the top options, related costs, custodians, and essential information to help you navigate this innovative financial instrument.

Let’s take a closer look.

Table of Contents

- What Are Bitcoin Exchange-Traded Funds (ETFs)?

Futures or Spot Bitcoin ETFs?

The Best Spot Bitcoin ETFs

BlackRock iShares Bitcoin Trust (IBIT)

Grayscale Bitcoin Trust (GBTC)

Fidelity Wise Origin Bitcoin Trust (FBTC)

Bitwise BITB

Valkyrie Bitcoin Fund (BRRR)

Ark 21Shares Bitcoin ETF (ARKB)

Franklin Bitcoin ETF (EZBC)

Invesco Galaxy Bitcoin ETF (BTCO)

VanEck Bitcoin Trust (HODL)

WisdomTree Bitcoin Fund (BTCW)

Hashdex Bitcoin ETF (DEFI)

In-Kind and In-Cash Redemption Models for Spot Bitcoin ETFs

In-Kind Redemption Model

In-Cash Redemption Model

How to Choose and Invest in Spot Bitcoin ETFs

Benefits of Spot Bitcoin ETFs

Alternatives to Spot Bitcoin ETFs

Best Bitcoin ETFs: Conclusion

What Are Bitcoin Exchange-Traded Funds (ETFs)?

A spot Bitcoin Exchange-Traded Fund (ETF) gives investors a straightforward way to own Bitcoin itself, unlike futures-based Bitcoin ETFs that enable investors to bet on Bitcoin’s future pricing.

Both options enable users to invest in the crypto market without having to directly own the digital currency. In simpler terms, Spot Bitcoin ETFs function by letting investors trade shares of the ETF that represent the underlying Bitcoin, rather than holding the actual cryptocurrency themselves.

- The Spot Bitcoin ETF issuer, like BlackRock, buys Bitcoin and holds the funds with a secure custodian. That custodian (spoiler alert, it’s mostly Coinbase) typically uses cold storage solutions, which are hardware wallets stored somewhere safe and offline.

Custodians not only safeguard the assets on behalf of issuers. In fact, the custodian is in charge of surveillance-sharing agreements with the ETFs’ listing exchanges.

Note that the ETF might invest in Bitcoin directly through a broker or buy derivatives linked to the price of BTC.

As an investor, you can simply buy the shares of the ETF on stock exchanges like the NYSE or NASDAQ or, more simply, brokers that have listed the ETF’s shares. So, when you do that, you’re essentially buying the ETF’s shares, which consequently means you’re buying a portion of the current market value of the fund’s Bitcoin holdings.

Instead of purchasing Bitcoin directly from a cryptocurrency exchange and dealing with the intricacies of safeguarding your coins, including creating a reliable Bitcoin wallet and implementing safety protocols, you can opt for investing in a fund that already owns the Bitcoin.

As a new crypto investor, I find it incredibly convenient not to have the added responsibilities of directly purchasing Bitcoin or any other cryptocurrency. Instead, using an investment platform or service can make the process more streamlined and accessible for me.

As a crypto investor, I can tell you that it’s important to know that companies looking to issue Bitcoin ETFs are regulated financial institutions subject to the strictest regulations set by the US Securities and Exchange Commission (SEC). Notably, these spot Bitcoin ETFs gained approval from the SEC as early as January 2024.

To learn more about Bitcoin you can read our beginners guide.

Futures or Spot Bitcoin ETFs?

As a crypto investor, I can tell you that Bitcoin futures Exchange-Traded Funds (ETFs) provide an alternative way for me to capitalize on Bitcoin’s price movements without actually owning the digital asset itself. By investing in these ETFs, I am essentially buying contracts that represent my future obligation to purchase or sell a specific amount of Bitcoin at a predetermined price and date in the future. This indirect exposure to Bitcoin’s price fluctuations can help me manage risk while still participating in the volatile crypto market.

Investors often employ futures contracts to secure prices and hedge against market volatility. However, these contracts can incur substantial expenses due to their management. In contrast, futures Exchange-Traded Funds (ETFs) exist as alternatives but come with their own set of higher fees. The intricacies of the futures markets add complexity and risk since the prices of futures contracts may deviate substantially from Bitcoin’s current market price.

We’ll review the Bitcoin futures ETF in another section at the end of this article.

The Best Spot Bitcoin ETFs

After gaining a solid grasp of how these financial instruments function, as well as other crucial details, we can now explore the top Spot Bitcoin ETFs.

BlackRock iShares Bitcoin Trust (IBIT)

The iShares Bitcoin Trust (IBIT) by BlackRock functions as an alternative for investors seeking easy access to Bitcoin’s price fluctuations without the need to personally hold the cryptocurrency. This cost-effective ETF simplifies the process of gaining exposure to Bitcoin.

An ETF that follows Bitcoin’s price movement enables investors to gain from its price fluctuations using a conventional brokerage account. By managing Bitcoin storage and security on behalf of investors, this ETF streamlines the investment process and eliminates the requirement for individuals to handle these complexities personally.

Fund Facts

Overview and fund facts:

- Fund inception: Jan 05, 2024

Sponsor fee: 0.25% (established after reaching over $5 billion in holdings)

Exchange: NASDAQ

Custodian: Coinbase Custody Trust Company, LLC

Assets Under Management (as of June 2024): 295,457 BTC ($20,8B)

Grayscale Bitcoin Trust (GBTC)

As a researcher, I’d express it this way: “The Grayscale Bitcoin Trust (GBTC) is currently one of the most substantial Spot Bitcoin Exchange-Traded Funds (ETFs), managing over $30 billion in assets.”

GBTC was established in 2013 primarily for accredited investors via private placements. The company pledged to transform this investment vehicle into an Exchange-Traded Fund (ETF) at some point.

In the past, regulatory barriers caused issues for the fund, including reduced liquidity during trades on the OTC market, limited availability for most individual investors, and potential inconsistencies due to the absence of creation or redemption processes. Despite these challenges, it managed to grow into one of the largest Bitcoin funds in existence.

The premium or discount of the Grayscale Bitcoin Trust (GBTC) represents the gap between the market price of its shares and the real value of the Bitcoin assets it holds in its trust. This difference reveals how much investors are ready to pay over (or under) the true worth of the Bitcoin owned by GBTC.

You should note that the fee structure is notably higher than other Bitcoin ETFs available today.

Fund Facts

Overview and fund facts:

- Fund inception: 2013, uplisted as a Spot Bitcoin ETF on January 10, 2024.

Sponsor Fee/Expense Ratio: 1.5% management fee.

Exchange: NYSE Arca

Custodian: Coinbase Custody Trust Company, LLC.

Total AUM and notional value (as of June 2024): 285,458 BTC ($20,3B).

Fidelity Wise Origin Bitcoin Trust (FBTC)

Fidelity Investments’ Fidelity Wise Origin Bitcoin Trust (FBTC) is a pioneering exchange-traded product (ETP) in the industry that enables investors to gain immediate exposure to Bitcoin’s price movements. Launched by Fidelity, this trust aims to mirror the performance of Bitcoin itself.

Financial advisors, institutional investors, and retailers have access to the fund through Fidelity’s user-friendly digital channels.

As a researcher, I’d express it this way: When compared to other Exchange-Traded Funds (ETFs), FBTC stands out for its Bitcoin holdings being safeguarded through Fidelity Digital Assets Services. This entity has been subjected to regulatory oversight by the New York Department of Financial Services (NYDFS) since 2019.

If you’re unsure about why FBTC is classified as an Exchange-Traded Product (ETP) instead of an Exchange-Traded Fund (ETF), here’s some background information. First, ETFs are a specific type of ETP. All ETFs belong to the larger group of exchange-traded products, which are bought and sold on stock exchanges just like regular shares during trading hours.

Put simply, ETFs (Exchange-Traded Funds) represent the most prevalent form of Exchange-Traded Product (ETP). These financial instruments are governed by the Investment Company Act of 1940. Essentially, they function as collective investments, holding a diverse mix of securities such as stocks, bonds, and other assets, based on the fund’s intended goals.

While an FBTC shares some characteristics with an Exchange-Traded Fund (ETF), it functions more like an Exchange-Traded Product (ETP). The key difference lies in the fact that an FBTC holds 100% Bitcoin and does not invest in securities. Consequently, it is exempt from the regulations imposed by the Investment Company Act of 1940. A quick online search for “Fidelity’s Spot Bitcoin ETF” will reveal marketing and labeling as an ETF, but technically speaking, it operates under different rules.

Fund Facts

Overview and fund facts:

- Fund inception: January 10, 2024

- Sponsor Fee/Expense Ratio: 0.25% (Waived until July 31, 2024.)

- Exchange: NYSE

- Custodian: Fidelity Digital Asset Services, LLC

- Total AUM (as of June 2024): Approximately $9.17B

Bitwise BITB

As a researcher studying investment vehicles, I can tell you that Bitwise Asset Management’s BITW Bitcoin Total Return Eris Fund (BITB) is a widely recognized exchange-traded fund (ETF) that provides investors with exposure to the price of Bitcoin. The fund achieves this by mirroring Bitcoin’s performance, taking into account its daily changes in value, while subtracting the Trust’s operating expenses and other liabilities from the returns.

TheBITB fund carries a management fee of 0.95%, which includes the costs for overseeing the fund, safekeeping of assets, and the standard fees paid to the fund administrator and auditor.

Fund Facts

Overview and fund facts:

- Fund inception: January 10, 2024

- Sponsor Fee/Expense Ratio: 0.95%

- Exchange: NYSE Arca

- Custodian: State Street Digital Assets

- Total AUM (as of June 2024): Approximately $2.4B

Valkyrie Bitcoin Fund (BRRR)

The Valkyrie Bitcoin Fund (BRRR) follows Bitcoin’s price fluctuations by directly owning Bitcoins within its investment portfolio.

Valkyrie Funds LLC designed an ETF that debuted on the Nasdaq exchange on January 10. This ETF safeguards its Bitcoin holdings via Coinbase Custody. Additionally, Valkyrie offers investors other cryptocurrency investment options such as a Bitcoin and Ether Futures ETF.

Fund Facts

Overview and fund facts as of June 2024:

- Fund inception: January 10, 2024

- Sponsor Fee/Expense Ratio: 0.25%

- Exchange: Nasdaq

- Custodian: Coinbase Custody Trust Company, LLC

- Total AUM (as of June 2024): Approximately $607M

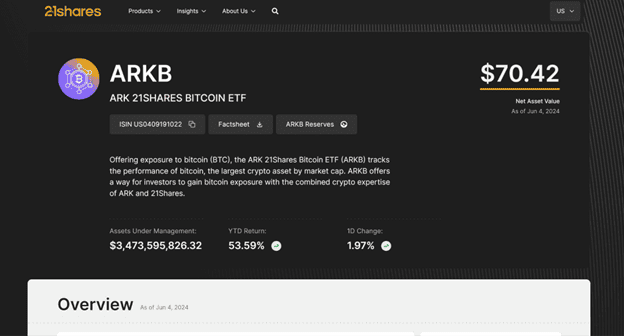

Ark 21Shares Bitcoin ETF (ARKB)

As a crypto investor, I can tell you that the Ark 21Shares Bitcoin ETF (ARKB) is an excellent option for those looking to add Bitcoin exposure to their portfolios in a secure and regulated manner. Co-created by Ark Invest and 21Shares, this exchange-traded fund (ETF) allows me to invest in Bitcoin through a single trade on a major stock exchange, without the need to set up complex wallets or navigate the intricacies of directly purchasing and storing Bitcoin.

As a researcher studying this particular Bitcoin investment product, I can tell you that it keeps tabs on its performance using the CME CF Bitcoin Reference Rate (New York Variant). Furthermore, it takes into account any associated expenses and liabilities in the process. This Bitcoin-trading instrument transacts on the Cboe BZX Exchange, carrying an expense ratio of 0.21% as of June 6, 2024.

As mentioned, the fund was co-launched by two well-known companies in the crypto and FinTech space.

Ark Invest, established in 2014 by Cathie Wood, is a distinguished FinTech company recognized for managing Exchange-Traded Funds (ETFs). These ETFs focus on emerging themes such as fintech innovation. The firm has gained notoriety for its optimistic perspective on groundbreaking technologies like blockchain and disruptive industry trends.

At present, 21Shares is a leading fintech firm based in Switzerland, focusing on the development of cryptocurrency investment tools. They provide investors with access to a range of exchange-traded products (ETPs), enabling them to invest in digital assets via conventional brokerage platforms under regulatory oversight.

Fund Facts

Overview and fund facts as of June 2024:

- Fund inception: January 11, 2024.

- Sponsor Fee/Expense Ratio: 0.21%

- Exchange: Cboe BZX Exchange

- Custodian: Coinbase Custody Trust Company, LLC.

- Total AUM (as of June 2024): $3,47B

Franklin Bitcoin ETF (EZBC)

On January 11, 2024, Franklin Templeton introduced the EZBC ETF, which is dedicated to Bitcoin investments. The fund allocates all of its resources towards this cryptocurrency and relies on Coinbase Custody for safekeeping.

Franklin Templeton is a worldwide investment management organization, which is a subsidiary of Franklin Resources, Inc., a US-based holding company established in 1947 by Rupert H. Johnson Sr. in New York City.

As an analyst, I’d put it this way: Just like Fidelity’s FBTC, EZBC operates outside the purview of the Investment Company Act of 1940. The reason being, EZBC doesn’t invest in securities; instead, it grants access to Bitcoin only. Consequently, it’s not bound by the same regulatory obligations.

Fund Facts

Overview and fund facts:

- Fund inception: January 11, 2024

- Sponsor Fee/Expense Ratio: 0.19% (waived until August 2, 2024, or first $10 billion in assets)

- Exchange: CBOE BZX Exchange, Inc.

- Custodian: Coinbase Custody Trust Company, LLC.

- Total AUM (as of June 2024): $312.2M

Invesco Galaxy Bitcoin ETF (BTCO)

The Invesco Galaxy Bitcoin ETF (BTCO) offers a simple and safe method for investors to gain access to Bitcoin without the complexity of handling the digital currency itself. By purchasing shares of this Exchange-Traded Fund, you’re essentially owning an equivalent amount of physically-backed Bitcoin.

An ETF that trades on the Cboe BZX exchange follows the real-time value of Bitcoin by utilizing the Lukka Prime Bitcoin Reference Rate.

Invesco and Galaxy Digital have teamed up to create this ETF, each bringing their expertise from the thriving cryptocurrency sector. Notably, both firms have previously introduced several crypto-focused Exchange-Traded Products (ETPs) in response to the escalating interest in digital assets.

Fund Facts

Overview and fund facts:

- Fund inception: January 11, 2024.

- Sponsor Fee/Expense Ratio: 0.25% (waived until July 2024)

- Exchange: Cboe BZX Exchange

- Custodian: Coinbase Custody Trust Company, LLC.

- Total UAM (as of June 2024): $384.4M

VanEck Bitcoin Trust (HODL)

As a crypto investor, I can tell you that the VanEck Bitcoin Trust (HODL) is a specialized investment vehicle tailored for us to gain exposure to the Bitcoin market without having to buy and hold the digital currency ourselves. Instead, this trust holds the actual Bitcoins and aims to track the price of the cryptocurrency, offering an accessible and potentially more convenient alternative for investors looking to diversify their portfolio with Bitcoin.

As a researcher studying investment vehicles, I can tell you that, according to VanEck’s design, HODL is intended as a passive investment product with the goal of mirroring Bitcoin’s price movements without actively pursuing extra gains or shielding against losses due to price fluctuations. Launched on January 4, 2024, this product was sponsored by VanEck Digital Assets, LLC and began trading on the Cboe BZX Exchange under the ticker symbol HODL.

As a market analyst, I would explain that the value of HODL shares is determined every day through reference to the MarketVector Bitcoin Benchmark Rate. This rate is computed based on Bitcoin prices obtained from what the fund sponsor deems as the most significant Bitcoin exchanges in the market.

Fund Facts

Overview of HODL and fund facts:

- Fund inception: January 4, 2024

- Sponsor Fee/Expense Ratio: 0.20%

- Exchange: Cboe BZX Exchange

- Custodian: Gemini Custody

- Total AUM (as of June 2024): $705.46M

WisdomTree Bitcoin Fund (BTCW)

As a researcher, I would describe the WisdomTree Bitcoin Fund (BTCW) as follows: I study this investment vehicle as an exchange-traded fund (ETF) specifically engineered to track the price movement of Bitcoin.

According to the site’s information, the fund determines the worth of its Bitcoin shares every day using a calculation derived from trades occurring on significant Bitcoin exchange markets.

Lastly, Bitcoin Trust Wise (BTCW) doesn’t actually oversee Bitcoin itself but instead adopts a passive strategy to mirror its market value via a benchmark rate. You can find it listed on the Cboe BZX Exchange, and for secure storage of assets, it relies on Coinbase Custody.

Fund Facts

Overview of BTCW and fund facts:

- Fund inception: January 11, 2024

- Sponsor Fee/Expense Ratio: Expense Ratio: 0.25%

- Exchange: BATS Exchange (Bats Global Markets).

- Custodian: Coinbase Custody Trust Company, LLC

- Total AUM (as of June 2024): $79.7M

Hashdex Bitcoin ETF (DEFI)

As a financial analyst, I would describe the unique feature of Hashdex Bitcoin ETF (DEFI) by saying: “This Bitcoin ETF stands out from its peers due to an integration of futures elements, which was introduced through a conversion process that took place in early March 2024.”

As a researcher studying exchange-traded funds (ETFs), I’ve come across the DEFi fund. Initially, this ETF functioned as a traditional spot ETF. However, following its conversion in March 2024, it primarily holds actual Bitcoin and aims to mirror the spot price of Bitcoin. Nonetheless, it’s important to note that up to 5% of DEFi’s assets can be allocated to Bitcoin futures contracts.

To better follow Bitcoin’s price movements and enhance the creation/redemption experience for investors, this minor addition of futures in our Defi ETF functions as a supportive mechanism. In simpler terms, although it falls under the category of a spot Bitcoin ETF, it incorporates a small element of futures contracts.

As a crypto investor, I’ve noticed that DeFi has a higher expense ratio compared to most ETFs, specifically at 0.94%. This fee includes various operational costs such as management fees, administrative expenses, and custody fees. In simpler terms, it’s the price we pay for the services provided by the DeFi platform to ensure smooth transactions and security of our investments.

Fund Facts

Overview and fund facts:

- Fund inception: September 15, 2022, updated on March 2024

- Sponsor Fee/Expense Ratio: 0.94%

- Exchange: NYSE Arca

- Custodian: BitGo

- Total AUM (as of June 2024): $12.4 million

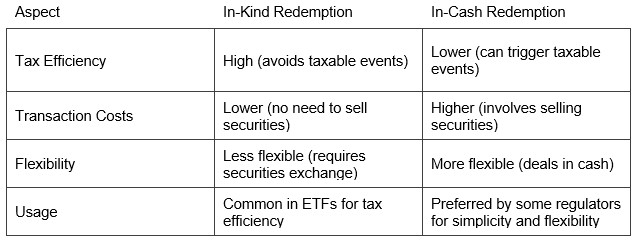

In-Kind and In-Cash Redemption Models for Spot Bitcoin ETFs

One issue that complicates the approval process for Spot Bitcoin ETFs is determining the purchasing and selling methods that both the applicants and the Securities and Exchange Commission (SEC) can accept for this distinctive asset class.

This is where the in-kind and in-cash redemption models kick in.

In-Kind Redemption Model

As a crypto investor, I can explain that in-kind redemptions are a crucial feature of Exchange-Traded Funds (ETFs), helping them preserve tax efficiency by enabling APs to swap ETF shares for the actual securities underlying the fund instead of selling appreciated assets to fulfill redemption requests. This method, which has been essential since ETFs’ inception, keeps the fund from triggering capital gains taxes and ensures a more streamlined redemption process.

In a nutshell:

- In-kind redemptions involve exchanging ETF shares for a basket of the underlying securities held by the ETF rather than cash.

- Only the APs, typically institutional investors, can directly redeem the shares from the ETF for a proportional basket of the underlying securities.

Institutions opt for ETFs over mutual funds due to their tax efficiency. This is because no securities are sold in the process of redeeming shares, which prevents a taxable event and defers capital gains taxes for non-redeeming shareholders. Additionally, ETFs limit trading and transaction costs, making them more economical for institutions in terms of taxes.

In-Cash Redemption Model

Authorized investors can exchange their ETF shares for cash in the process known as in-cash redemptions. This practice is prevalent among ETFs investing in less liquid assets or those managing active strategies, who prefer to maintain discretion over their tactics by avoiding the distribution of securities upon redemption.

Here’s the skinny:

- In-cash redemptions involve the exchange of ETF shares for cash equivalent to the net asset value (NAV) of the shares being redeemed.

- The AP deposits cash into the ETF and uses it to purchase the underlying assets. That, or the ETF sells the underlying assets to generate the cash needed for redemption.

Cash redeemptions offer greater convenience for fund investors as they allow for straightforward transactions by exchanging shares for hard currency instead of dealing with securities.

As a crypto investor, I’ve noticed that in-kind crypto transfers, where you transfer the actual cryptocurrency instead of selling it and then buying new coins, can be more tax-efficient. This is because selling securities to generate cash for transactions can result in taxable events, leading to capital gains distributions that impact all shareholders. Additionally, the process involves higher transaction costs due to wider bid/ask spreads and broker commissions when selling the underlying assets.

Below is a table that can help you compare both types of redemption models:

For spot Bitcoin ETFs, the SEC has mandated that redemptions must be in cash rather than in-kind.

Although it may seem unfavorable to Bitcoin investors, this issue might originate from Bitcoin’s distinct characteristics and fears of significant market disruption if large quantities of BTC were exchanged for physical goods.

The responsibility for buying or selling Bitcoin (BTC) when shares are bought in or sold out lies with the issuers, resulting in investors bearing the trading expenses, which encompass transaction fees, price differences between bid and ask prices, and market influence costs.

How to Choose and Invest in Spot Bitcoin ETFs

When considering investing in a Bitcoin Exchange-Traded Fund (ETF), keep in mind that not every brokerage provides access to shares of spot Bitcoin ETFs. This is an essential factor to verify from the outset. Furthermore, examine the types of investment accounts the broker supports and determine if they align with your specific needs.

Fidelity offers various account options, including Individual Retirement Accounts (IRAs) and standard brokerage accounts.

Once your account is open, you must fund it with cash to be ready to invest in spot Bitcoin ETFs.

The steps are simple:

Step 1: Open an investment account.

Step 2: Fund the account with cash.

Step 3: Select the ETF you wish to purchase.

Step 4: Execute the trade to buy the ETF’s shares.

Regardless of your selection, keep in mind that Bitcoin-linked ETFs, such as those for spot BTC, aim primarily to provide investors with Bitcoin exposure. The methods they use to achieve this, the amount of liquidity they offer, their industry standing, and the fees they charge are the significant factors to consider.

As a crypto investor, I understand that the decision to buy cryptocurrencies is not a straightforward one. It’s not just about purchasing a fund like an ETF and owning its shares. Instead, I must consider my investment strategy – whether I plan to hold onto my investments for the long term or actively trade them in the short term. Both approaches have their unique advantages and challenges. So, I need to carefully evaluate my goals, risk tolerance, and market knowledge before making an informed decision.

- Fees are the primary consideration for long-term, buy-and-hold investors as their impact compounds over time. Choosing a low-cost ETF is crucial to maximizing returns.

Several ETFs, including ARK, Fidelity, VanEck, and iShares, have expense ratios of around 0.25% after fee waivers expire. The Bitwise Bitcoin ETF (BITB) has the lowest expense ratio at 0.20%.

Consult each ETF’s official website and be up-to-date with fee waivers; they can expire on a specified date or when the ETF reaches a certain NAV number.

For active traders, liquidity and tight bid-ask spreads are more important for those frequently trading in and out of their positions because higher liquidity allows for easier entry/exit and lower trading costs.

Larger, more established issuers like BlackRock’s IBIT and Fidelity’s FBTC may offer the highest liquidity initially.

Benefits of Spot Bitcoin ETFs

As a researcher studying investment opportunities in the digital currency market, I’ve discovered that Investment Products Based on Bitcoin ETFs offer several attractive advantages for investors looking to gain exposure to Bitcoin (BTC) without actually possessing the cryptocurrency itself. Let me outline some of these benefits:

- Legitimacy: Approval of spot Bitcoin ETFs by regulatory bodies such as the SEC lends credibility to Bitcoin as an asset class. This approval makes Bitcoin more acceptable to a wider range of investors, including those with retirement accounts like IRAs and 401(k)s.

- Accessibility: Spot Bitcoin ETFs offer a simple way for investors to gain Bitcoin exposure without needing to manage digital wallets and private keys or navigate cryptocurrency exchanges.

- Market Liquidity: By buying and selling large blocks of Bitcoin based on demand, spot Bitcoin ETFs can enhance Bitcoin’s overall liquidity, potentially stabilizing its price over time.

- Accurate Price Tracking: Spot Bitcoin ETFs are designed to closely follow Bitcoin’s current price, providing investors with a transparent and straightforward way to track its market value.

- Daily Creation and Redemption: Shares of spot Bitcoin ETFs can be created or redeemed daily, helping keep the ETF’s price aligned with the underlying Bitcoin holdings’ net asset value (NAV).

- Regulation: Spot Bitcoin ETFs operate within a regulated framework, offering an added layer of security and oversight compared to unregulated cryptocurrency exchanges.

- Portfolio Diversification: Spot Bitcoin ETFs provide investors with an easy way to diversify their portfolios by adding Bitcoin exposure without the complexities of direct ownership. This can be particularly beneficial for retirement accounts and other long-term investment strategies.

- No Futures Roll Costs: Unlike Bitcoin futures ETFs, spot Bitcoin ETFs do not incur additional costs associated with rolling futures contracts, which can erode returns over time.

Alternatives to Spot Bitcoin ETFs

As a crypto investor unable to access a spot Bitcoin Exchange-Traded Fund (ETF), I have some options to gain exposure to Bitcoin’s price movements. However, it’s essential to keep in mind that these alternatives don’t offer direct exposure and their values aren’t perfectly aligned with the price of BTC.

Bitcoin Futures ETFs

Bitcoin Futures ETFs track the price of Bitcoin futures contracts rather than BTC’s spot price.

How do spot and futures contracts differ for investors? While investors in spot contracts transact at the current market price for immediate delivery, those using futures contracts agree on a fixed price for an asset to be delivered or settled at a later date. This distinction enables investors to protect themselves from potential losses due to price fluctuations in the interim period.

Futures contracts involve some complications, such as contango and backwardation. Contango refers to situations where the price of a commodity or asset for future delivery is higher than its current market price. Conversely, backwardation exists when the futures price is lower than the spot price. Essentially, these phenomena can result in significant differences between the expected and actual price performance.

Notable examples include the ProShares Bitcoin Strategy ETF identified as BITO, and the VanEck Bitcoin Strategy ETF referred to as XBTF.

Bitcoin Trusts

As a crypto investor, I frequently consider investing in vehicles such as the Grayscale Bitcoin Trust (GBTC). This trust functions by holding actual Bitcoins and attempting to mirror its price movement. However, it’s essential to recognize that the price of these trusts on the stock market might differ from the value of the underlying Bitcoin itself. Consequently, their performance in comparison to Bitcoin could be influenced by this premium or discount.

Direct Purchase on Crypto Exchanges

One option for acquiring Bitcoin is to purchase it directly from exchanges like Coinbase, Binance, Kraken, or Bitfinex. With this approach, you’ll have sole possession of the Bitcoin and will be responsible for its safekeeping. For a deeper understanding of the differences between investing in a Bitcoin ETF and buying Bitcoin directly, please refer to our comparison.

Bitcoin Mining Stocks

As a financial analyst, I would recommend considering investment opportunities in companies specializing in Bitcoin mining, such as Riot Blockchain (RIOT) and Marathon Digital Holdings (MARA). By investing in these stocks, you’ll gain indirect exposure to the Bitcoin market. The prices of their shares frequently follow the trends set by Bitcoin’s price fluctuations.

As a researcher, I’ve come across an intriguing investment trend: some publicly-traded companies have Bitcoin as part of their assets. This indirect exposure to the cryptocurrency is an appealing option for investors. For instance, Tesla (TSLA) and MicroStrategy (MSTR) are well-known examples. MicroStrategy, in fact, boasts a substantial amount of Bitcoin holdings and identifies itself as a “Bitcoin development company.”

As an analyst, I would emphasize that while these instruments offer some exposure to Bitcoin (BTC), they don’t mirror its price movements exactly. Their values are connected to but not entirely dependent on the BTC price.

Blockchain ETFs

Instead of purchasing Bitcoin itself, these ETFs focus on investing in companies that utilize blockchain technology. For instance, consider the Amplify Transformational Data Sharing ETF (BLOK) and Siren Nasdaq NexGen Economy ETF (BLCN).

When selecting a method for investing, it’s crucial to take into account each approach’s unique risks and regulatory requirements. Proper research is necessary to find the best fit for your investment plan and risk comfort level.

Best Bitcoin ETFs: Conclusion

The introduction of Spot Bitcoin ETFs marked a significant turning point for Bitcoin and the cryptocurrency market, making it more accessible to investors and generating broader media coverage in a controlled and authorized framework. Nevertheless, it’s essential to grasp the fundamentals of Bitcoin, cryptocurrencies, and how investment tools like spot or futures ETFs function.

As a researcher delving into the intricacies of Spot Bitcoin Exchange-Traded Funds (ETFs), I’ve come to appreciate the extensive regulatory dialogues that transpired between lawmakers and prospective applicants prior to their approval. Notably, these types of ETFs have been specifically engineered for those new to the crypto sphere. They offer a simplified avenue for investing in Bitcoin without:

1) understanding traditional finance complexities and

2) the hurdles and complexities of buying, managing, and securing crypto directly.

In some aspects, Bitcoin Exchange-Traded Funds (ETFs) simplify the investment process for beginners by enabling them to put their money into these funds via established financial institutions. These institutions then handle the complexities of purchasing Bitcoin, safekeeping it, and dealing with various administrative tasks, reducing the learning curve for new investors.

Additionally, these Exchange-Traded Funds (ETFs) provide a controlled and convenient avenue for individuals to invest in Bitcoin, making the procedure more approachable for a larger audience due to regulation and ease of access.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Dead by Daylight: All Taurie Cain Perks

2024-06-06 16:13