This text discusses several AI crypto projects and how they utilize artificial intelligence in various ways within the crypto space. The projects mentioned include SingularityNET, Ocean Protocol, and others. Each project offers unique features and benefits, such as self-organizing networks of AI agents, open-source general AI systems, data marketplaces, and more.

There has been surging interest in cryptocurrencies capable of or intending to utilize artificial intelligence (AI).

The rapid advancement and growth of artificial intelligence (AI) has sparked significant excitement, debate, and apprehension among the general population, particularly tech aficionados, financiers, and even high-level government personnel and political figures. Innovations such as OpenAI’s ChatGPT and its competitors have been garnering widespread attention, leading to repercussions within the crypto sector.

As a researcher studying the evolution of financial systems, I’ve come across an interesting analogy. The emergence of Bitcoin and the subsequent development of Decentralized Finance (DeFi) markets bear striking resemblances to certain aspects of this new financial landscape.

Identifying the authentic and worthwhile AI-centered projects within the larger cryptocurrency sector can be a complex task due to the growing number of options available.

In this comprehensive analysis, we delve deeper into the leading AI-driven cryptocurrency protocols worth keeping an eye on.

Quick Navigation

- What is AI Crypto?

Best AI Crypto Projects to Watch This Year

Fetch.AI (FET)

Render Network (RNDR)

The Graph (GRT)

BitTensor (TAO)

Akash Network (AKT)

AIOZ Network (AIOZ)

SingularityNET (AGIX)

Ocean Protocol (OCEAN)

Is AI Good for Crypto?

How to Buy AI Cryptos?

Best AI Crypto Projects: Conclusion

What is AI Crypto?

Let’s take a moment to clarify what AI crypto is and discuss the reasons behind its recent growth.

In the vanguard of crypto innovation, artificial intelligence (AI) projects in the cryptocurrency sector experienced significant growth, particularly during the initial quarter of 2024. This surge wasn’t solely driven by hype; rather, it stemmed from the groundbreaking fusion of AI and blockchain technology, which has introduced numerous possibilities for finance, data storage, cloud computing, and various other sectors.

As a DeFi analyst, I’ve observed various decentralized applications (dApps) in this ecosystem harnessing the power of artificial intelligence (AI). For instance, decentralized exchanges (DEXs) leverage AI to streamline trade processes via algorithmic automation. This is commonly employed by automated market makers to enhance overall efficiency and user experience.

As a crypto investor, I can attest that the integration of AI in the world of blockchain technology brings numerous benefits. For instance, when it comes to smart contracts, AI can significantly enhance the screening process. By using advanced algorithms, AI enables founders to detect potential threats and vulnerabilities that might otherwise go unnoticed. This results in more secure and reliable transactions for all parties involved.

Approximately hundreds of AI-driven cryptocurrency initiatives exist now, catering to various niches within and beyond the crypto community.

Best AI Crypto Projects to Watch This Year

Fetch.ai (FET)

Fetch.ai is one of the top crypto AI projects boasting billions in total market capitalization.

As a crypto investor, I can tell you that Fetch offers me the opportunity to utilize advanced resources and instruments to create and generate income from my AI-driven cryptocurrency applications and solutions. What sets Fetch apart, though, is its self-governing economic entities.

These entities, encompassing devices, services, organizations, or people, possess the ability to carry out diverse functions. Among these tasks are processing and transmitting data between Internet of Things (IoT) devices, executing cryptocurrency transactions on behalf of users, and enabling trades and exchanges on decentralized platforms such as Uniswap through automated crypto trading bots.

This protocol runs on a distinct blockchain, fueled by its functional token named FET. One of its exceptional features is the consensus mechanism it employs: a combination of Proof-of-Work (PoW) and Proof-of-Stake (PoS). In this setup, miners are responsible for validating transactions within blocks, while agents garner rewards by accomplishing various AI-related tasks and collecting related fees.

Developers can utilize Fetch for building decentralized AI projects with ease, as it provides them access to advanced tools such as AI, Web3, and blockchain technology. Additionally, Fetch offers a wealth of resources, infrastructure, and comprehensive documentation.

As a crypto investor, I would describe it this way: Fetch, the platform I’m invested in, comes equipped with an intelligent Open Economic Framework (OEF). This AI-powered layer keeps data for various agents. Agents can engage and obtain information through this framework, while nodes are incentivized to support these interactions by being remunerated with FET tokens.

Render Network (RNDR)

The Render Network is a decentralized Ethereum blockchain solution designed to democratize GPU cloud rendering. By facilitating connections between individuals in need of rendering services and GPU owners with powerful hardware, it seeks to create a decentralized marketplace for high-performance rendering capabilities.

It is one of the top Solana projects.

this platform allows artists, individuals, and businesses to execute rendering jobs at a lower cost and faster pace than conventional centralized solutions.

As a crypto investor, I’d describe it this way: I invest in the Render Network (RNDR), a platform where creators post rendering jobs. In return, node operators use their idle GPU power to complete these tasks and get compensated with RNDR tokens. The platform caters to various types of rending tasks, such as simple ones for gaming and entertainment, as well as intricate projects involving artificial intelligence and machine learning.

This protocol features a tiered pricing structure where the fee for using a node depends on the operator’s reputation. The most reputable nodes belong to tier 1 and tend to be pricier but provide more dependable and adaptable services, commonly preferred by Render’s collaborators.

As an analyst, I would describe it as follows: I find that Tier 2 offers top-notch services at a more affordable price point, while Tier 3 represents the most cost-effective options. However, their reliability and scalability don’t rank as highly compared to other tiers. This pricing model is particularly beneficial for Web3 creators with varying budgets, allowing them to access GPU cloud computing in a more democratic way.

The Graph (GRT)

The Graph is an open-source, decentralized system for indexing data and information, functioning in a way akin to a search engine like Google in collecting, organizing, and storing data.

As a crypto investor, I can tell you that The Graph enables me to traverse and delve into various blockchain universes and their accompanying decentralized applications (dApps) with ease. Plus, it’s accessible in over a dozen languages including English, Spanish, Chinese, and more.

The Graph’s standout feature includes Subgraphs, customized indices that streamline data retrieval for users on various networks such as EVM-compatible blockchains and IPFS.

Subgraphs serve as global indexers for publicly available information, linking the worlds of Web2 and Web3. This data is then stored, arranged, and can be easily accessed by various applications. Consequently, anyone can run queries on this information using the native currency, GRT, as payment.

As a researcher examining the cryptocurrency market, I’ve come across GRT, which boasts one of the most extensive token supplies within the AI sector. Specifically, this supply reaches a maximum cap of 10,799,004,319 tokens. Currently, around 9.5 billion tokens are in circulation.

BitTensor (TAO)

Open-source project BitTensor operates on the blockchain network Subtensor. Unique to this system is its consensus mechanism, named Proof-of-Intelligence (PoI).

In simple terms, this mechanism is similar to Proof-of-Work (PoW), as it recognizes and compensates miners for their significant efforts and discoveries in diverse technological and research areas of the BitTensor network.

As an analyst, I would describe BitTensor as a decentralized marketplace composed of multiple specialized subnetworks. Unlike parallel chains in systems such as Avalanche, these subnets function as competitive markets dedicated to AI, machine learning, data storage, price feeds, cellular automation, and other tasks. Each subnet is designed to optimally handle specific use cases, fostering a dynamic and efficient ecosystem.

In the context of BitTensor, a significant illustration is Decentralized AI Detection, where participants are motivated to contribute discoveries, resolutions, innovations, resources, and architectures to support the network in identifying content produced by large language models (LLMs) such as ChatGPT.

In simple terms, anyone can set up a subnet by making a payment using TAO, BitTensor’s native token, in the TAO platform. Additionally, you can establish reward systems for both miners and validators within each subnet. Validators are responsible for evaluating miner performance and distributing TAO as incentives.

BitTensor aims to democratize and commoditize AI and emerging technologies through blockchain technology.

Akash Network (AKT)

“Akash Network stands out among the leading AI cryptocurrencies, offering a trading platform for cloud computing resources where participants can transact using AKT as their currency of exchange.”

As a market analyst, I’ve observed the significant rise of Akash Network among the top AI crypto coins. Its unique value proposition stems from a straightforward business model. In this setup, I act as a user in need of cloud computing resources. Simultaneously, I could be a provider with excess capacity. The beauty lies in the peer-to-peer nature of these transactions, enabling seamless resource sharing and optimization within the network.

As a researcher studying the blockchain industry, I’ve discovered that this particular platform stands out due to its unique feature of offering decentralized storage and asset ownership at economical prices compared to conventional centralized systems. This advantage attracts not only businesses but also individual users.

I, as a crypto investor, have successfully established collaborations with prominent players in the cryptocurrency industry. Notable among these are Coinbase Prime, which securely holds my AKT tokens, and Solve.Care, an innovative blockchain healthcare platform. This collaboration aims to decentralize patient data and seamlessly integrate the advantages of blockchain technology into healthcare systems.

Akash employs Interplanetary File System (IPFS) for its decentralized storage because of its heightened security features and immunity to censorship.

The growing preference for decentralized cloud solutions like DeCloud, along with the surge in applications of artificial intelligence (AI) and machine learning (ML) technologies, has led to a significant uptick in usage and renewed enthusiasm among investors for projects such as Akash and related AI cryptocurrencies.

AIOZ Network (AIOZ)

AIOZ Network, developed by technology firm AIOZ, serves as a decentralized platform utilizing blockchain technology to provide efficient and dependable services in the areas of Web3 data storage, artificial intelligence computation, live broadcasting, and video-on-demand.

As a researcher studying the innovative tech company led by Erman Tjiputra, I’ve discovered their mission: to democratize and decentralize AI development through two primary offerings. The first is the W3AI marketplace, where users can access AI computation resources, and the second is the Web3 AI Platform, which delivers a range of AI solutions tailored for businesses, developers, and individual needs.

As a researcher investigating AIOZ, I can explain that this project runs on the Cosmos network and supports both BEP and EVM. Its consensus mechanism is based on Delegated Proof-of-Stake (DPoS) technology, which relies on Tendermint Core to facilitate up to 1,500 transactions per second. Additionally, AIOZ boasts a Decentralized Content Delivery Network (dCDN), where a worldwide network of nodes contributes extra processing power.

In simple terms, the network provides a decentralized platform where people can buy and sell Decentralized Physical Infrastructure (DePin) market assets related to artificial intelligence and computing power. This means that individuals with such resources have an opportunity to earn money from them.

In simple terms, this configuration provides affordable pricing for cloud computing services and enables the integration of artificial intelligence apps. Consequently, it presents cost-effective options for businesses and developers compared to conventional infrastructure setups.

SingularityNET (AGIX)

SingularityNET functions as a platform where AI goods and services are traded. It empowers individuals to generate custom AI models using the blockchain’s protocol, facilitating efficient development and deployment via pre-designed smart contract blueprints.

Developers can construct artificial intelligence models and systems on this platform or acquire pre-existing ones for use in their projects, resulting in a dispersed AI environment that advantages both projects and creators. Transactions involving these and other platform activities are executed employing the native AGIX token.

SingularityNET stands out among AI cryptocurrency initiatives with its rich array of offerings, boasting over seventy distinct AI-driven services. Examples include:

- Domain-Specific Language (DSL): a self-organizing network of AI agents that can delegate tasks to each other.

OpenCog Hyperon: an open-source general AI system based on OpenCog, a framework for developing AI models, robotics, and virtual embodied cognition.

Training AI models: users can train and customize AI models for various services based on specific needs.

Other services include speech command recognition, neural image generation, multilingual speech translators, real-time voice cloning, and more.

Ocean Protocol (OCEAN)

Using intelligent smart contracts driven by artificial intelligence, Ocean Protocol enables data providers to offer targeted data for purchase by end-users. This data encompasses various sectors such as healthcare, politics, finance, e-commerce, and many others.

Ocean Protocol, founded in 2017, is a pioneering entity in the realm of artificial intelligence (AI) and cryptography. It was established by Bruce Pon, an entrepreneur with a background in founding BigchainDB, a software company specializing in blockchain databases, and Trent McConaghy, who holds a PhD in Creative AI research.

Ocean Protocol boasts several alluring attributes. Among them is the Ocean Predictor, enabling users to operate AI-driven forecasting or cryptocurrency trading algorithms on real-time price data to accrue returns.

This platform enables the creation of decentralized AI applications using both Javascript and Python. It offers builders a rich collection of resources and tools. With it, developers can construct AI apps and generate APIs for monetization. Key features include IP ownership rights, access control, payment processing, on-chain data analytics, among others.

How to Buy AI Crypto?

As a crypto investor, I can tell you that there are two primary methods for acquiring AI crypto tokens. The first approach involves using centralized exchanges such as Binance. This means finding the token on their platform, placing an order at the desired price, and completing the transaction through their secure system.

For CryptoPotato’s valued readers who join Binance as our partner, you’ll be eligible for an exclusive reward: a $600 voucher. To claim this offer, simply use the provided link to sign up with Binance. Once your account is created and verified, complete the specified tasks to receive up to a $600 credit.

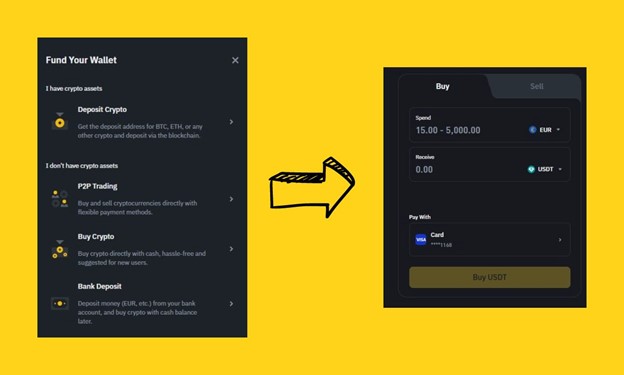

After creating an account, you’ll need to access the main menu at the top of the page. Then, click the “deposit” button located in the upper right corner and choose the “buy crypto” option.

After that, you have two easy steps left: specify the currency you prefer for the transaction and indicate which cryptocurrency you intend to purchase. You may utilize a standard credit or debit card for this process.

Another option you have is to utilize a decentralized exchange (DEX). However, this method comes with added complexity and necessitates a higher level of technical proficiency.

Is AI Good for Crypto?

From the perspective of an analyst, I believe that integrating artificial intelligence (AI) and blockchain technology can lead to significant synergies when each is utilized optimally. For instance, in a blockchain-centered financial system, AI can be harnessed for automated trading based on specific protocols. This application not only streamlines transactions but also enhances trading functions and price automation.

Crypto institutions benefit significantly from the application of AI algorithms in their operations. By leveraging machine learning techniques, these platforms are able to process trading requests faster and more efficiently. Furthermore, AI systems enable the creation of chatbots that cater to user queries in a conversational manner. In addition, advanced trading bots infused with AI capabilities can analyze market trends and even predict price fluctuations, thereby enhancing overall trading performance.

As a researcher specializing in blockchain technology and security, I would recommend implementing Artificial Intelligence (AI) solutions for enhanced on-chain analysis. Smart contract developers at blockchain firms can leverage AI to proactively identify potential threats and vulnerabilities within their codebase. This could involve recognizing patterns indicative of known vulnerabilities or analyzing the contract’s behavior against a predefined set of benchmarks.

As a data analyst specializing in the mining industry, I’ve noticed an intriguing trend emerging between AI and cryptocurrency. Specifically, AI marketplaces are increasingly offering solutions to allocate computing power more efficiently for users involved in cryptocurrency mining. This synergy enables miners to optimize their resources while ensuring they remain competitive within the dynamic and complex world of blockchain technology.

There are certain drawbacks, however, and we can summarise them as follows:

- Centralization: There’s a growing concern in the public that leading AI companies are working on their AI models behind closed doors, leaving investors and users out of the picture and raising concerns over the lack of transparency and power centralization. Projects like BitTensor try to democratize AI developments and innovation by rewarding users for sharing their discoveries and models.

- Black Box Problem: AI algorithms can be opaque, making it difficult to understand their decision-making processes. The black box problem refers to the challenge of transparency and interpretability of AI algorithms during their time of existence and may complicate/strain operations in crypto projects.

- New risk and security challenges: introducing AI in crypto could mean new risks and vulnerabilities that malicious actors can exploit.

Best AI Crypto Projects – Conclusion

AI and cryptocurrencies interact in various methods to enhance functionality and security. These include detecting fraud, ensuring smart contract security, conducting on-chain analysis, utilizing cloud resources, participating in mining activities, and optimizing trading processes.

The collaboration of AI technology and cryptocurrencies is expanding the possibilities for various sectors with innovative use cases and applications. Yet, it’s crucial to examine and address any potential downsides in order to minimize the risks for users and investors.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- W PREDICTION. W cryptocurrency

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Honkai: Star Rail’s Comeback: The Cactus Returns and Fans Rejoice

2024-05-23 15:29