Ah, the crypto markets-a theater of dreams and delusions! On the fateful eve of November 17th, the grand stage witnessed a plunge to $3.15 trillion, as if the gods of finance had grown weary of mortal folly. Sundar Pichai, the high priest of Alphabet, whispered of an AI bubble, and lo, the world trembled. Economist Tracy Shuchart, with a wink and a nod, declared the collapse of Bitcoin’s macro narrative as inevitable as a Russian winter. 🥶

Bitcoin’s Tragic Correction and the Liquidation Waltz

In the twilight of November 17th, the crypto economy, once a proud colossus, stumbled like a drunken bear. Its market capitalization shrank to $3.15 trillion, a victim of global market hysteria. The culprit? Whispers of an AI bubble, amplified by Pichai’s admission of “irrationality” in the AI boom. Ah, irrationality-the very essence of human endeavor! 🤪

In a BBC interview, Pichai, with the gravitas of a soothsayer, warned that no company would escape the bubble’s burst. Tech stocks quivered, and the sell-off began-a domino effect of fear and greed. Meanwhile, the U.S. economy, that fickle mistress, added her own woes to the melodrama. 🌪️

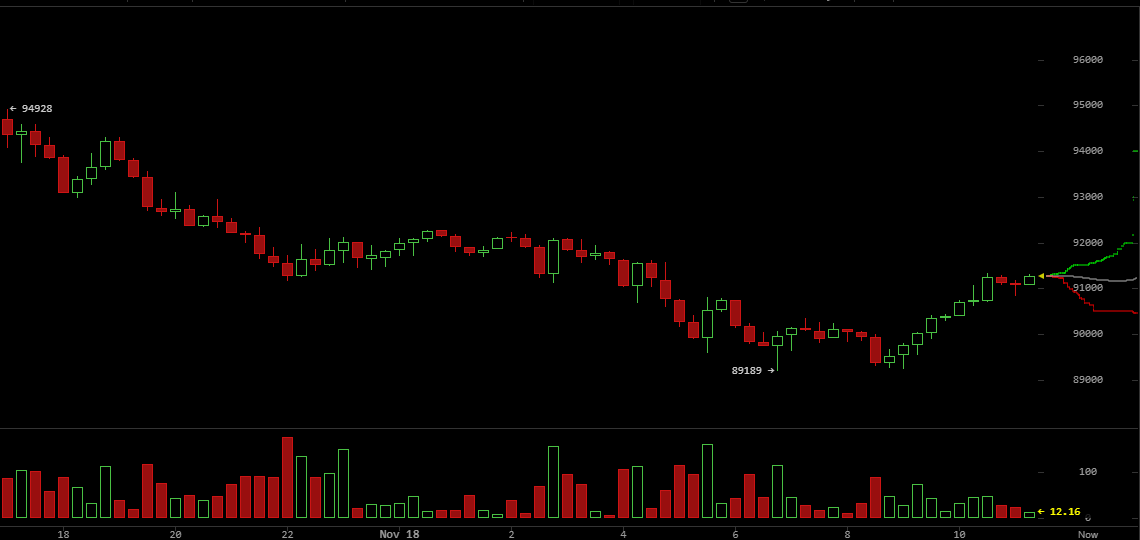

Amid this chaos, Bitcoin (BTC) plummeted to $89,226, erasing gains as swiftly as a Cossack’s saber. Its market cap, once a towering $1.8 trillion, crumbled like a poorly baked pirozhok. Leverage, that double-edged sword, claimed $560 million in 24 hours, leaving 185,000 traders in tears. A billion dollars in positions liquidated-a veritable massacre! ⚔️

The Collapse of the Grand Narrative

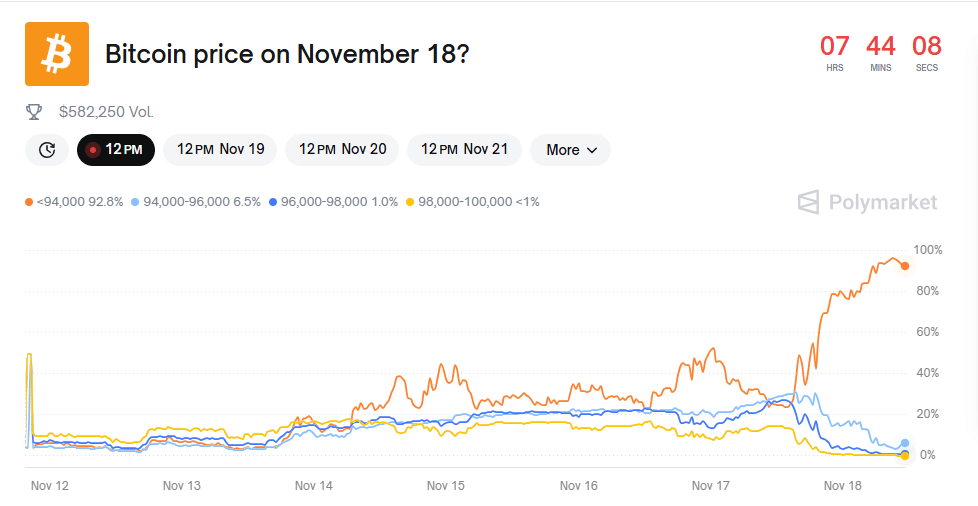

As the dust settled, experts and bettors alike abandoned hope of BTC reclaiming $125,000. Tracy Shuchart, the sage of Ninjatrader, declared the decline as inevitable as a Turgenev novel’s bittersweet ending. On X, she proclaimed the macro narrative’s collapse, leaving Bitcoin bereft of its sustaining myth. 🧙♀️

Two culprits emerged from the shadows: the spot BTC ETFs, once hailed as saviors, now creators of institutional-scale sell liquidity. Shuchart pointed to massive ETF outflows, the work of portfolio managers fleeing like peasants from a pogrom. The second villain? Long-term holders, cashing in their chips with profits of 50 to 150 percent. “Smart money,” Shuchart quipped, “knows when to step aside and rebuy lower.” 🧠💰

“They sold 815,000 Bitcoin in 30 days,” she noted, with the detachment of a chronicler. “Not because they despise Bitcoin, but because they foresee volatility-and why ride the storm when you can wait for calmer seas?” 🌊

The Leverage Hangover and Market Purgatory

The fall below $100,000 triggered a liquidation cascade, a financial tsunami sweeping through derivatives markets. Open interest plummeted from $94 billion to $68 billion, yet Shuchart suspects excess leverage lingers like an unwelcome guest. 🕷️

Thus, Bitcoin’s descent may continue until leverage is purged and long-term holders return, like prodigal sons, to accumulate once more. “The question is not why this happened,” Shuchart mused, “but at what price genuine buyers will emerge from the shadows.” 🕵️♂️

FAQ 💡

- What sparked the global rout? Fear of an AI bubble and U.S. economic jitters-a perfect storm of panic. 🌪️

- How did crypto react? Market cap plunged to $3.15T, Bitcoin dipped below $90K, and $1B in positions were liquidated. A bloodbath, indeed! ⚔️

- What drove BTC’s decline? ETF outflows and profit-taking by long-term holders-institutional sell pressure at its finest. 🏦

- What’s next for investors? BTC may fall further until leverage clears and genuine buyers return. Patience, dear comrades! ⏳

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Mario Tennis Fever Review: Game, Set, Match

- NBA 2K26 Season 5 Adds College Themed Content

- Train Dreams Is an Argument Against Complicity

- Every Death In The Night Agent Season 3 Explained

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-11-18 15:49