A Comprehensive Guide on Renzo Protocol (REZ) – Token Release Schedule, Team, Investors, and How to Participate in the Binance Launchpool

As a analyst, I’ve observed that Ethereum‘s network has been the backdrop for numerous stories over the years, and liquid staking is certainly one worth exploring in more detail.

It’s normal to be puzzled by the term “liquid restarting” given the prevalence of the term “liquid staking” in the discourse.

To fully grasp the significance of the Renzo Protocol, introduced in this manual, let’s first cover some essential foundational concepts.

Quick Navigation

- What’s the difference between Liquid Staking and Liquid Restaking?

Liquid Staking Tokens (LST)

Liquid Restaking Tokens (LRT)

What is EigenLayer?

Understanding Actively Validated Services (AVS)

What is Renzo Protocol?

Understanding restaking strategies

Understanding ezETH

Restaking with Renzo Protocol: step-by-step guide

ezPoints: everything you need to know

The REZ token in depth

Utility

Tokenomics

Token Distribution

Token Release Schedule

The Renzo (REZ) airdrop

The Team

Investors

Participating in the Binance Launchpool for Renzo Protocol (REZ)

That’s a Wrap

What’s the difference between Liquid Staking and Liquid Restaking?

As a researcher studying decentralized finance (DeFi), I can explain that both of these methods entail the process of securing your Ethereum (ETH) tokens by depositing them into a specific protocol with the intention of contributing to a certain function. In return, you’ll receive compensation in the form of interest or other rewards.

Liquid Staking Tokens (LST)

As an observer, I’d describe liquid staking as follows: When you participate in the process of staking your Ethereum (ETH) through designated protocols, these platforms issue a token representation of your deposited ETH, which is referred to as a liquid staking token (LST). The primary objective remains the same – enhancing Ethereum’s economic security by having your ETH contribute to validating and securing the network. The term “liquid” signifies the flexibility that comes with this synthetic asset; you can employ it in various Decentralized Finance (DeFi) initiatives based on your preferences.

I observe that Ethereum serves as the foundation for various liquidity solution protocols, including Rocket Pool, Lido, Binance ETH, and Mantle ETH, among others.

Liquid Restaking Tokens (LRT)

Using liquid staking, you deposit your Ethereum (ETH) into a specific protocol to bolster the economic stability of external systems such as Oracle networks or Rollups. In return, you obtain a new type of token, referred to as Liquid Rewarded Tokens (LRT), which serves as a representative form of your original ETH stake. The distinction lies in the intent behind staking: enhancing the security and functionality of external systems instead of just earning rewards.

In this context, EigenLayer serves as the fundamental protocol. Notable variants of LRT (Layer 2 scaling solutions) are Renzo, Eigenpie, Kelp DAO, Pufferfish, and ether.fi, among others.

Crucial reminder: LSTs and LRTs maintain a one-to-one relationship with Ethereum (ETH), meaning you can swap your synthetics for the same value in ETH anytime.

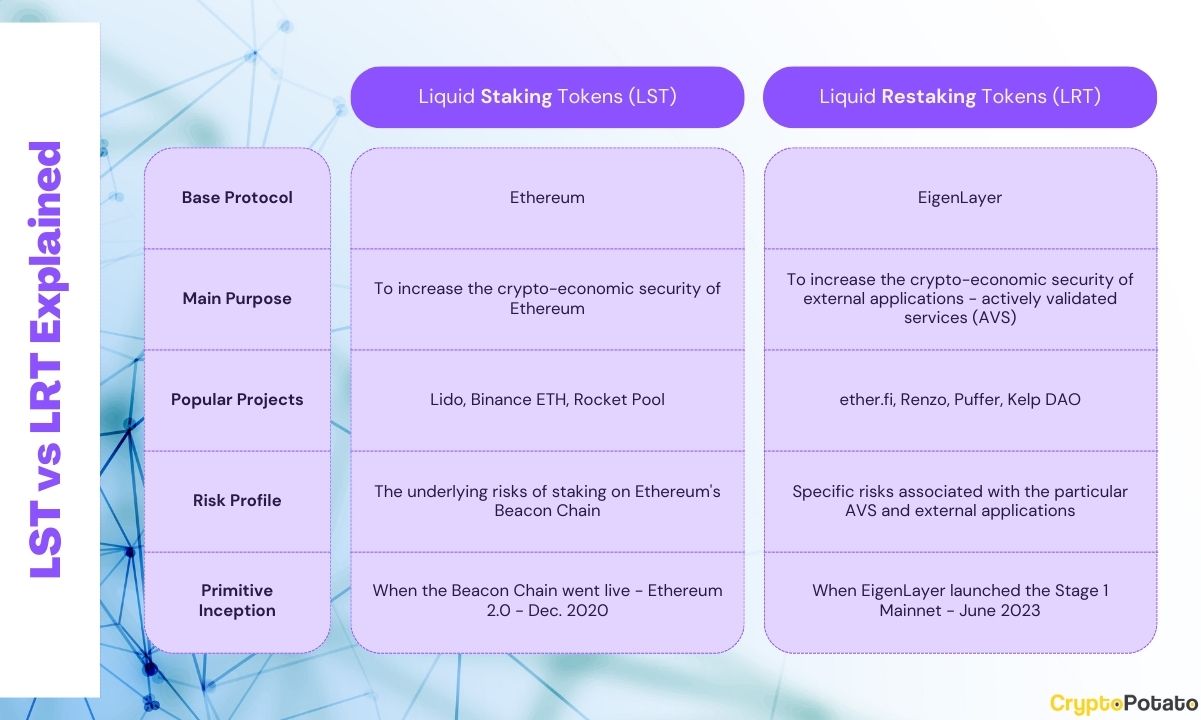

Here’s a table to visualize the above:

What is EigenLayer?

As someone who’s familiar with Liquid Rewarding Tokens (LRTs), I’d be happy to shed some light on the role of EigenLayer in this context. This is an essential aspect of our guide, as Renzo Protocol functions as both a LRT and a strategy manager for EigenLayer. Don’t fret; it will become clearer soon.

EigenLayer is a groundbreaking Ethereum protocol that pioneered the concept of restaking. By engaging with this protocol, users have the opportunity to reallocate their ETH for use in the consensus layer. This enables them to join EigenLayer’s smart contracts and boost the security of various applications on the Ethereum network through the process of restaking.

EigenLayer acts as an intermediary, allowing users to delegate enforcement rights over their staked Ethereum to the platform. With this authorization, EigenLayer can then re-stake the Ethereum on other applications.

I’ve come across various types of applications in the crypto sphere, which can be categorized as rollups, oracle chains, or those built on similar cryptoeconomic foundations. These applications are referred to as Actively Validated Services (AVS) from my perspective, and they play a crucial role in grasping the essence of the Renzo Protocol.

Understanding Actively Validated Services (AVS)

I observe that an Automated Verification System (AVS) refers to any complex system where validation for verification is carried out across multiple components or nodes. This could encompass various structures like sidechains, bridges, keeper networks, data availability layers, oracle networks, and more.

From an outside perspective, when you choose to restake your Ethereum (ETH) on Automated Market Making (AMM) platforms to earn Additional Value Streams (AVS), each unique AVS carries distinct risk profiles. Consequently, the potential rewards vary. Therefore, deciding which AVS to allocate your tokens to and devising an effective strategy becomes crucial.

This is where the Renzo Protocol comes in.

What is Renzo Protocol?

I observe Renzo as a user-friendly interface nestled within EigenLayer’s ecosystem. By employing a blend of operator nodes and smart contracts, it ensures optimal risk/reward opportunities for its users when it comes to restaking strategies.

We know this can be quite confusing, so let’s try to break it down even further.

Understanding restaking strategies

With a clear understanding of EigenLayer and its role, as well as that of LRTs, let’s make Renzo’s tasks simpler to grasp. Renzo works on developing these concepts within the context of machine learning algorithms or models, specifically for improving their performance in handling large datasets. By utilizing EigenLayer, he focuses on implementing techniques such as LRTs (Low-Rank Approximations) to reduce computational complexity and memory requirements without significantly sacrificing accuracy.

In simpler terms, an AVS in EigenLayer refers to any decentralized service aiming to leverage Ethereum’s security. A restaking strategy allows users to secure one or more of these AVS options, creating various combinations. The more available AVSs there are, the greater the number of potential strategies that can be employed.

As an analyst, I find it challenging to select the option that provides the optimal risk-reward ratio. However, by utilizing a tool like Renzo, I can simplify this decision-making process and trust that the chosen alternative will deliver the most favorable risk-reward ratio.

Understanding ezETH

As a token analyst, I’d describe ezETH as follows: ezETH functions as the Liquid Restaking Token within the Renzo Protocol. By holding this token, users signify their staked positions in the system.

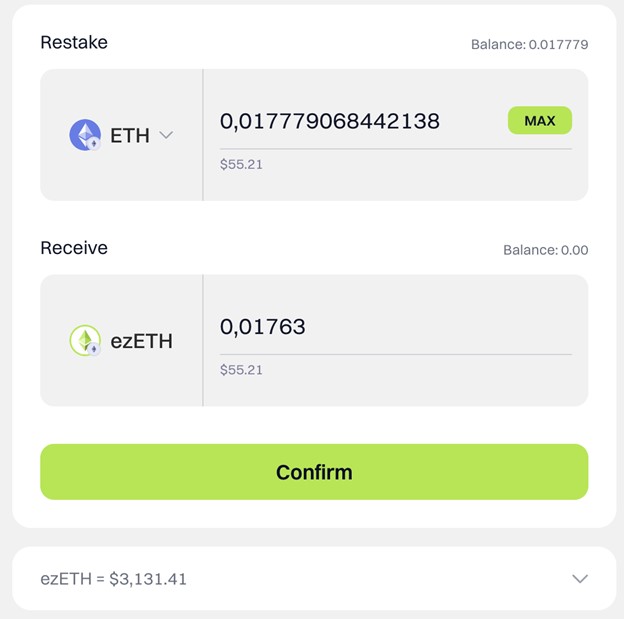

Users can deposit their native Ethereum (ETH) or equivalent liquid staking tokens (LSTs), like wBETH and stETH, to obtain ezETH in return.

One key aspect to consider is that ezETH functions as a token with incentives attached. Consequently, its worth may grow faster than the original tokens due to the enhanced rewards it generates when utilized within Automated Market-making Systems (AVSs).

Renzo has connected with Pendle Finance, allowing for the creation of a new token, the EIP5115 SY Token, through a sole contract. This token is equivalent to ezETH, but it offers the flexibility to be tokenized into principal tokens and yield tokens for those who prefer such options.

Restaking with Renzo Protocol: Step-by-Step Guide

With a solid grasp of the Renzo protocol’s fundamentals under your belt, it’s time to explore practical applications.

Step 1: You will need some ETH (or LSTs such as stETH) in your MetaMask wallet.

Step 2: Visit the Renzo Protocol restaking dashboard and connect your wallet.

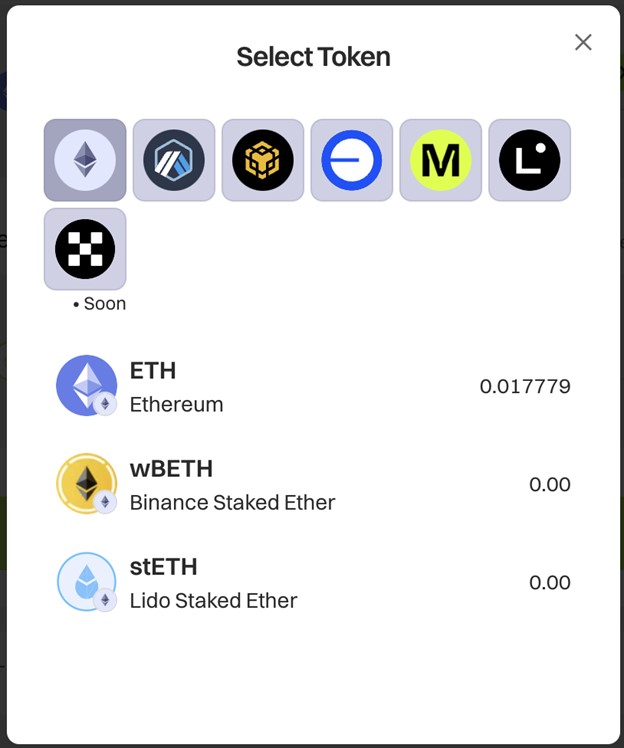

Step 3: In this stage, you’ll have the flexibility to select among various ecosystems and opt for native ETH or other compatible Layer 2 Solutions such as wBETH (Binance Staked Ether) and stETH (Lido Staked Ether), which are supported Ethereum alternatives.

Step 4: In our case, we will restake native ETH.

Step 5: Enter the amount you wish to stake and hit “Confirm.”

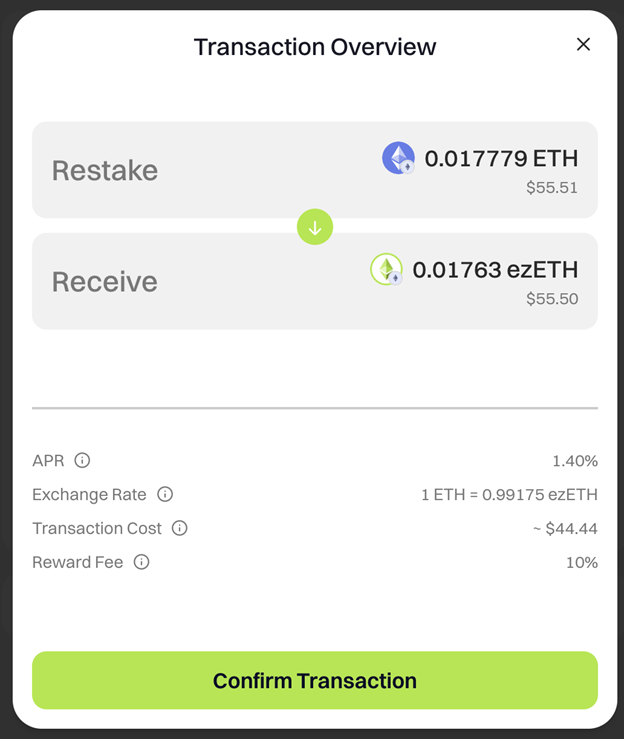

Step 6: Confirm the transaction from the interface.

Step 7: Confirm the transaction from your wallet.

Step 8: Head to the Portfolio tab where you’ll be able to view your earned points and rewards.

And you’re done!

Please note that withdrawals are currently disabled. Users will be able to withdraw their deposited ETH following a so-called cooldown period, to be determined by the team. However, ezETH is traded on secondary markets so you can always swap it on DEXs.

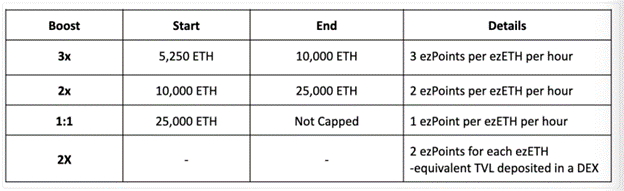

ezPoints: Everything You Need to Know

As a researcher studying the ezPoints system, I can explain that this platform grants rewards in the form of Renzo points to individuals who engage and contribute significantly to the protocol’s success. Each participant will receive points, but the quantity awarded depends on both the length and specifics of their involvement.

As an observer, I’d describe it this way: When you own ezETH, you earn ezPoints. Specifically, one Renzo ezPoint is granted each hour for every ezETH you possess. Your early involvement in the system also pays off, and the more ezETH you hold, the greater the number of points you receive, thanks to various boosts.

As an analyst, I would explain that ezPoints represent the amount of REZ tokens allotted to each user post the token generation event.

The REZ Token in Depth

“Renzo’s dedication to decentralization hinges on the REZ token, which serves as the cryptocurrency driving the decision-making process within the protocol.”

Utility

As a researcher exploring the REZ protocol, I can tell you that REZ functions as the native governance token within the system. By holding REZ tokens, community members gain the power to participate in decision-making processes related to the protocol. This includes voting on various proposals covering matters such as governance and other aspects of the platform.

- Operator whitelisting

- Actively Validated Services whitelisting

- Frameworks for general risk management

- Community and treasury grants

- Concentration amounts, collateral assets, deposits, etc.

Tokenomics

The total supply of REZ tokens is capped at 10,000,000,000.

The initial circulating supply (listing on April 30th) will be 1,150,000,000.

You can find the contract here.

Token Distribution

Fundraising: 31.56%

- These tokens are for the project’s early investors.

Community: 32%

- 7% will be for Season 1 airdrop rewards based on the earned ezPoints.

- Various community campaigns

- 5% allocated towards second season of incentives

Core Contributors: 20%

- Distribution to Renzo Labs’ team and advisors

Foundation: 12.44%

Binance Launchpool: 2.5%

Liquidity: 1.5%

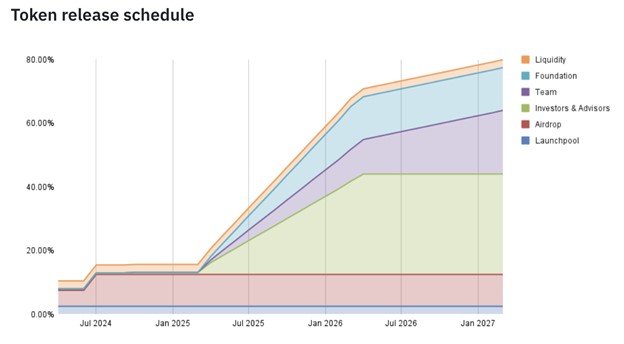

Token Release Schedule

The token release schedule looks like this:

The Renzo (REZ) Airdrop

Community members eagerly awaited the REZ airdrop after accumulating ezPoints through farming in preparation since the announcement.

Seven percent of the overall supply is allocated for Season 1 airdrop rewards, which are determined by each user’s accumulated ezPoints.

Here are the airdrop eligibility criteria:

- You need minimum 360 ezPoints per wallet.

- Most of the eligible wallets, accounting for over 99% of the total, will be fully unlocked at TGE.

- This doesn’t apply to larger wallets. Those who have more than 500,000 ezPoints will see 50% unlocked at TGE and the rest vested linearly over 3 months.

As a data analyst, I’d describe it this way: Starting from April 26, 2024, I’ll use that date as my reference point. However, if someone wants to make a claim, they should do so by April 30, 2024, at the latest. The window for making claims opens an hour before the asset listing on Binance, which is scheduled for 12:00 (UTC).

Season 2 is yet to be given a specific release date, but it’s assured that it will include 5% of the overall supply.

The Team

Lucas Kozinski is a key member of the team that established Renzo Protocol. With an extensive history in the cryptocurrency sector, he has previously held positions at Moonwell, a lending and borrowing application, TokenSoft, and the Tezos Foundation.

As a researcher studying the backgrounds of key figures in the tech industry, I’ve come across James Coole. He has an impressive resume, having co-founded Renzo and previously serving as the CTO at TokenSoft for a five-year tenure.

Kratik Lodha is identified as one of the initial key contributors. He brings a wealth of experience having held several analytical roles in different investment firms including Woodstock Funds, WorldQuant, and Equity Research among others.

Investors

In the beginning of January 2024, Renzo announced that Maven11 spearheaded a $3.2 million seed investment round for their company. Additionally, IOSG Ventures, Figment Capital, SevenX Ventures, and other investors took part in this funding round.

Based on the information provided on its official site, Binance Labs, OKX Ventures, Mantle, Edessa Capital, BODHI Ventures, Robot Ventures, and Re7Capital are among the investors, along with some other undisclosed entities.

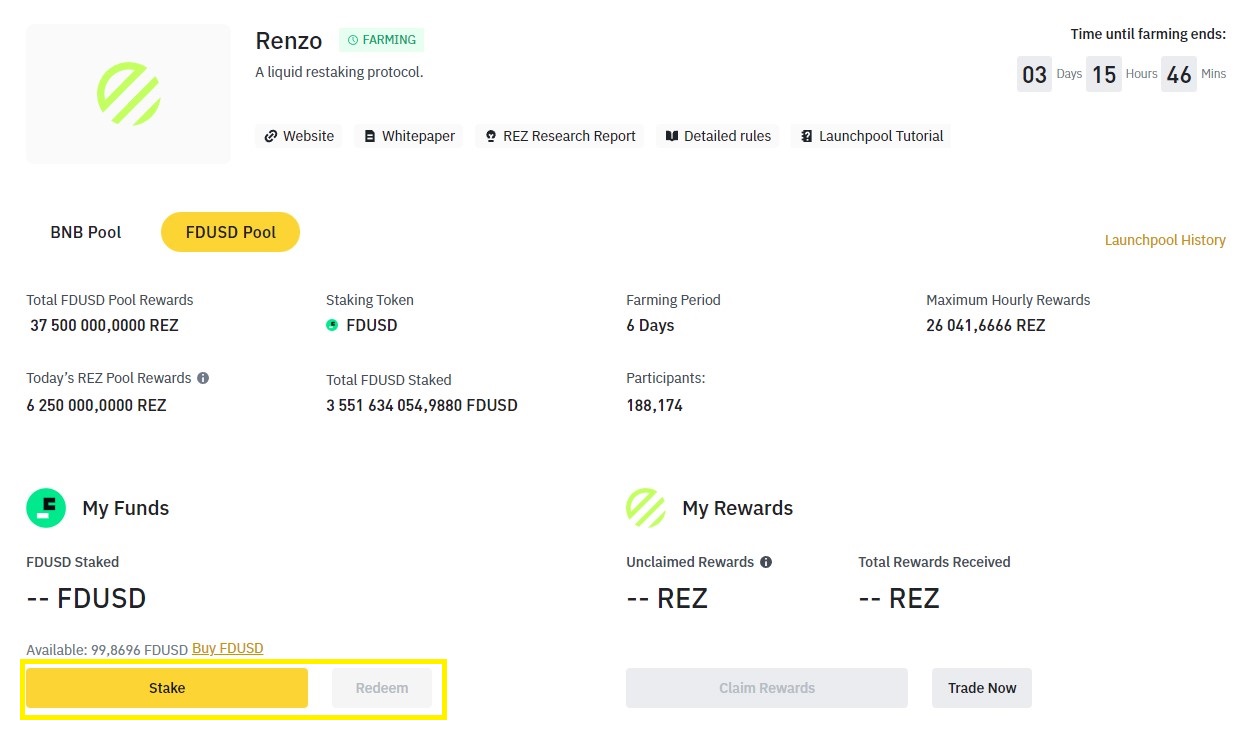

Participating in the Binance Launchpool for Renzo Protocol (REZ)

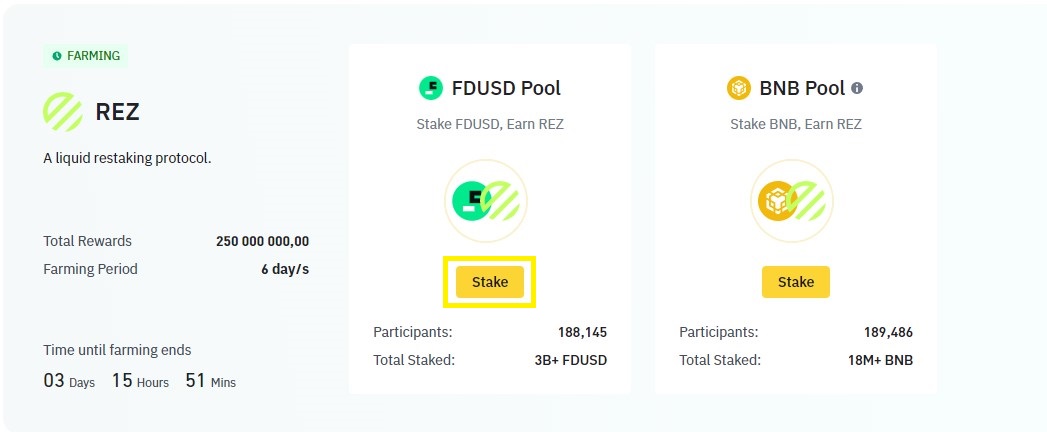

The Binance Launchpool campaign will last until April 30th. Trading will start at 12:00 (UTC).

As an analyst, I would advise that to join in, you’ll require a Binance account first. If you don’t currently possess one, simply click on this link to create an account. Following account creation, kindly proceed with the KYC (Know Your Customer) verification process. The entire procedure is swift and shouldn’t take longer than a few minutes.

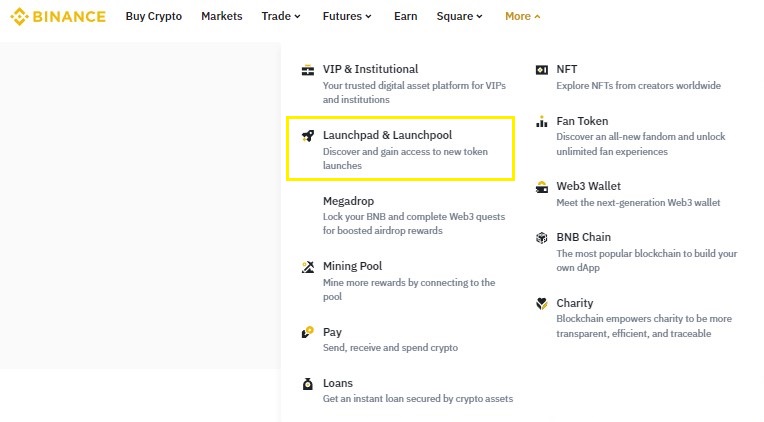

Step 1: Locating the Launchpool Section

After setting up your account, make your way to the Launchpad & Launchpool area by selecting it from the top menu bar (for desktop users).

Step 2: Selecting a Pool

Upon arriving, the most recent Renzo launchpool will be displayed, allowing you to select the pool you’d like to participate in. For REZ, there exist two such pools.

- FDUSD Pool

BNB Pool

As a financial analyst, I’ll recommend that for the purpose of this tutorial, we select the FDUSD Pool as our focus. By investing FDUSD into this pool, you’ll earn rewards denominated in REZ tokens.

Click on “Stake.”

Step 3: Staking the Selected Cryptocurrency

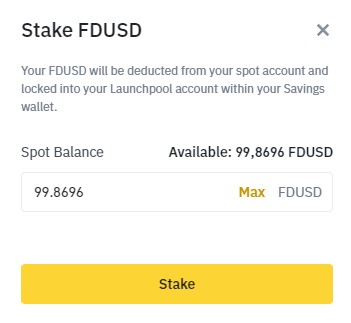

In the upcoming window, you’ll have a clear view of all the crucial details regarding the chosen pool, such as total rewards, highest hourly earnings, number of participants, staked amounts, and more. Additionally, this platform enables you to keep tabs on your own rewards and collect them once the claiming period becomes available.

You will once again have to click on “Stake.”

Following that, simply enter the desired bet amount and then hit “Stake” once more.

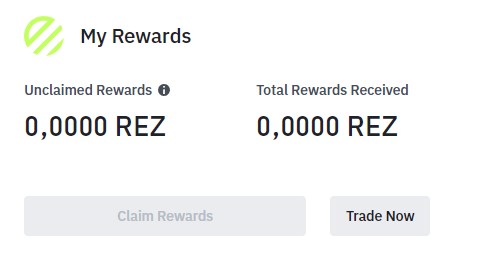

Step 4: Claim Your Rewards When Possible

Hourly, your earnings are computed. After sufficient hours have elapsed, you’ll find the accumulated rewards under the “My Rewards” section of the page. You’re welcome to claim them, but keep in mind that trading REZ is permitted solely after the listing process on April 30th has been initiated.

That’s a Wrap

In recent developments, the Renzo Protocol has garnered significant interest due to its impressive expansion within a brief timeframe. Additionally, the story surrounding liquid restaking is among the most intriguing trends of the year 2024. EigenLayer, in particular, is experiencing surging usage and popularity.

As an analyst, I would describe it this way: This protocol offers me a simple solution for generating returns from my idle tokens. However, it’s essential to acknowledge that there are inherent risks associated with such an approach.

While Renzo takes steps to secure your finances, it’s essential for each user to conduct thorough research, evaluate their individual risk tolerance, and consider seeking advice from a financial expert before making any investment decisions.

The above post is powered by Renzo Protocol.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- PENDLE PREDICTION. PENDLE cryptocurrency

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- Sim Racing Setup Showcase: Community Reactions and Insights

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-04-26 13:11