During discussions on monetary policies implemented by governments including the US, China, and Japan, Arthur Hayes of BitMEX pointed out that Bitcoin stands out as an effective alternative when central banks increase their balance sheets.

He made these comments during the current Token2049 conference in Dubai.

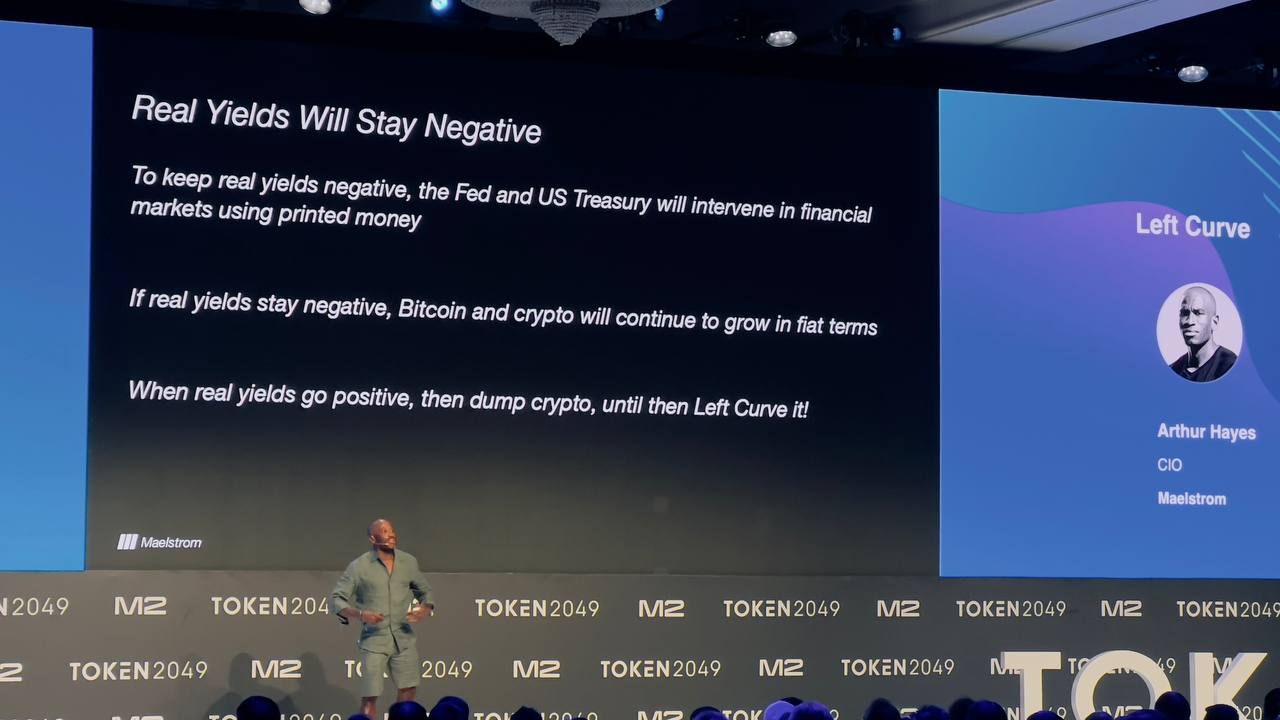

To start with, Hayes argued that the true returns would persistently remain in the red, a situation that the Federal Reserve and the US Treasury intentionally sustain. They accomplish this by obtaining loans at reduced interest rates.

If the current trend persists, as it has for several decades, the value of Bitcoin and other cryptocurrencies is expected to rise further according to the ex-BitMEX executive. However, he issued a cautionary note about the possibility of the opposite happening, but expressed doubt that real yields will turn positive any time in the near future.

The GDP figures reported by the US and other governments, according to him, are fabricated for public consumption and are intended to maintain public trust rather than reflecting reality.

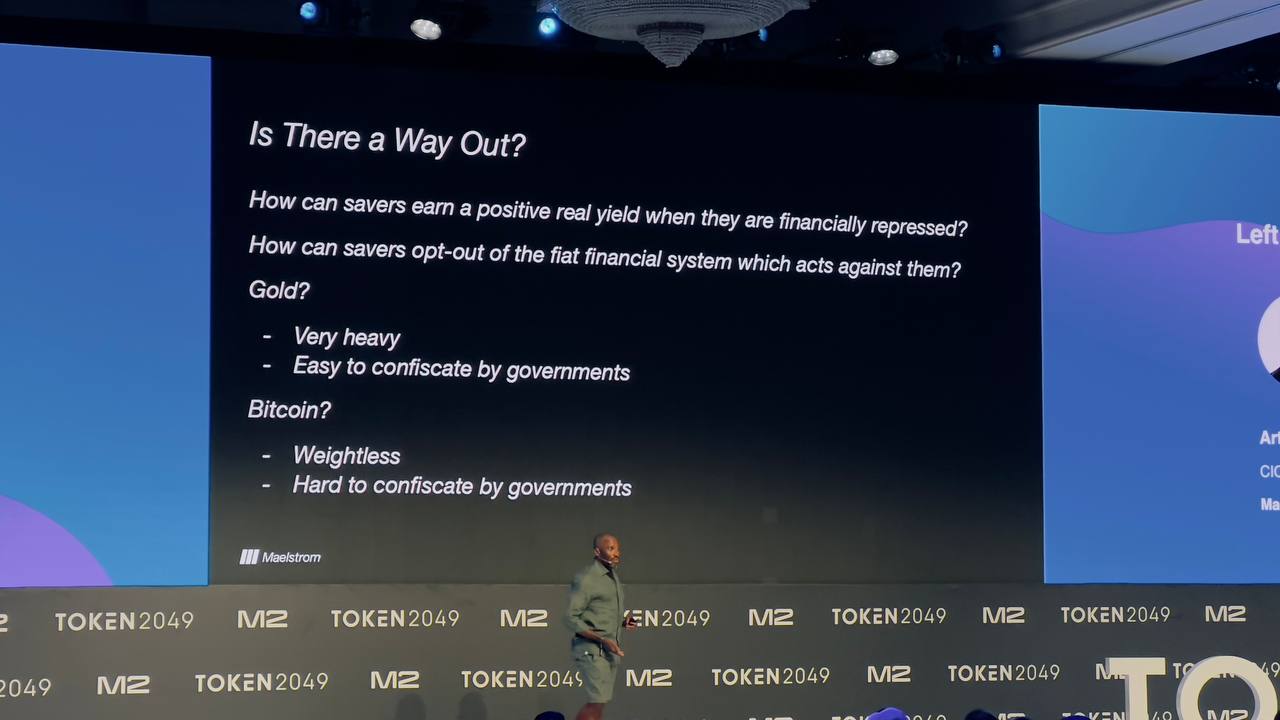

According to Hayes, the answer to this monetary policy using fiat currency is not within it. He pointed towards gold as a historical alternative, with its long history spanning thousands of years. However, gold comes with drawbacks that can be avoided by holding an asset with all its benefits and no downsides – this is where Bitcoin comes in.

In his speech, it was made clear that gold is heavy and difficult to transport, particularly in significant quantities. On the other hand, Bitcoin is a digital currency, making it easier to move and store. Throughout history, governments have confiscated gold hoards. However, since Bitcoin resides within the digital realm, it cannot be physically seized.

Based on Hayes’ belief that the US monetary policy won’t change, he advised individuals not to be dissuaded by Bitcoin’s recent surge and continue investing. They shouldn’t abandon the market merely because they’ve achieved substantial profits, around 200%, in the previous months.

This individual is convinced that Bitcoin’s value will continue climbing without hitting a plateau at $100,000. He has previously made bold assertions about Bitcoin’s future worth, estimating it could reach an astounding $750,000 in the not too distant future.

Read More

- Finding Resources in Palworld: Tips from the Community

- UFO PREDICTION. UFO cryptocurrency

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- BONE PREDICTION. BONE cryptocurrency

- W PREDICTION. W cryptocurrency

- EUR HKD PREDICTION

- Michelle Yeoh Will Not Appear in ‘Avatar 3,’ Says James Cameron: ‘She’s in 4 and 5’

- TANK PREDICTION. TANK cryptocurrency

- Skull and Bones: Gamers’ Frustrations with Ubisoft’s Premium Content Delivery

- Last Epoch: Why Keystroke Registration Issues Are Frustrating Players

2024-04-19 12:54