After dropping close to the significant support of $3,000, Ethereum‘s cost has experienced a prolonged period of price stability.

Although the value of the cryptocurrency is currently restricted between $3,000 and $3,700, it’s uncertain that price swings will increase unless it surpasses these limits by rising or falling.

Technical Analysis

By Shayan

The Daily Chart

Looking closely at Ethereum‘s daily chart, we observe that it has been trading sideways for an extended period after hitting significant support around $3,000. This area lines up with important Fibonacci retracement levels – specifically, the 50% level at $3,190 and the 61.8% level at $2,972. Additionally, the crucial 100-day moving average sits at $2,972. This cluster of support zones triggered a rebound in Ethereum’s price, propelling it upwards towards the upper limit of its range, around $3,700.

Lately, the price has hit a roadblock close to the top limit of its range, implying that sellers are active in this important area.

Despite this, Ethereum continues to trade within a holding pattern, as investors look forward to a potential surge in value that will enable the cryptocurrency to surpass its current key price level.

The 4-Hour Chart

Looking more closely at the price action on the 4-hour chart, we notice the development of a sideways triangle formation. This pattern usually emerges during periods of correction and often signals the resumption of the uptrend once the triangle’s upper boundary is breached.

In spite of this setback, Ethereum saw strong demand near the important $3K mark, triggering a fresh surge in buying power and pushing the price beyond the wedge’s upper limit.

The buying force in the market is clearly in control, as shown by this price trend. But when Ethereum hit the $3.7K mark as resistance, it encountered rejection and caused a minor pullback.

After experiencing a pullback following the recent decline, Ethereum’s price has returned to its previous wedge resistance level. If this pullback is strong, Ethereum could be gearing up for another price increase, potentially reaching the $3.7K mark. However, there is also a chance that Ethereum may experience a bearish retracement instead, with support at $3.2K as the next likely floor.

On-chain Analysis

By Shayan

It’s worth considering if Ethereum’s recent price increase is driven by investors purchasing the cryptocurrency directly or if it’s due to futures contracts with leverage.

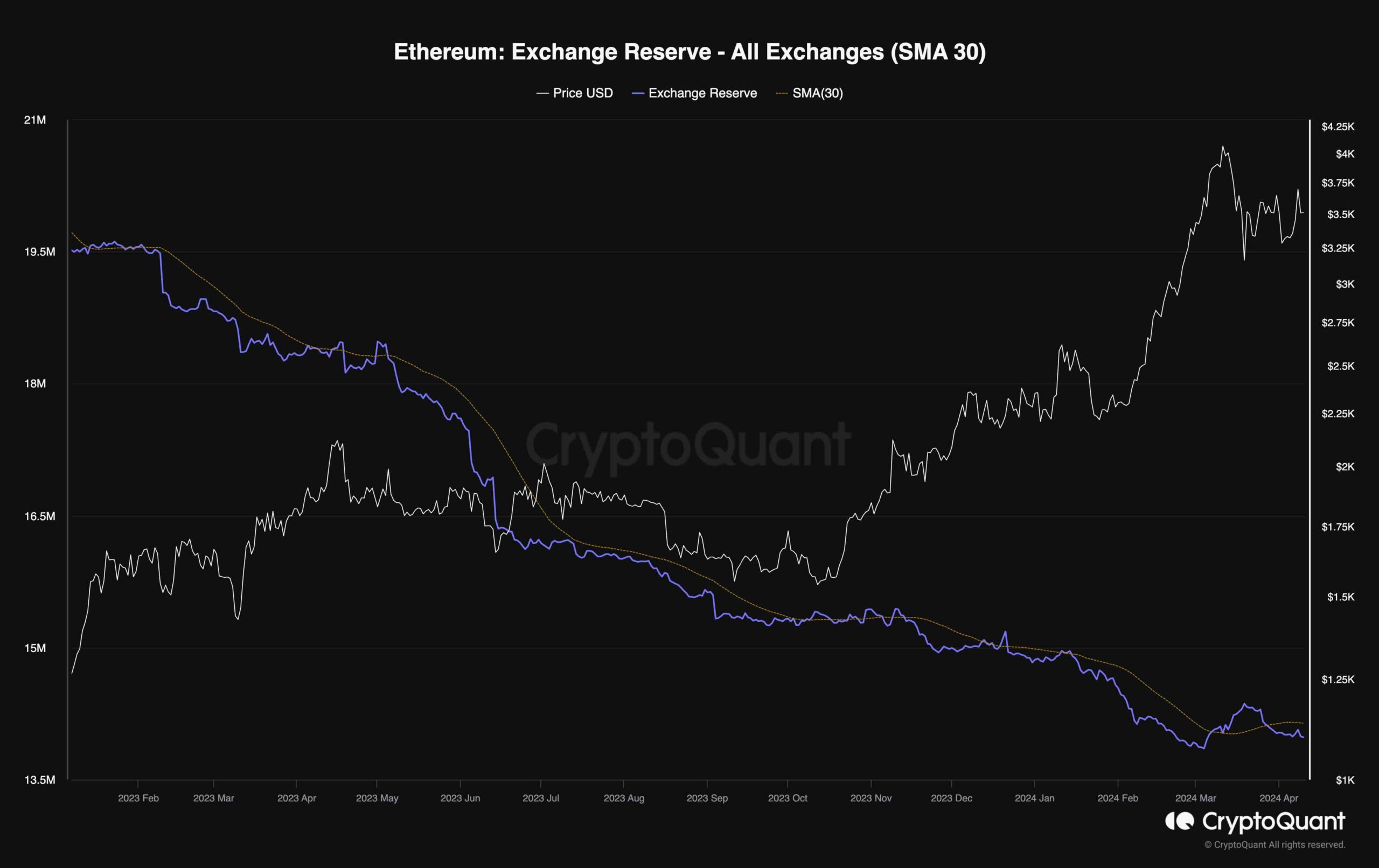

This chart shows the quantity of Ethereum kept in exchange wallets, indicating the exchange reserve metric.

In simpler terms, the exchange reserve metric for Ethereum has dropped below its moving average after previously surging above it. This decrease suggests that investors have been taking ETH off exchanges for personal use, signaling strong demand in the spot market. As a result, this demand could be fueling a potential price increase, potentially leading to a more prolonged uptrend.

Read More

- Discovering the Infinite Power: The Abiotic Factor that Could Change Everything

- AAVE PREDICTION. AAVE cryptocurrency

- BONE PREDICTION. BONE cryptocurrency

- Uncovering the Mystery of Red King Players in Clash Royale – What Reddit Users Have to Say

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- Finding Resources in Palworld: Tips from the Community

- Skull and Bones: Navigating the Quest for Extra Teeth in the Game

- UFO PREDICTION. UFO cryptocurrency

- Diablo Lag Issues: Is the Latest Update Playing Tricks on Gamers?

- Unveiling the Mystery of Palworld IVs: What Redditors Have to Say

2024-04-10 18:40