Over the last seven days, the cryptocurrency market has seen a significant drop, leading to a loss of nearly $200 billion in total value. Bitcoin‘s price dipped towards $93,000, causing a cascade of liquidations for over-leveraged positions worth hundreds of millions. Most other digital currencies have also declined in value during this period.

Bitcoin’s price has dipped by approximately 4.5% compared to a week ago, currently hovering around $93,000. This follows a turbulent week where Bitcoin tried to push toward its peak but was halted near $102,000. As the new week began and economic data started emerging, the market took a downturn, coinciding with broader stock markets as well.

On Tuesday, U.S. employment figures exceeded expectations, causing some investors to worry that the Federal Reserve’s current interest rate reductions might not persist due to a surge in inflation. This concern is echoed by Jerome Powell, the Fed chairman, who previously indicated that future rate cuts will likely be significantly less frequent up until 2025.

Despite some pessimism, it’s not all bleak news. While many large-cap cryptocurrencies are experiencing losses, artificial intelligence agents remain a hot topic. Admittedly, their prices have also dropped over the past week, but they quickly surge whenever there’s a sign of recovery, suggesting ongoing interest in them. In fact, Binance recently listed some of these digital assets, underscoring the attention this specific trend is receiving.

In the last week, Bitcoin’s influence over the market has significantly increased by 2%, highlighting its robustness compared to other cryptocurrencies.

It’s intriguing to contemplate what the remainder of this month may bring, particularly since the inauguration of Trump is scheduled for January 20th – a date that has been eagerly anticipated across the whole field.

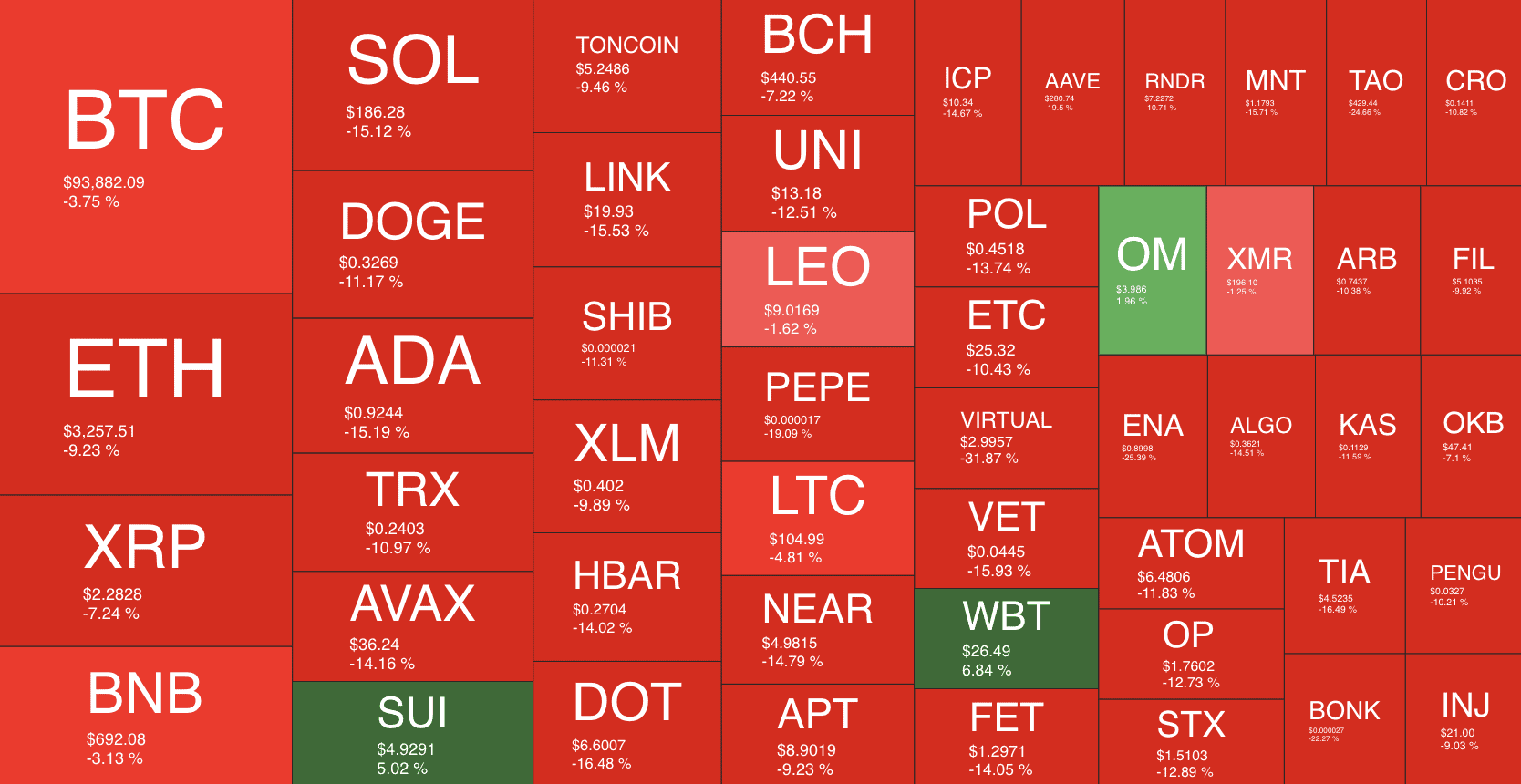

Market Data

Market Cap: $3.41T | 24H Vol: $181B | BTC Dominance: 54.5%

BTC: $93,800 (-4.5%) | ETH: $3,260 (-8.7% ) | XRP: $2.29 (-6.5%)

This Week’s Crypto Headlines You Can’t Miss

The price of Bitcoin soared beyond $100,000 this week following MicroStrategy’s announcement of their latest purchase, a relatively small acquisition compared to their previous ones in November and December. Remarkably, this recent purchase triggered an immediate jump in BTC’s price, reaching a high not seen for several weeks at $102,000.

Arthur Hayes, the ex-CEO of BitMEX, anticipates that the overall cryptocurrency market may experience a thrilling ride similar to a rollercoaster as January 20th (inauguration day) nears. While he expects some short-term ups and downs, he also believes that the current bullish trend will continue for a while longer but is likely to reach its peak around March this year.

The U.S. Government Might Have Already Sold Off $6.5 Billion Worth of Bitcoin Seized from Silk Road, So There’s No Need for Concern Regarding Market Panic

Bitcoin Holdings of U.S. Institutions Reach All-Time High: Insights

In good news for the global economy, American institutions have significantly increased their ownership of Bitcoin. These entities include Exchange-Traded Funds (ETFs), trading platforms, companies like MicroStrategy, miners, and others. Notably, their Bitcoin holdings are 65% greater than those held by non-U.S. based counterparts.

At a recent event at Mar-a-Lago, top executives from Ripple, specifically CEO Brad Garlinghouse and CLO Stuart Alderoty, had the opportunity to meet with Donald Trump, who is about to take office in ten days. With his encouraging statements towards the crypto industry, there has been a flurry of reports about crypto leaders meeting with the incoming President and his team.

In recent trends, a larger proportion of investors appear to be holding onto Ethereum for the long term compared to Bitcoin. According to IntoTheBlock’s data, about 74.7% of Ethereum addresses are from long-term holders, while that figure stands at over 60% for Bitcoin. However, this disparity could shrink if Ethereum reaches or surpasses its 2021 peak price of nearly $5,000.

Charts

This week’s post features an examination of Ethereum, Ripple, Cardano, Binance Coin, and Solana prices – check out our comprehensive analysis right here!

Check out this week’s in-depth chart analysis on Ethereum, Ripple, Cardano, Binance Coin, and Solana – click for the full price breakdown.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-10 19:54