What to know:

- Bitcoin miners listed in the U.S. accounted for 25.3% of the global network in December, the report said.

- Jefferies cuts its MARA price target to $20 from $24 and maintained its hold rating on the shares.

- Mining profitability rose in December as the rally in bitcoin outpaced the rise in the network hashrate, the bank said.

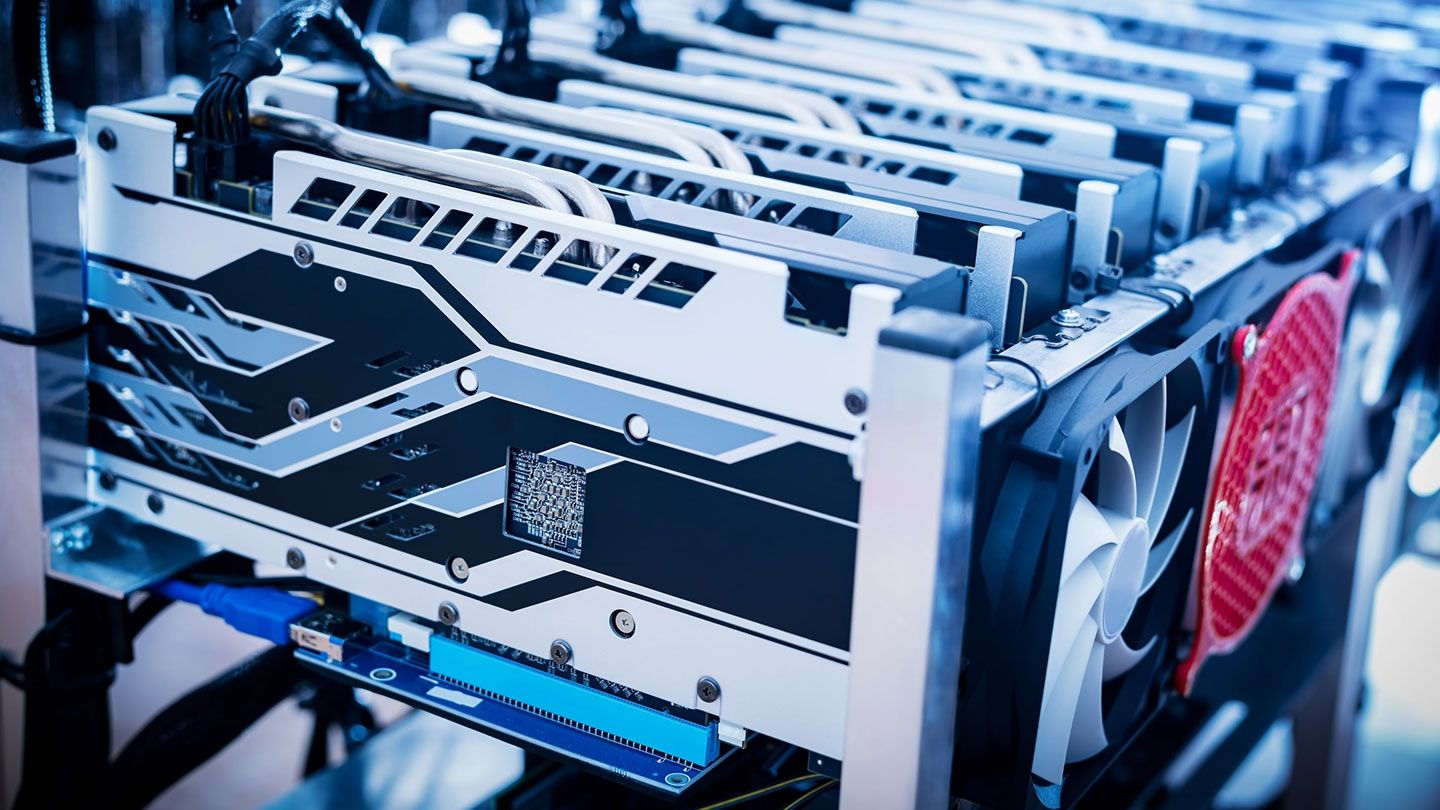

According to a report published by Jefferies on Thursday, bitcoin mining companies listed in the United States made up around a quarter (25.3%) of the entire global bitcoin mining network in December.

The financial institution adjusted its predicted value for MARA Holdings (MARA) from $24 to $20, but continues to advise keeping the stock. The shares increased by 0.5% to $18.43 in early trading on Friday.

In December, the profitability from mining Bitcoin saw an enhancement due to a 15% rise in the average Bitcoin price, which surpassed the 6.5% growth in the mining network’s overall hashrate, according to the report.

In simpler terms, the hashrate represents the collective processing strength employed for both mining new blocks (transactions) and validating them on a ‘proof-of-work’ blockchain system. Essentially, it serves as an indicator of competition among miners and the level of complexity involved in the mining process.

Average daily revenue was $59,585 per exahash, a 7.1% increase from November, Jefferies said.

3,602 bitcoins were mined by U.S.-based mining companies in December compared to 3,404 in November, according to the bank’s report. Notably, MARA led the pack in December, mining 890 bitcoins, while CleanSpark (CLSK) came in second with 668 tokens mined.

In the industry, MARA held the top spot for hashrate with a capacity of 53.2 billion hashes per second (bh/s), while CleanSpark followed closely behind at 39.1 bh/s, according to the findings.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-10 12:59