What to know:

By James Van Straten (All times ET unless indicated otherwise)

The overall value of cryptocurrencies currently stands at approximately $3.2 trillion, following a loss of over $300 billion since January 6th. This erasure of gains for the year, as measured by TradingView’s TOTAL metric, has caused bitcoin (BTC) to maintain a position above $93,000. Notably, bitcoin has been consistently making higher bottoms since December 30th.

The negative market outlook is heightened due to rumors circulating from DB News, yet unconfirmed, that the U.S. government may be authorized to sell up to 69,370 Bitcoin (valued at approximately $6.5 billion). This development adds an extra layer of interest to the political drama between the outgoing and incoming U.S. administrations. The president-elect, Donald Trump, who is just days away from being sworn in on January 20th, has previously pledged not to sell any Bitcoin in the government’s possession, which, according to data from Glassnode, amounts to 187,236 Bitcoin.

The intense activity in the cryptocurrency market is largely driven by a significantly high DXY index (over 109), which gauges the strength of the U.S. dollar compared to several significant foreign currencies. Furthermore, for a short while, the yields from U.S. treasuries were increasing before slightly decreasing the day prior. The peak for the 10-year yield reached 4.73%.

The worries about inflation that triggered the selloff in the broader market are escalating along with growth forecasts, according to LondonCryptoClub’s statement to CoinDesk. In essence, as both economic expansion and inflation predictions rise, coupled with an increase in term premiums due to the market grappling with a large amount of treasury supply to cover these deficits, U.S. interest rates are going up, which is causing global yields to climb (with the exception of China).

Meanwhile, there’s chaos brewing over the Atlantic in the U.K., as gilt yields keep surging today. A new record was established today, with the 30-year UK gilt climbing up to nearly 5.45%, a peak not seen since 1998. The benchmark 10-year gilt also approached 4.95%, a level last reached in 2008. In response to this volatility, the treasury had to step in and intervene in the market to reassure investors, as per reports from The Telegraph.

LondonCryptoClub outlined several significant factors contributing to the current turbulence: “The U.K. is facing difficulties due to a poorly received budget that has boosted borrowing requirements, yet failed to produce substantial economic growth, worsening its debt-to-GDP ratio and expanding the fiscal deficit.

Consequently, the less-than-mighty British Pound has dropped once more, reaching 1.22 per US dollar – a low not seen since November 2023, and having decreased nearly 4% over the past month.

9th January is marked as a day of mourning across the United States, honoring the passing of ex-President Jimmy Carter. Consequently, financial markets will remain shut on this day. Meanwhile, anticipation builds towards the release of the jobs report coming Friday. Currently, the market finds itself in a predicament where good news is met with negative sentiment – rate cuts for 2025 are being postponed, with only one rate cut projected for 2025.

As an analyst, I anticipate that a robust jobs report, with unemployment potentially dipping to 4.2% and nonfarm payroll projected at 154,000, could potentially halt the anticipated rate cut. If this “hot” jobs data materializes, it might propel the dollar up to 110, exerting additional stress on risk-assets. Stay vigilant!

What to Watch

- Crypto

- Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync’s latest release.

- Jan. 12, 10:30 p.m.: Binance will halt Fantom token (FTM) deposits and withdrawals and delist all FTM trading pairs. FTM tokens will be swapped for S tokens at a 1:1 ratio.

- Jan. 15: Derive (DRV) to create and distribute new tokens in token generation event.

- Jan. 15: Mintlayer version 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Macro

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Nonfarm payrolls Est. 154K vs. Prev. 227K.

- Unemployment rate Est. 4.2% vs Prev. 4.2%.

- Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 73.8 vs. Prev. 74.0.

- Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

- PPI MoM Prev. 0.4%.

- Core PPI MoM Prev. 0.2%.

- Core PPI YoY Prev. 3.4%.

- PPI YoY Prev. 3%.

- Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ending on Jan. 11. Prev. 6.8%.

- Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

- Core Inflation Rate MoM Prev. 0.3%.

- Core Inflation Rate YoY Prev. 3.3%.

- Inflation Rate MoM Prev. 0.3%.

- Inflation Rate YoY Prev. 2.7%.

- Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

- GDP MoM Prev. -0.1%

- GDP YoY Prev. 1.3%.

- Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending on Jan. 11. Initial Jobless Claims Prev. 201K.

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

Token Talk

By Shaurya Malwa

A parody token just got its own parody.

Yesterday, a new AI platform called upstart ai16z, which operates similarly to the venture fund a16z but uses AI to manage investments, experienced a surge in interest among small investors. This led to a massive increase in the value of their token, reaching a market capitalization of $130 million during European morning hours.

In a playful twist, the Large Language Model (LLM) challenges the idea that AI and investment are compatible, implying that if AI has the ability to take on any form, it could just as easily become a meme without any practical use for it.

Among X users, LLM was swiftly labeled as the “McDonald’s-esque version of $ai16z”, blending speedy food services with AI. This moniker suggests that while the marketing might be intelligent, the real AI prowess could be limited to just that – clever marketing.

1. The $LLM token is designed as a humorous jab at AI-related investments, similar to $fartcoin, without any real purpose or function.

2. Unlike other tokens, $LLM was created naturally and had an equal opportunity distribution model, allowing everyone the chance to purchase it even before its bonding.

— 冷静冷静再冷静 (@hexiecs) January 9, 2025

This asset lacks any intrinsic value or technical support; its worth is entirely speculative and relies on community interest, primarily due to the meme’s popularity and the amusement it generates within the cryptocurrency discussions.

I purchased it due to its humorous nature, but it has since transformed into a thriving community. Moreover, the ticker fits perfectly with our current context, and the wit behind the ticker symbol is simply priceless now.

— him (@himgajria) January 9, 2025

In simpler terms, over the past few weeks, the stocks of virtual systems (Virtuals), AI16z, and other similar technologies have dropped by more than 20% from their highest points. This decline comes in response to criticisms about the performance of their artificial intelligence models, as a previous analysis by CoinDesk pointed out.

Derivatives Positioning

- The annualized one-month basis in BTC and ETH CME futures has retreated to 6%-7%, the lowest since the election day. The positioning continues to moderate, with ETH open interest dropping to a one-month low of $2.9 billion, according to data source Amberdata.

- Annualized funding rates in perpetual futures tied to large cap tokens now hover at around 5%, down significant from last month’s excessively bullish 80% to 100%. However, the OI-normalized CVD continues to signal net selling pressure in the market.

- In options market, front-end skews now show bias for BTC and ETH puts, but longer duration continue to reflect a bullish bias.

- Notable block trades include a large short trade in the BTC $55K put expiring on March 29. In ETH, traders shorted calls at strikes $4,800, $5,500 and $6,000.

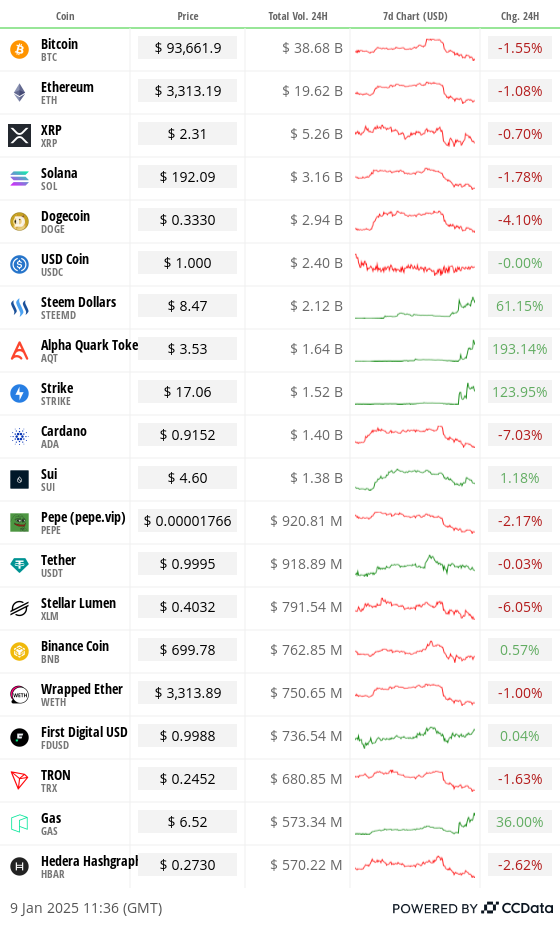

Market Movements:

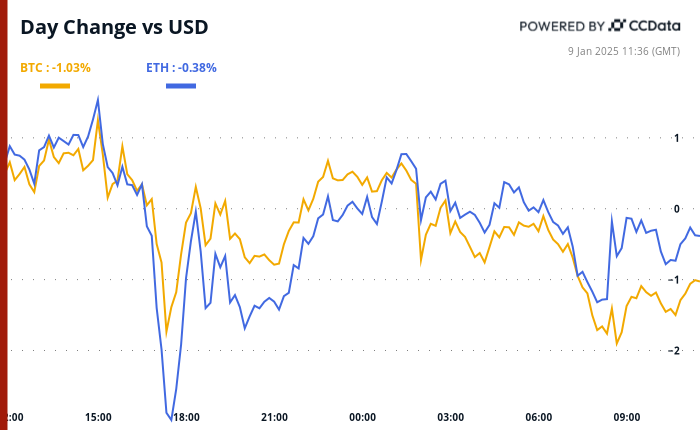

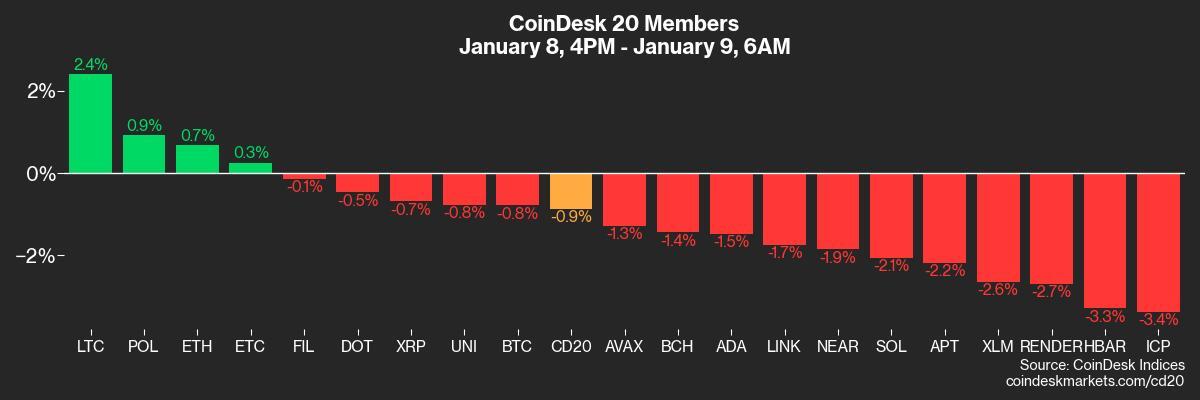

- BTC is down 1.24% from 4 p.m. ET Tuesday to $93,307.05 (24hrs: -1.8%)

- ETH is up 0.23% at $3,307.13 (24hrs: -1.15%)

- CoinDesk 20 is down 1.18% to 3,954.73 (24hrs: -2.28%)

- Ether staking yield is up 1 bp to 3.15%

- BTC funding rate is at 0.0061% (6.66% annualized) on Binance

- DXY is up unchanged at 109.19

- Gold is up 0.72% at $2,683.8/oz

- Silver is up 1.71% to $30.86/oz

- Nikkei 225 closed -0.94% at 39,605.09

- Hang Seng closed -0.2% at 19,240.89

- FTSE is up 0.63% at 8,303.24

- Euro Stoxx 50 is unchanged at 4,997.63

- DJIA closed +0.25% to 42,635.20

- S&P 500 closed +0.16% at 5,918.25

- Nasdaq closed unchanged at 19,478.88

- S&P/TSX Composite Index closed +0.49% at 25,051.70

- S&P 40 Latin America closed -0.87% at 2,204.98

- U.S. 10-year Treasury is down 2 bps at 4.68%

- E-mini S&P 500 futures are down 0.1% to 5,953.0

- E-mini Nasdaq-100 futures are down 0.18% at 21,323.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 42,874.00

Bitcoin Stats:

- BTC Dominance: 57.85

- Ethereum to bitcoin ratio: 0.035

- Hashrate (seven-day moving average): 785 EH/s

- Hashprice (spot): $55.7

- Total Fees: 7.57 BTC/ / $722,439

- CME Futures Open Interest: 176,215 BTC

- BTC priced in gold: 34.8 oz

- BTC vs gold market cap: 9.90%

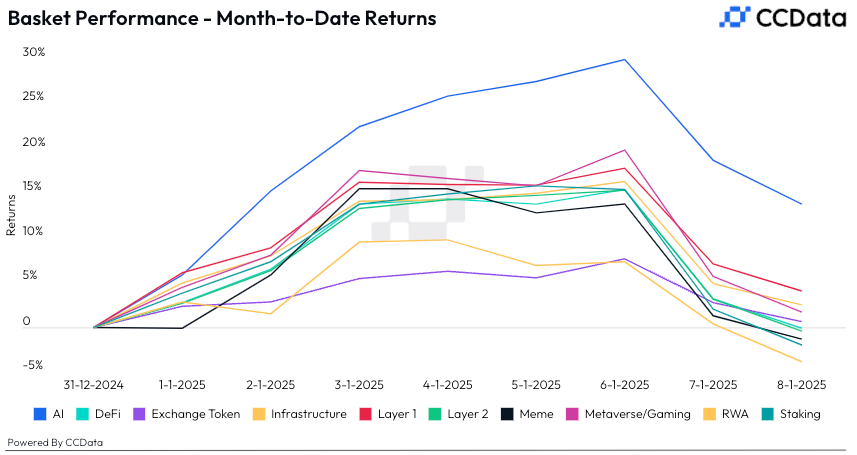

Basket Performance

Technical Analysis

- The chart shows BTC’s downward momentum is weakening.

- While prices continue to chalk out lower highs, the momentum oscillator RSI is now moving in the opposite direction, diverging bullishly to signal a potential price bounce ahead.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $331.7 (-2.85%%), up 0.99% at $335.00 in pre-market.

- Coinbase Global (COIN): closed at $260.01 (-1.63%), up 0.55% at $261.45 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.62 (-2.23%)

- MARA Holdings (MARA): closed at $18.34 (-3.84%), up 0.11% at $18.36

in pre-market. - Riot Platforms (RIOT): closed at $12.02 (-3.14%), unchanged in pre-market.

- Core Scientific (CORZ): closed at $14.05 (-0.5%), up 0.36% at $14.10 in pre-market.

- CleanSpark (CLSK): closed at $10.09 (-5.79%), unchanged in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.15 (-4.93%), down 1.08% at $22.90 in pre-market.

- Semler Scientific (SMLR): closed at $50.19 (-9.14%), unchanged in pre-market.

- Exodus Movement (EXOD): closed at $37.78 (-3.89%), up 0.21% at $37.86 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$568.8 million

- Cumulative net flows: $36.37 billion

- Total BTC holdings ~ 1.140 million.

Spot ETH ETFs

- Daily net flow: -$159.4 million

- Cumulative net flows: $2.52 billion

- Total ETH holdings ~ 3.627 million.

Overnight Flows

Chart of the Day

- The MiCA-led decline in tether’s (USDT) market capitalization has stalled.

- So, the ongoing decline in BTC may lose momentum. USDT, the world’s largest dollar-pegged cryptocurrency is widely used to fund crypto purchases.

In the Ether

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-09 15:10