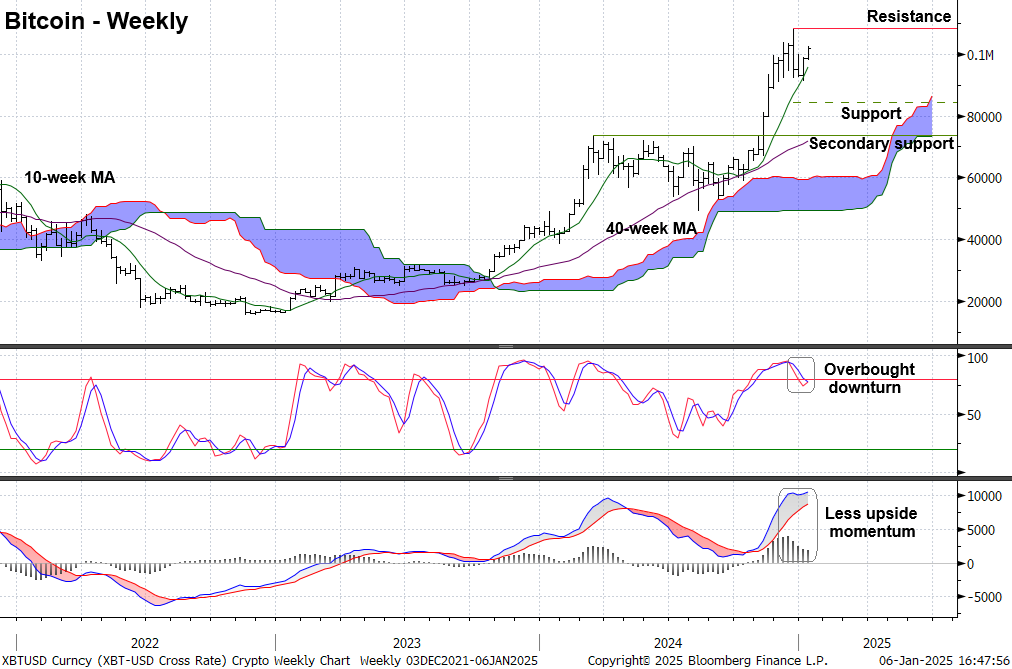

2024 saw Bitcoin achieve a remarkable 120% year-on-year growth, but it ended the year on a subdued note. This is because the stochastic oscillator, which signals trend exhaustion, has shown an overbought “sell” signal in its weekly chart for the first time since mid-April. This suggests that Bitcoin may remain within a certain range for a short period (around 2-6 weeks), as other risk assets like equities experience a pullback.

Key technical levels to watch for bitcoin:

- Minor resistance is at the most recent high, near $108K, above which is “uncharted” territory. A breakout would be a bullish development, but the momentum does not appear strong enough to generate a breakout at this time.

- Initial support is near $84.5K, defined by the Ichimoku cloud model, which is a trend-following model based on historical prices. Recent deterioration in our intermediate-term indicators increases the chances that a pullback will deepen further, with secondary support near $73.8K, reinforced by the rising 200-day (~40-week) moving average.

Each Wednesday, you can receive our Crypto Long & Short newsletter. This digest provides expert insights, latest crypto news, and analysis tailored for the professional investor. Click here to subscribe now!

Although there may be temporary and mid-term indications pointing towards a bear market, the overarching prediction for Bitcoin’s future from a technical standpoint remains optimistic. The breakout in November following the elections signaled an exit from a prolonged downtrend channel, which allowed momentum indicators like the Monthly Moving Average Convergence/Divergence (MACD) to regain speed. Therefore, if Bitcoin experiences a correction in Q1, it could offer a chance to increase investment for another potential upward trend in Bitcoin towards the end of 2025.

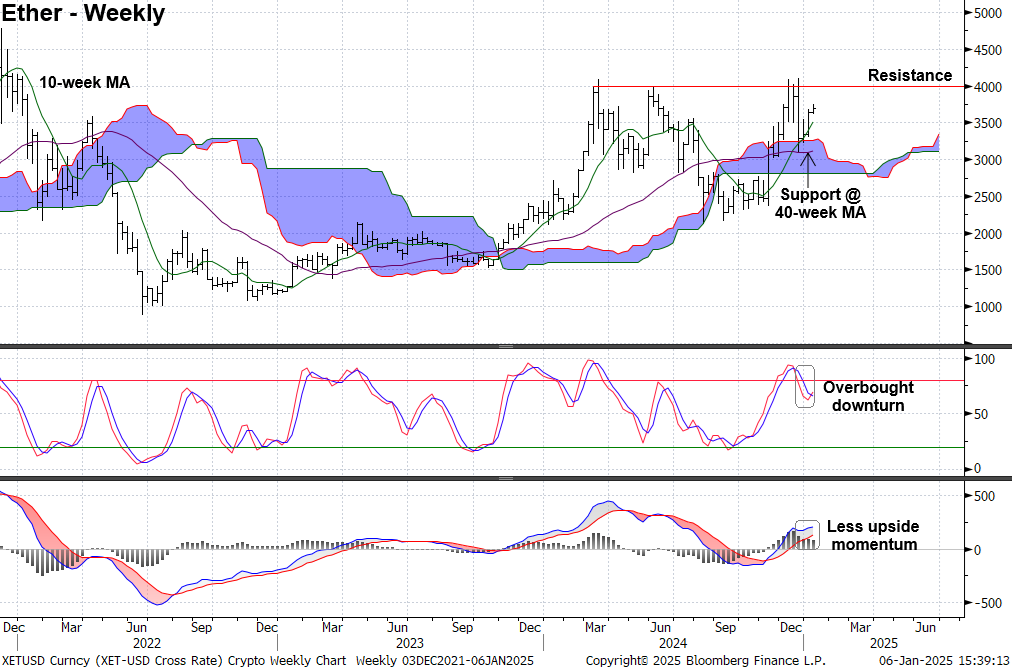

Ethereum: resistance near $4000 is a hurdle for early 2025

As a crypto investor, I’ve noticed that Ether, similar to Bitcoin, has shown an overbought “sell” signal. This follows a rejection at a significant resistance around $4000. This “sell” signal suggests a potential corrective phase lasting a couple of months. Interestingly, Ether also has initial support at the daily Ichimoku cloud model, approximately $3226. Above this level, it appears to have stabilized.

In Q1, I anticipate a correction that could lead to a breakdown and a test of the 200-day (40-week) moving average. However, my long-term indicators still hint at an upward trend for Ether, albeit less forcefully compared to Bitcoin. A break above the $4000 level might strengthen these long-term metrics such as the monthly MACD.

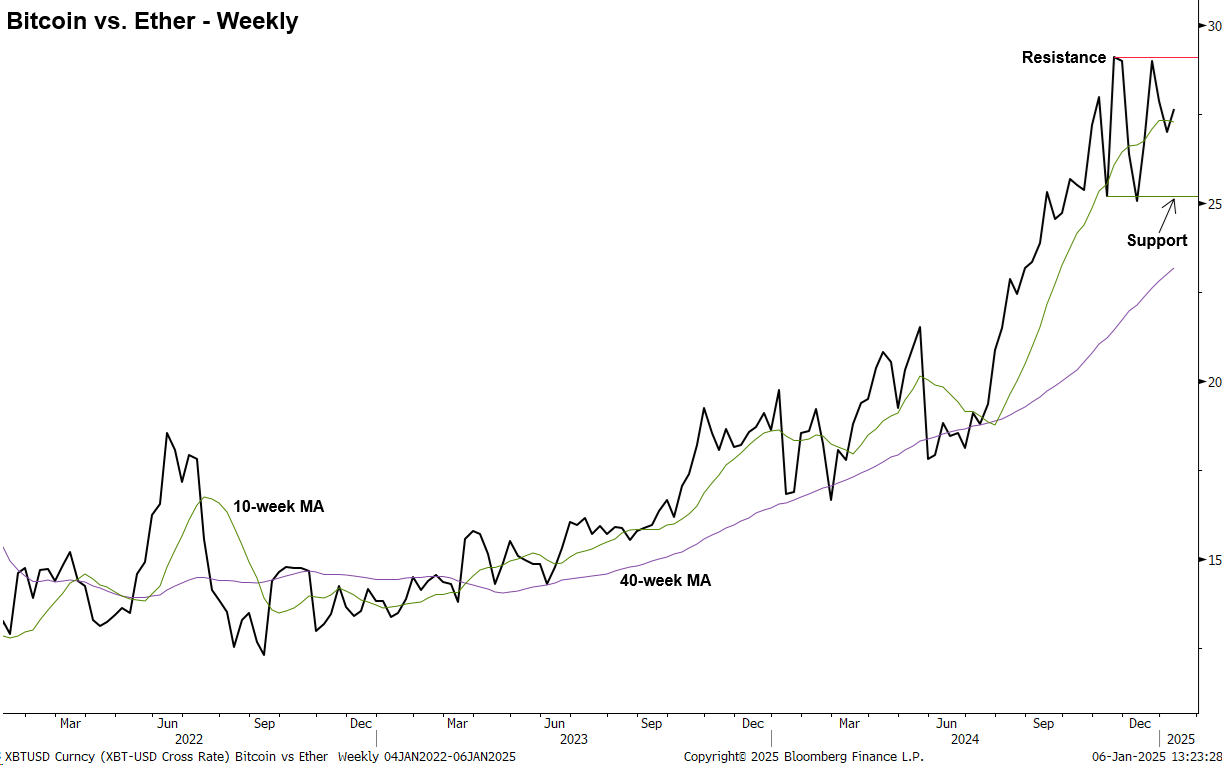

Bitcoin vs. ether: 2024 outperformance by bitcoin gives way to volatility

In 2024, Bitcoin surpassed Ether by a significant margin of 74%, and this superiority is evident when comparing their values (bitcoin/ether ratio). However, since November last year, the relative strength between these two major cryptocurrencies has shown more fluctuation, as demonstrated by the broad fluctuations in the bitcoin/ether ratio.

As a researcher studying the crypto market, I’ve noticed an interesting trend: during market corrections, Bitcoin often outperforms Ether due to its perceived safety. However, it’s essential to remember that all cryptocurrencies typically see a decline when risk assets are under pressure. Interestingly, correlations between different cryptos tend to increase when the market is heading south.

But here’s the silver lining: a bullish long-term perspective might make Q1 volatility an excellent opportunity to boost exposure with a potentially better risk/reward ratio. The key strategy would be to wait for the short-term indicators to turn positive again before making any moves.

The opinions put forth in this article belong solely to the writer; they may not align with the perspectives of CoinDesk, Inc., its proprietors, or its related entities.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-08 19:32