Attempts to push Ethereum above the significant $4,000 level proved unsuccessful, resulting in a steep reversal and causing some investors to question whether sellers hold sway over the market.

As an analyst, I’m observing a growing sense of apprehension, given the possibility of a forthcoming sell-off should crucial support levels prove insufficient to maintain price stability.

Technical Analysis

By Shayan

The Daily Chart

Recently, Ethereum saw an increase trying to break through the significant resistance level at around $4,000. Yet, strong selling activity around the estimated value range of $3,700 to $3,800 created a solid refusal.

The price of ETH is nearing its previous low around $3,300. If the daily closing price falls beneath this level, it could indicate more downward pressure. However, in the larger context, the $3,000 area serves as a crucial defensive zone for buyers because it aligns with the important 100-day moving average. In the medium term, Ethereum could experience a substantial drop if the price falls below this region.

The 4-Hour Chart

On smaller timeframes, Ethereum’s price movements appear to have created a three-part pattern around the $4K level, while also showing a bearish discrepancy on the Relative Strength Index (RSI) graph. This bearish reversal pattern suggests a weakening in the buying pressure.

After surpassing the significant $3.5K barrier, the asset has led to a retreat and subsequent chain reaction. At present, Ethereum is nearing a significant support area at its significant swing low of $3K, which coincides with the 0.5-0.618 Fibonacci retracement zones.

A failure to hold this support could lead to further declines, with potential targets at lower price levels in the mid-term.

Onchain Analysis

By Shayan

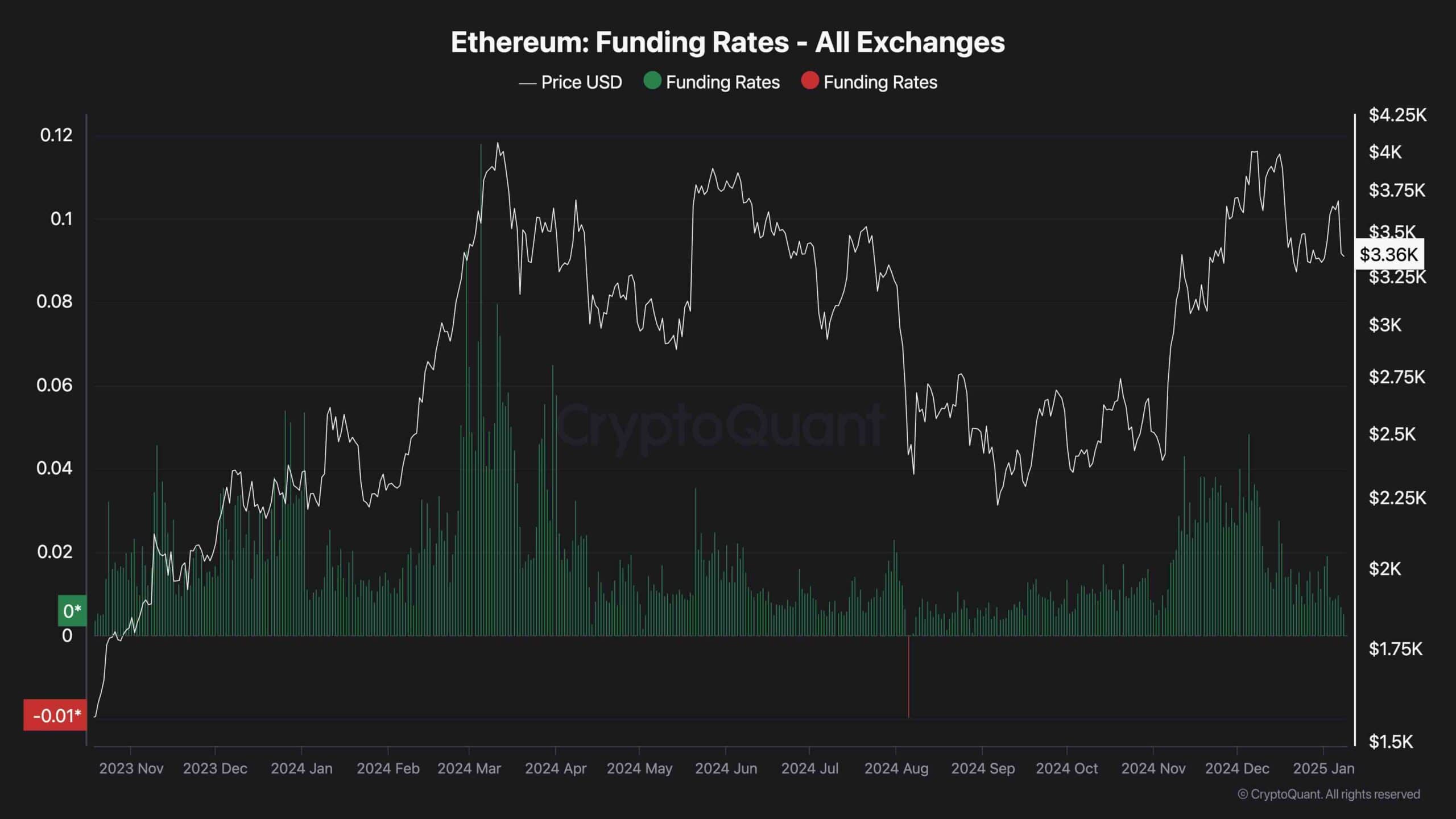

The longevity of any price spike in a market is typically supported by a growth in Funding Rates, indicative of strong demand in the derivatives market. If this growth isn’t present, the upward trend could weaken. It’s worth noting that this growth doesn’t have to happen right away during a rally, but its absence can create doubts about the market’s resilience.

As Ethereum surged recently, Funding Rates noticeably climbed halfway through the price rise, indicating a late surge in demand interest. But once ETH encountered a roadblock at the $4K resistance level, Funding Rates dropped significantly.

This decrease highlights a reduced commitment from traders in the derivatives market and insufficient demand to maintain the uptrend. If Ethereum fails to hold above the $3K support, the market could face increased selling pressure and deeper corrections. Hence, the $3K support level remains crucial for ETH’s next move.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-08 18:13