2024 saw Ether lagging behind other cryptocurrencies, but it’s now caught up with the surge driven by Bitcoin’s unprecedented ascent, reaching $4,000 in December. However, its price is still below its all-time high of $4,900.

2024 saw ether experiencing approximately a 53% rise compared to bitcoin’s impressive 113% surge. Yet, ether’s recent upward trend hints at potential growth. Following the U.S. election outcome, ether has jumped by 39%, surpassing bitcoin’s 35% increase and suggesting a possible rebound, fueled by market optimism about president-elect Donald Trump’s anticipated pro-cryptocurrency policies.

Important contributors to the positive outlook are strong mechanisms for staking, consistent transaction charges, and an increase in institutional involvement, notably via Exchange-Traded Funds (ETFs).

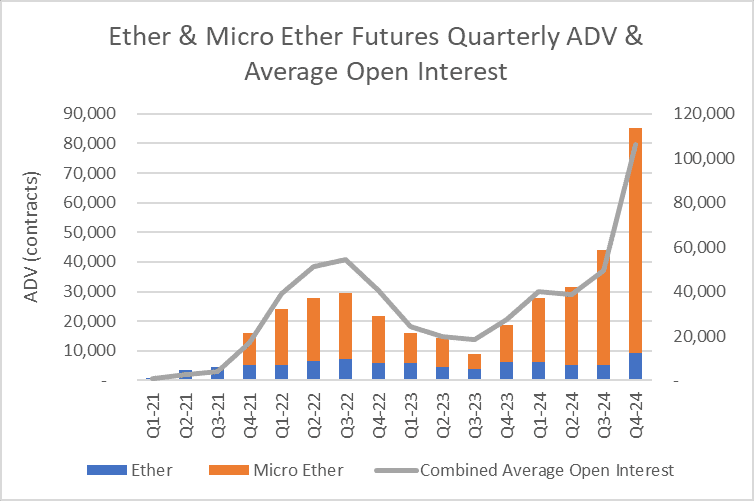

Ether futures

2021 began with subdued activity, but CME ether futures became popular for risk mitigation as ether spot ETFs commenced trading in mid-year and market volatility resurfaced by year-end. In 2024, around 12 million contracts, equivalent to a total worth of $256 billion, were exchanged between ether and micro ether futures. Approximately 39% of the total volume was traded in Q4 2024, as the crypto market responded to the U.S. election results, suggesting a positive outlook.

Significant entities, identified by the Commodity Futures Trading Commission as those possessing 25 or more Ether contracts, hit fresh weekly highs consistently during December. This suggests a surge of investor enthusiasm for controlled methods to handle potential risks associated with Ether, using regulated solutions.

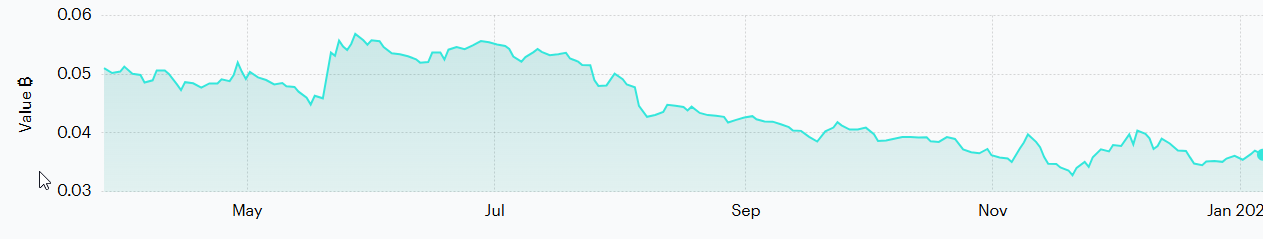

Ether-bitcoin ratio

The ratio comparing Ether’s (ETH) performance against Bitcoin (BTC), indicating the amount of Bitcoin required to purchase one Ether, hit a record low since its launch on November 20 at 0.032857. This might be the bottom as we witness improved regulatory conditions and growing institutional adoption, suggesting potential upward momentum for ETH.

What’s behind ether’s rebound

1. Ether ETFs outperform bitcoin ETFs

Since their launch in July 2021, U.S.-listed Ethereum ETFs have collectively attracted approximately $577 million in net investments, indicating a significant success compared to the broader ETF market. Interestingly, during the period between November 25 and November 29, Ethereum ETFs outpaced Bitcoin ETFs in daily inflows, with an impressive net inflow of $467 million. This surge includes a massive single-day inflow of $428 million, signaling a shift in investor preference towards Ethereum.

Reaching the point where both Bitcoin and Ether ETFs have been approved marks a significant step forward for the acceptance of digital currencies in mainstream finance. As more regulatory approvals are granted, institutional interest might grow even stronger, especially if asset managers can include Ethereum staking rewards within ETFs.

2. Alt Season

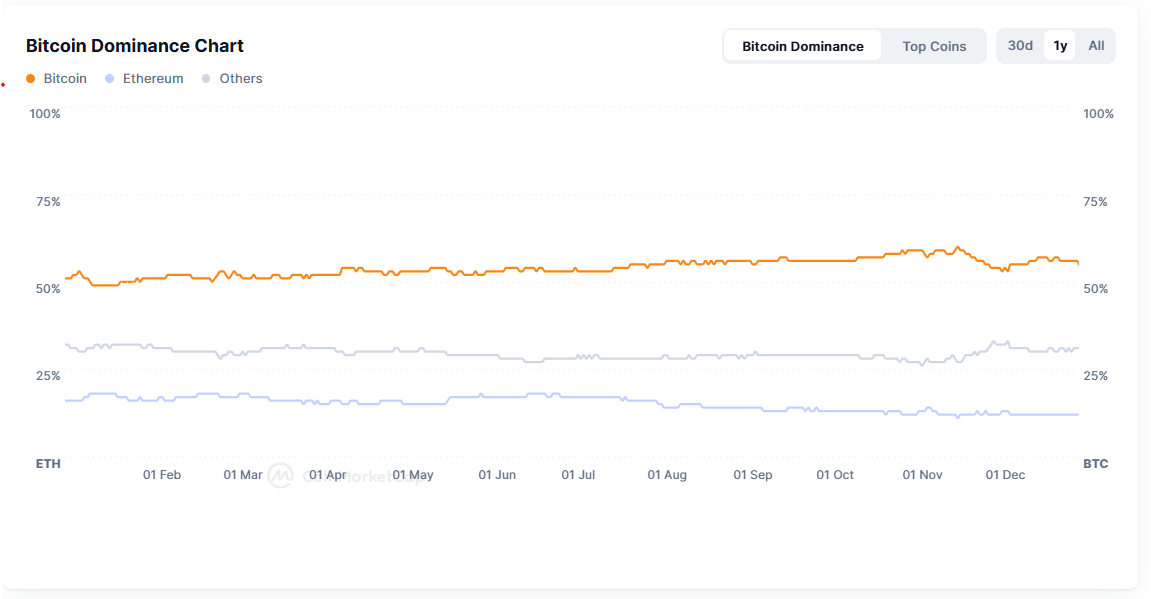

After several months of Ethereum not keeping pace with Bitcoin, traders might view the drop in the ETH/BTC ratio as a chance for investment. This could signal a possible shift, albeit gradual, from Bitcoin towards Ethereum and other alternative cryptocurrencies.

Generally speaking, Bitcoin often takes the initial lead during market surges, then settles while Ethereum and other alternative coins follow suit. This pattern has been observed in this particular cycle as well, with Bitcoin’s dominance decreasing from 61.7% in October to 57.4% in November and further to 56.5% in December. This decline could indicate that alternative coins might be gearing up for a potential surge known as an “alt season”.

3. Staking yields

As a crypto investor, I’m always on the lookout for ways to maximize my returns on my Ether holdings. One effective strategy is staking or locking my coins within the network, which not only secures the network but also rewards me with additional earnings. Currently, about 28% of Ether’s total supply is locked in staking contracts, with an annualized reward rate averaging around 3%. With a new administration coming into power and speculation surrounding potential Federal Reserve interest rate cuts, as well as ongoing blockchain upgrades, there might be an increase in the staking yield for ETH.

4. DeFi, smart contracts, DAPPS and NFTs

Ethereum‘s worth goes beyond just digital money, since it stands out as the leading platform for creating Decentralized Finance (DeFi) apps (dApps), smart contracts, Non-Fungible Tokens (NFTs) for unique digital assets, and Web3 applications.

In recent times, the combined worth, often referred to as Total Value Locked (TVL), within Decentralized Finance (DeFi) projects built on the Ethereum network has significantly increased. As per DefiLlama’s latest updates, this figure now stands at approximately $69.4 billion. This escalation indicates a growing trust and faith in Ethereum as a hub for financial innovation.

5. Ether upgrades

On March 24, the Dencun upgrade was implemented on Ethereum, lowering transaction fees for Layer 2 solutions and increasing the number of Transactions per Second (TPS) it can handle within the Layer 1. Over the past year, there has been a significant shift in the use of Layer 2 technologies. Furthermore, the Pectra upgrade, anticipated in Q1 2025, is one of Ethereum’s largest forks yet, according to the number of Ethereum Improvement Proposals (EIPs). Its goal is to boost protocol efficiency, enhance user experience, expand data capacity, and pave the way for future scalability improvements.

Conclusion

Everyone is eagerly waiting to see what the Trump administration’s impact will be and how it could affect the entire cryptocurrency market. The increasing institutional interest in Ether Exchange-Traded Funds (ETFs) might indicate a broadening of institutional investment portfolios, which were previously heavily focused on Bitcoin. In 2025, the potential for staking rewards and Ether’s key role in DeFi and NFT developments could lead to even greater demand for Ether.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-07 18:30