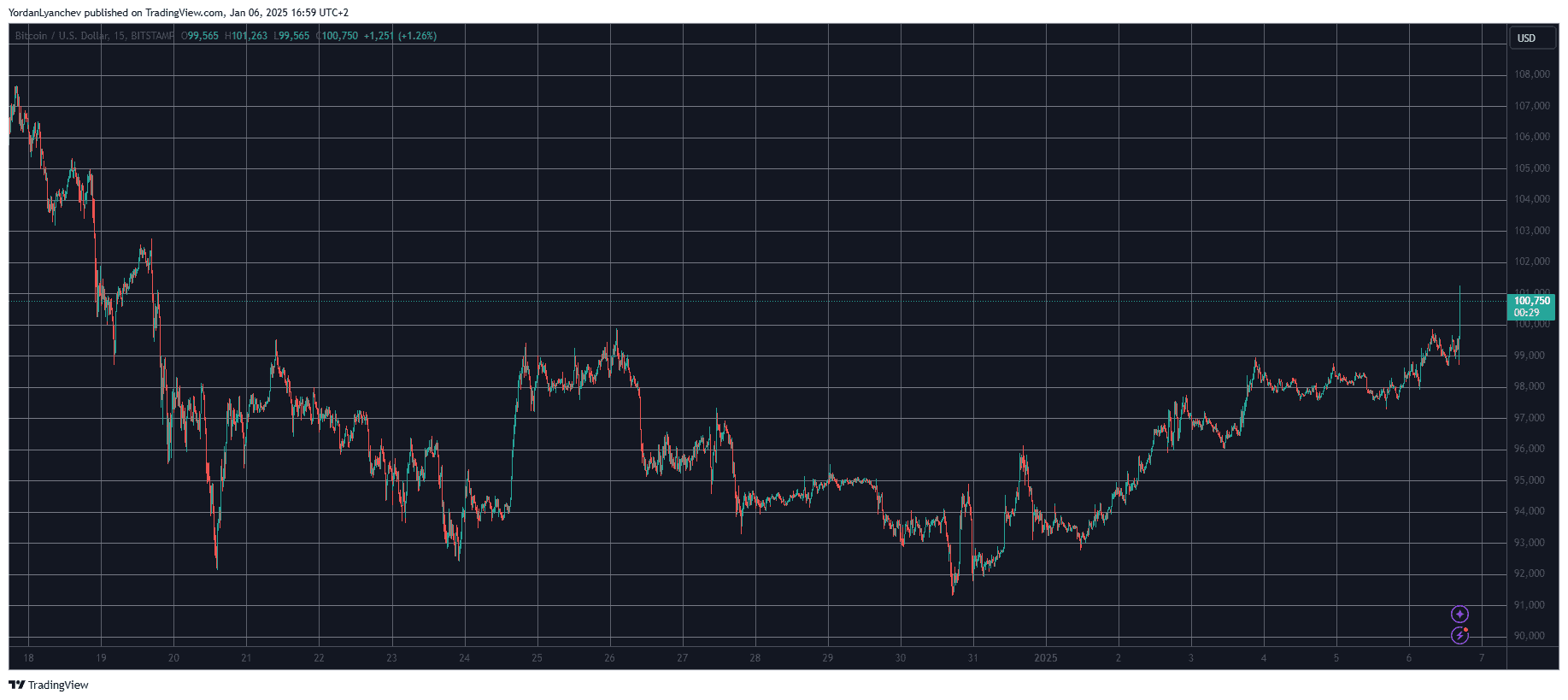

In about three weeks, Bitcoin managed to emerge from its difficulties, soar above $100,000, and reach a record high of over $101,000 for the year.

Following the latest MicroStrategy acquisition, this event appears unforeseen considering the trends that emerged post-similar past transactions.

Last Monday, following the announcement of its latest Bitcoin purchase by a NASDAQ-listed company, CryptoPotato reported that the cryptocurrency experienced a significant dip, falling from around $94,000 to a monthly low of $91,300. It’s worth noting that similar price declines occurred after each of MicroStrategy’s previous bullish acquisitions.

Currently, the most significant digital asset launched a surge approximately an hour after the announcement by the Saylor-led company on X. The value skyrocketed from around $98,000 to reach its peak price level since December 19, surpassing $101,000.

The price increase occurred following a relatively small Bitcoin purchase by MicroStrategy. Specifically, they acquired 1,070 Bitcoins worth $101 million, with each Bitcoin costing approximately $94,004 on average in their latest transaction.

As a crypto investor, it’s quite clear that the massive purchases worth billions back in November and early December are a thing of the past. However, the latest updates suggest that the company is planning to rake in an additional $2 billion to further stockpile on this digital currency.

MicroStrategy purchased approximately 1,070 Bitcoins for around $101 million each costing about $94,004 per Bitcoin in Q4 of 2024. This move yielded a return of 48.0% in Q4 and an impressive 74.3% over the full year of 2024. As of May 1, 2025, they now hold about 447,470 Bitcoins, acquired for around $27.97 billion each costing roughly $62,503 per Bitcoin. $MSTR.

— Michael Saylor (@saylor) January 6, 2025

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-06 18:08