What to know:

- Options market sees renewed action in call options at $100,000 and $120,000 strikes on Deribit.

- Its a sign of expectations for a rally to record highs after Trump’s inauguration, according to Amberdata.

Based on current Bitcoin (BTC) market movements, it seems that investors are optimistic about the cryptocurrency’s price potentially hitting new peak values following Donald Trump’s inauguration as president on January 20th.

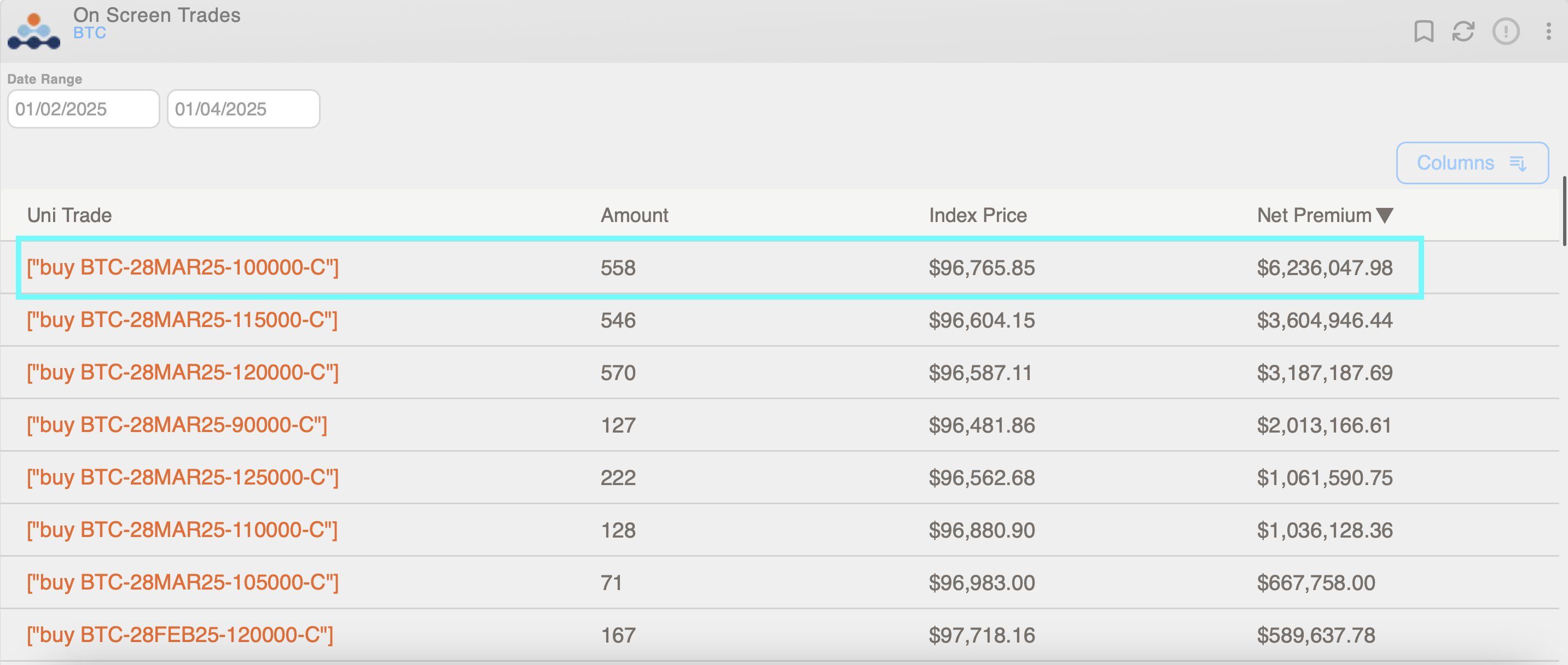

Last Saturday, a user on the crypto exchange Deribit invested more than 6 million dollars in buying call options with a $100,000 strike price, which will mature on March 28th, as per data from Amberdata.

Amberdata predicts that the record-high value of Bitcoin may be surpassed within a few months following Donald Trump’s inauguration, as stated on X.

At the price point of $120,000, traders are collectively purchasing more options than they’re selling, demonstrating a high level of expectation for an upward trend that could drive prices beyond this level. The call option for $120,000 is currently the most sought-after on Deribit, with an outstanding open interest of approximately $1.52 billion as reported at the time of press.

A call option allows someone to have the opportunity to purchase a particular asset at a set price at some point in the future. By buying a call option, one is optimistic about the market and hopes for a price increase, as they aim to profit from this anticipated rise in value.

As a crypto investor, I’ve noticed a resurgence in the appeal of call options as Bitcoin aims to reclaim the significant milestone of $100,000. Currently, Bitcoin is trading above $99,500, representing an 8% climb from its low on December 30, which was $91,384, as perched by CoinDesk and TradingView data.

In simple terms, according to Greg Magadini, Director of Derivatives at Amberdata, the upcoming events and subsequent period will present excellent opportunities for optimistic declarations and strategies that might act as significant triggers propelling Bitcoin prices upward, as stated in his weekly newsletter.

In simpler terms, CF Benchmarks, a company responsible for managing regulated cryptocurrency indices, shared a similar viewpoint, cautioning that any delays in policy-making might dampen the current optimistic sentiment.

According to a statement made by CF Benchmarks in their annual report, the reorganization of the Securities and Exchange Commission under cryptocurrency leadership might decrease enforcement risks and stimulate innovation. By simplifying compliance regulations, this restructuring could boost investor trust.

The company stated that they anticipate the arrival of a standard framework for the industry, but there might be delays in its implementation or changes in policy, which could dampen initial enthusiasm and lead to temporary fluctuations in the market.

Positive anticipation for crypto regulation improvements has lifted market sentiment since Donald Trump’s victory in the U.S. election in early November. Bitcoin surged from around $70,000 to record highs above $108,000 a few weeks after the election. But, the upward trend slowed down in late December, possibly due to year-end selling for profits and more aggressive Federal Reserve interest rate predictions.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-06 08:55