What to know:

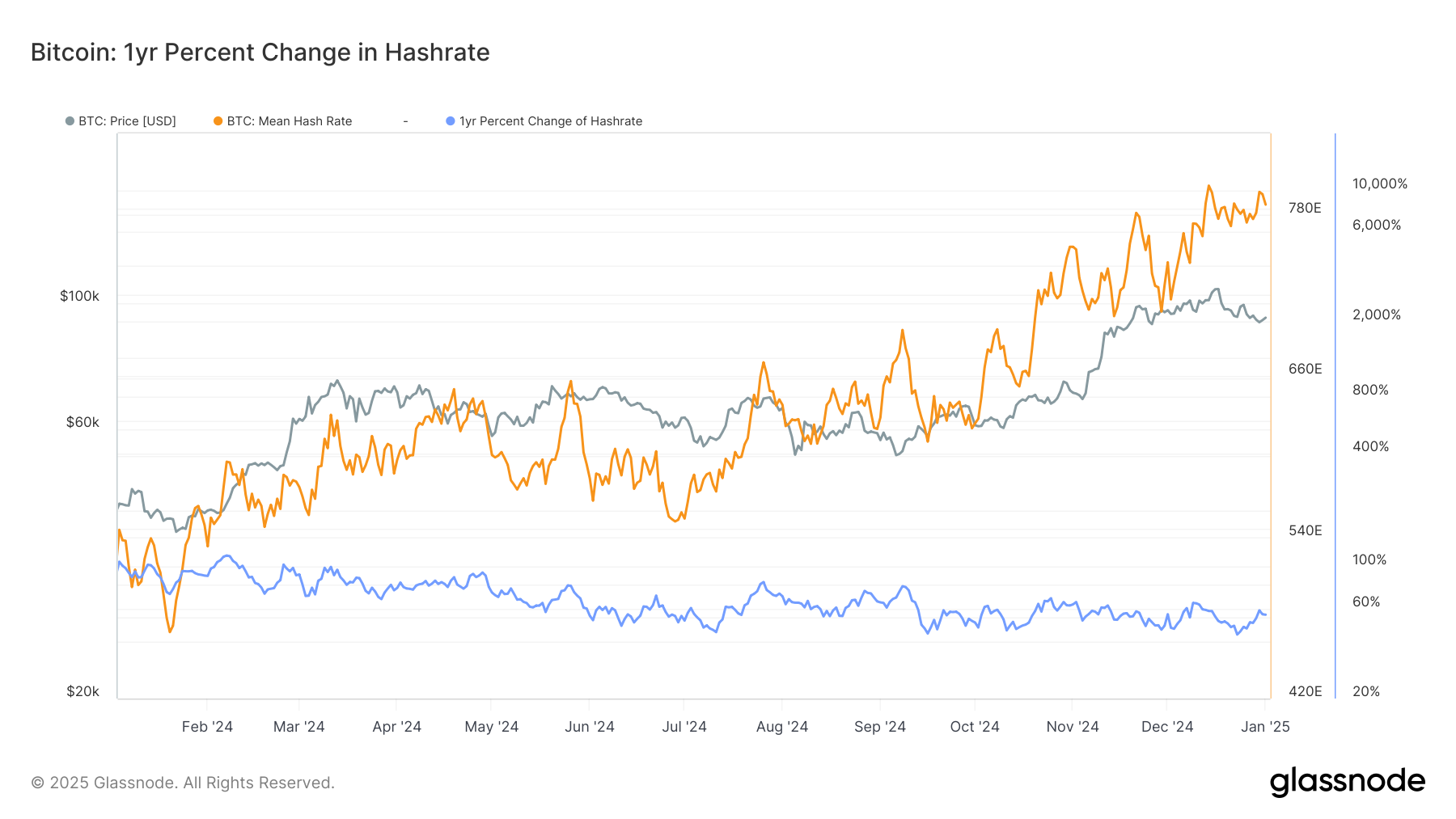

- The Bitcoin hashrate has appreciated 56% in the past year, averaging around 787 EH/s on a seven-day basis.

- If the hashrate grow at a conservative pace of 20%, 1 zettahash should be achieved by 2027.

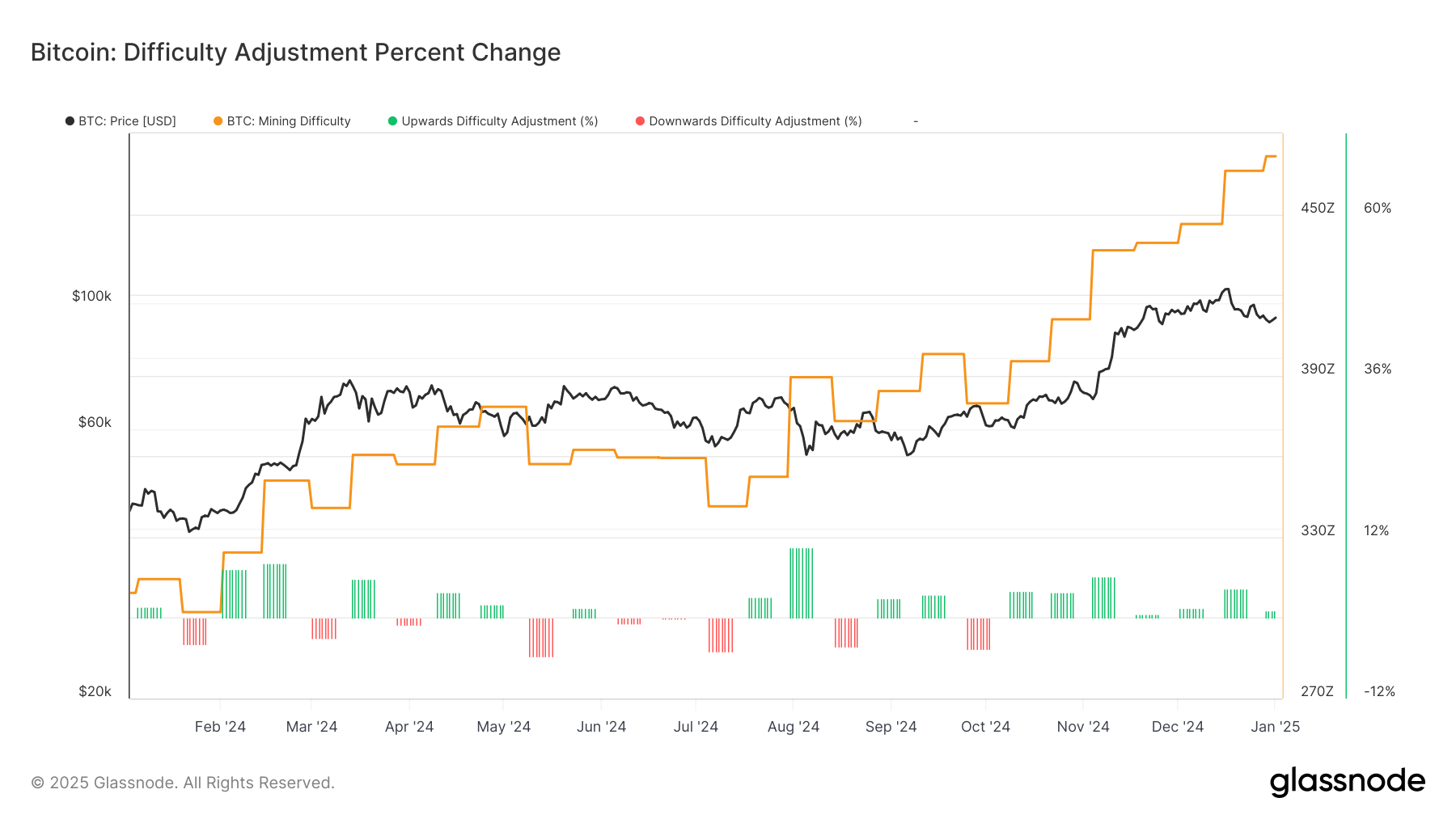

- Since October, the bitcoin network has seen seven consecutive positive difficulty adjustments, a run not seen since China’s mining ban in 2021.

As a seasoned researcher with years of experience tracking the cryptocurrency market, I find myself constantly intrigued by the relentless growth and evolution of Bitcoin (BTC). The recent surge in its hashrate to an average of 787 EH/s is nothing short of impressive. It’s reminiscent of watching a mighty oak tree sprouting from a tiny acorn, or perhaps more accurately, a humble computer rig turning into a formidable mining operation.

The predicted achievement of 1 zettahash per second before the next halving event in 2027 is a testament to the resilience and adaptability of miners. They’ve proven time and again that they can weather the storm, be it through innovative solutions or strategic pivots like diversifying into AI computing.

However, I must admit, the thought of miners scrambling to stay afloat in a more challenging market does bring a chuckle to my lips. After all, who would have thought that the quest for digital gold could lead one down the path of artificial intelligence? It’s akin to setting out on a journey to discover new lands only to find yourself lost in a labyrinth of algorithms and neural networks!

But then again, isn’t that the beauty of this space? The constant evolution, the relentless pursuit of innovation, the unpredictability that keeps us on our toes. It’s like being a cryptographer trying to crack an endless string of ciphers, or a miner chasing after an elusive digital gold rush. And as we stand at the precipice of 1 zettahash, I can’t help but wonder what new challenges and opportunities await us in this ever-changing landscape.

Oh, and let me leave you with a little joke: Why don’t miners ever play hide and seek? Because nothing is more elusive than a block reward!

The amount of computational power required to mine a single Bitcoin block within a proof-of-work blockchain (the hashrate of Bitcoin) is projected to surpass one sextillion hash operations per second (1 zettahash) prior to the upcoming halving event, which is approximately 3.5 years away. This development could put pressure on miners, compelling them to seek out affordable energy plans and invest in more efficient mining equipment.

By 2027, the average hashrate might ascend to approximately 1,000 exahashes per second (EH/s), provided it increases at a relatively modest annual rate of 20%. Since 2020, it has been expanding at an average pace of around 65% each year and is currently hovering at roughly 787 EH/s based on a seven-day moving average, as per data from Glassnode.

A miner’s profitability with Bitcoin heavily relies on their hashrate. The greater the hashrate, the more energy they consume, leading to increased operational costs. Therefore, it is crucial for miners to streamline their business practices. Moreover, it impacts the overall network security, which has seen a 56% growth in the last year.

2024 saw a speed-up in growth during the latter half, particularly following the halving in April which cut block rewards by 50% to approximately 450 Bitcoins daily. This reduction in reward led to a diminished income for miners, causing such strain that some found it impossible to sustain their operations solely through bitcoin mining. As a result, they diversified into artificial intelligence (AI) computing, while others resorted to buying bitcoins from the open market.

1 ZH/s miners may have to think outside the box and adapt to a tougher market environment by finding innovative solutions to keep their operations profitable.

It’s been suggested, based on a post from X on Thursday, that the hashrate might have reached 1 Quintillion Hashes per Second (ZH/s) for one block. However, it’s important to note that data from a single block isn’t always accurate because of the random nature of mining, variations in block time, and short-term network fluctuations. Instead, industry experts generally rely on a seven-day moving average to account for outliers and ensure the data is reliable.

Not just the hashrate but also the mining difficulty is on the rise, having increased for the past seven times in a row. As of now, the difficulty level stands at approximately 109.78 trillion. The blockchain undergoes this adjustment every 2,016 blocks, aiming to maintain a consistent rate of block production every 10 minutes. Interestingly, the last time we saw seven consecutive positive adjustments was when China prohibited mining in 2021, which led to a significant 50% decrease in the hashrate at that time.

This time, however, hashrate and difficulty are moving in tandem.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-03 13:48