What to know:

- Treasury Secretary Janet Yellen said she expects the new debt ceiling limit to be reached between Jan. 14 and Jan. 23.

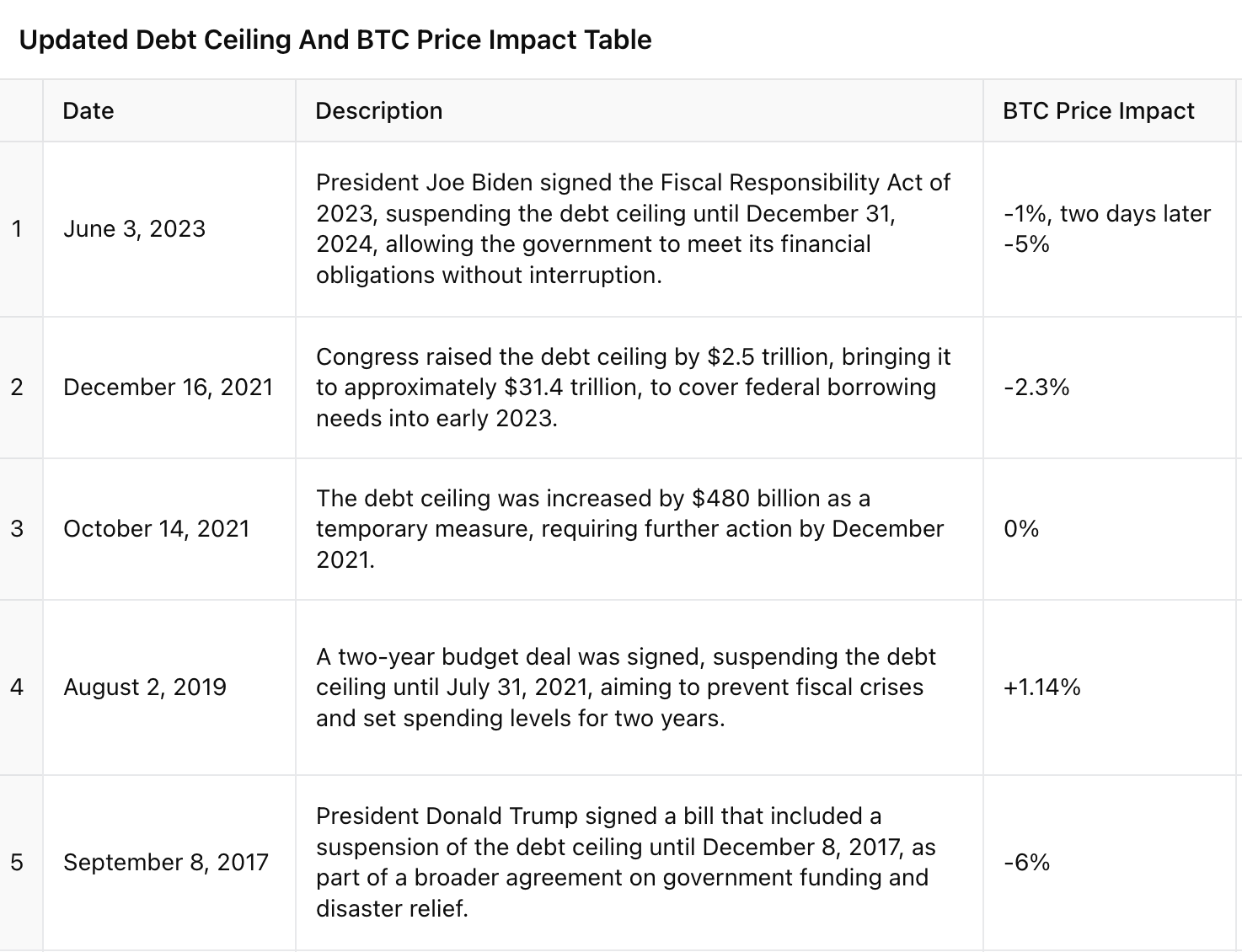

- Raising the U.S. debt ceiling has historically been bearish for bitcoin.

- The inauguration of President-elect Donald Trump on Jan. 20 adds to the political and economic uncertainty.

As a seasoned market observer with over two decades of experience, I have witnessed numerous economic cycles and political turmoil. The impending debt ceiling crisis in the United States, combined with President-elect Trump’s inauguration, is a perfect storm that sends shivers down my spine.

I remember the last time we faced a similar situation back in 2011 when the U.S. credit rating was downgraded for the first time in history due to the debt ceiling standoff. The market volatility and uncertainty were palpable, and it took months for investors to regain their footing.

Raising the debt ceiling has historically been bearish for risk assets like Bitcoin, and given its correlation with previous cycles, I wouldn’t be surprised if we see a similar pattern this time around. The fact that we are currently on track for Bitcoin’s first red month since August does not bode well for the bulls.

However, it is essential to keep in mind that markets can be unpredictable, and sometimes they surprise us with unexpected outcomes. As the old saying goes, “Don’t fight the Fed” – or in this case, don’t fight Janet Yellen.

To lighten up the mood, let me share a joke: Why did Bitcoin go to therapy? Because it had a lot of baggage and needed to work through its issues!

According to a recent letter from U.S. Treasury Secretary Janet Yellen to House Speaker Mike Johnson, it’s expected that the U.S. will reach its debt limit somewhere between January 14th and January 23rd. Following this point, the Treasury Department plans to employ special strategies to reduce borrowing.

As a responsible crypto investor, I earnestly appeal to Congress to take immediate action to safeguard the integrity and credibility of the U.S. dollar. You’ve previously extended the debt limit until January 1, 2025, but it’s crucial that we address this issue before then. The financial health and stability of my investments, as well as millions of others, are deeply intertwined with the strength of the American economy. Let’s work together to ensure a secure future for us all.

As the market was closing, risky assets began to falter slightly. This happened just before a significant announcement was made. In the U.S., major stock indices such as the S&P 500, Nasdaq 100, and Dow Jones Industrial Average experienced a decrease of nearly 1%. Similarly, Bitcoin saw a drop of up to 4% from its highest point during the day.

Historically, increasing the debt ceiling has often been associated with economic uncertainty, leading Bitcoin (the largest cryptocurrency) to either decline or perform poorly in the subsequent days, as seen in the last five instances.

This December hasn’t been a favorable period for Bitcoin. In fact, it has experienced a decrease of about 3%, indicating that it might end up with negative returns for the first time since August.

As an analyst, I would like to emphasize that the already existing political and economic uncertainties are set to escalate with the inauguration of President-elect Donald Trump on January 20th, falling within the timeframe previously highlighted by Chairwoman Yellen.

Since the year 1939, when Congress initially set a debt limit of $45 billion, they’ve increased this ceiling a total of 103 times due to government spending consistently surpassing tax revenue collected. Today, the U.S. national debt stands at more than $36.2 trillion.

One factor affecting Bitcoin’s price is its similarity to past price cycles. After reaching a low point due to the FTX crash in November 2022, Bitcoin’s price trend mirrors the patterns seen in the prior two cycles.

Currently, we’re almost at a fivefold increase (499%, approximately), which mirrors the last two market cycles at this stage. This isn’t typically a positive indicator for optimistic investors, or ‘bulls.’

During the periods from 2018-2022 and 2015-2018, there were notable drops in value, as indicated by the red box on the chart. It’s plausible that Bitcoin might have reached its lowest point following Trump’s inauguration on January 20th, 2017.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-30 16:05