As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find myself drawn to Ethereum‘s recent stability at the $3K support region. My personal journey has taught me that price action often follows a predictable pattern, and the golden cross on the daily chart is a beacon of hope in these challenging market conditions.

The daily chart indicates a potential shift toward bullish sentiment, as Ethereum remains confined below the $3.5K resistance but shows signs of strength at the $3K support. The confluence of demand and the alignment of moving averages adds credence to this bullish outlook. However, I remain cautious, as a decisive breakout is required to catalyze a new upward trend.

The 4-hour chart paints an equally promising picture, with Ethereum finding support at critical Fibonacci retracement levels. The current buildup of buying interest suggests that bulls are ready to defend this zone aggressively. If the $3K support holds, we could witness a fresh bullish surge toward $3.5K and beyond.

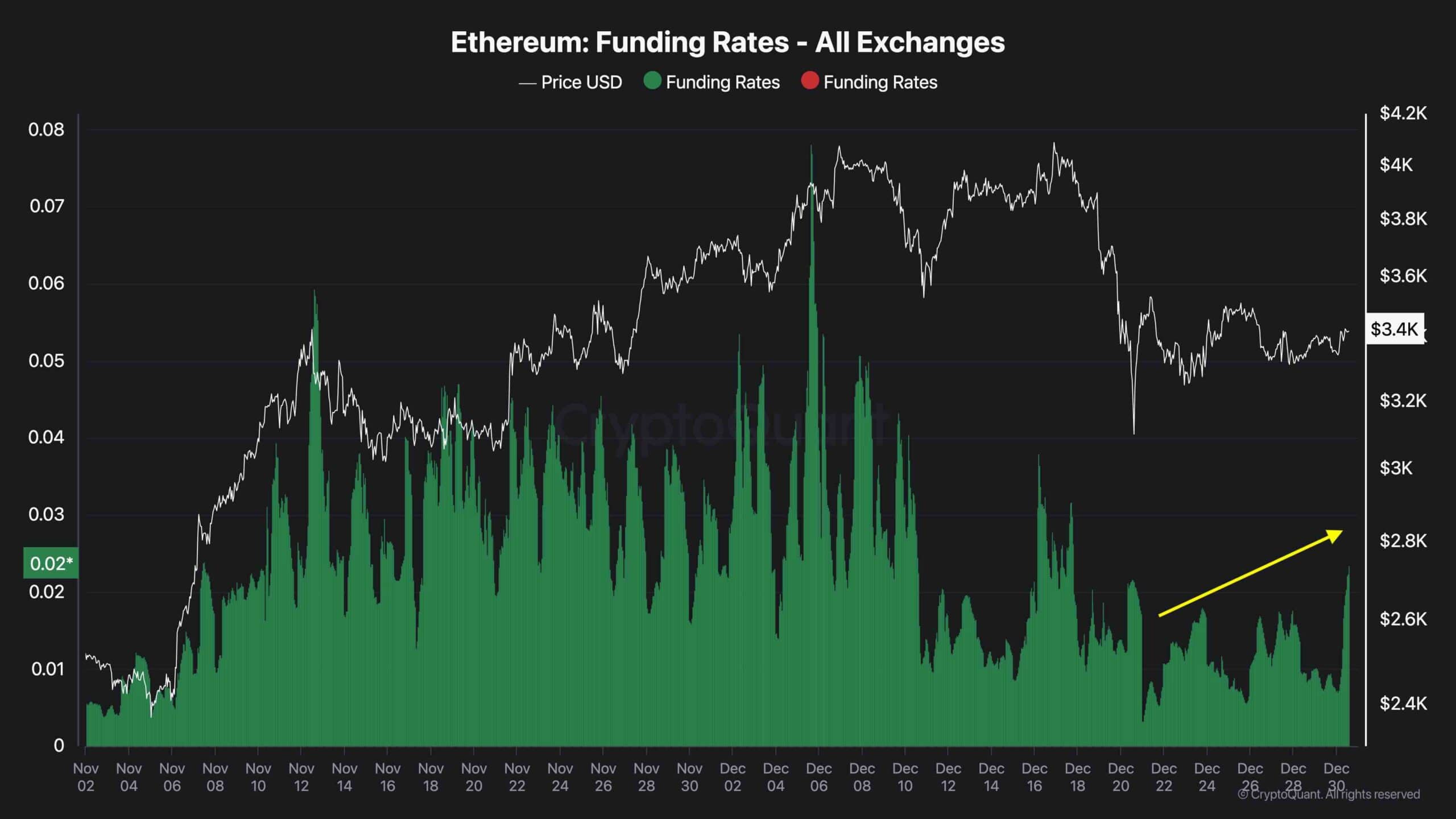

Onchain analysis supports my optimism, as the uptick in funding rates indicates growing confidence among market participants. The influx of buyers could potentially drive a substantial bullish rebound in the short to mid-term.

In conclusion, Ethereum’s technical and onchain indicators suggest a promising outlook for the asset. As always, remember that investing in crypto is like playing a game of chess against an AI – it’s unpredictable, but with careful analysis, you can increase your chances of success. Just don’t forget to check the king’s position every now and then!

Recently, Ethereum has managed to hold its ground near the $3,000 support area following significant bouts of selling activity, resulting in a period of price stabilization and potential accumulation.

On the daily graph, a golden cross indicates a possible mid-term upward recovery, reflecting growing optimism about the market’s future direction.

Technical Analysis

By Shayan

The Daily Chart

The price of Ethereum has shown higher fluctuations, especially after being turned down at the $4,000 resistance point. As a result, its value dipped below the important $3,500 level, but found solid support in the $3,000 area. This specific $3,000 level is significant because of the combination of buyer demand and the alignment of the 100-day and 200-day moving averages.

In other words, when the 100-day moving average goes above the 20-day moving average (a phenomenon known as a “golden cross”), it suggests a possible change toward optimism in the market. However, Ethereum is currently held back by resistance at $3.5K and needs a strong breakout to initiate a new bullish trend. If it manages to surpass this resistance, it could pave the way for another price surge.

The 4-Hour Chart

On the 4-hour chart, Ethereum’s descent from its price channel reached a key level around $3,000. This area isn’t just psychologically important but also corresponds with the 50% ($3,200) and 61.8% ($3,000) Fibonacci retracement levels, making it a sturdy line of support.

Current price action suggests a potential buildup of buying interest, with this region serving as a critical defense line for bulls. If this support holds, Ethereum is likely to embark on a fresh bullish surge, with targets set toward reclaiming the $3.5K resistance. Conversely, a sudden breakdown below the $3K threshold could trigger a cascade of liquidations, driving the price toward the $2.5K support, marking a deeper retracement.

Onchain Analysis

By Shayan

Following Ethereum’s noticeable dip down to the $3,000 mark, there seems to be a phase of calmness in the futures market, sparking optimism about a possible bullish recovery. The funding rates indicator, often seen as an accurate gauge of sentiment within the futures market, provides valuable insights into this trend.

Strengthening above the significant $3K barrier by Ethereum has given optimistic investors an opportunity to get back into the market. This new interest is evident in the rise of funding rates, suggesting that more traders are initiating long positions. This pattern usually hints at increasing trust among market participants as they predict a change in the ongoing trend direction.

The recent spike in funding rates suggests an influx of buyers, which, if sustained, could drive a substantial bullish rebound. This renewed buying pressure can potentially push Ethereum toward the crucial $4K resistance in the short to mid-term.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-30 15:34