As a seasoned cryptocurrency researcher with over a decade of experience in the volatile world of digital assets, I find myself constantly amazed by the rollercoaster ride that is Bitcoin (BTC). After the impressive surge to nearly $100,000 in December, BTC has once again stalled at around $95,000. The recent correction has been a sobering reminder of the market’s unpredictability, but I remain optimistic about its long-term potential.

The declining trading volumes are concerning, as they could indicate a lack of investor interest or whale activity. However, if the latter is indeed the case, it might actually be a positive development for BTC and other assets in the long run. After all, who wouldn’t want to see a few whales making significant purchases?

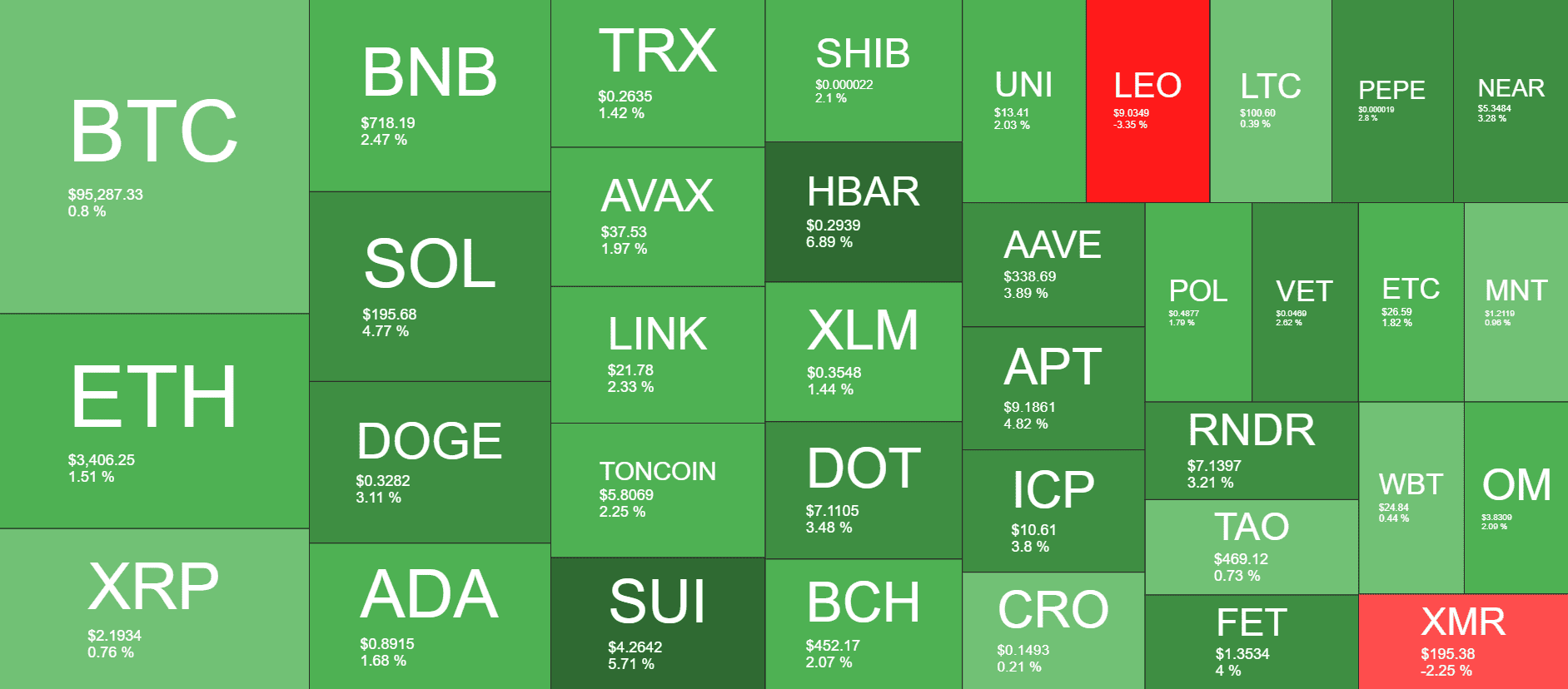

The altcoins have shown some resilience, with Ethereum (ETH) recovering above $3,400 and Dogecoin (DOGE) aiming for $0.33. It’s always fascinating to witness the ebb and flow of these digital currencies, as they dance around their price floors and ceilings like a choreographed performance.

One can’t help but chuckle at the irony of it all – here we are, watching a decentralized, borderless currency that was created to liberate us from traditional financial systems, and yet, we still find ourselves analyzing its every move with the intensity usually reserved for high-stakes poker games.

In any case, I’ll continue to keep a close eye on BTC and the broader market, ready to capitalize on any opportunities that present themselves. After all, in the world of cryptocurrency, patience is a virtue, and laughter is the best medicine to help us navigate through its ups and downs.

The trading volume of Bitcoin has persistently decreased throughout the weekend, with minimal or no significant price fluctuations observed within the last 24 hours.

On a positive note, some altcoins have regained lost territory following the weekend adjustments. At present, Ethereum (ETH) stands above $3,400, while Dogecoin (DOGE) is targeting around $0.33.

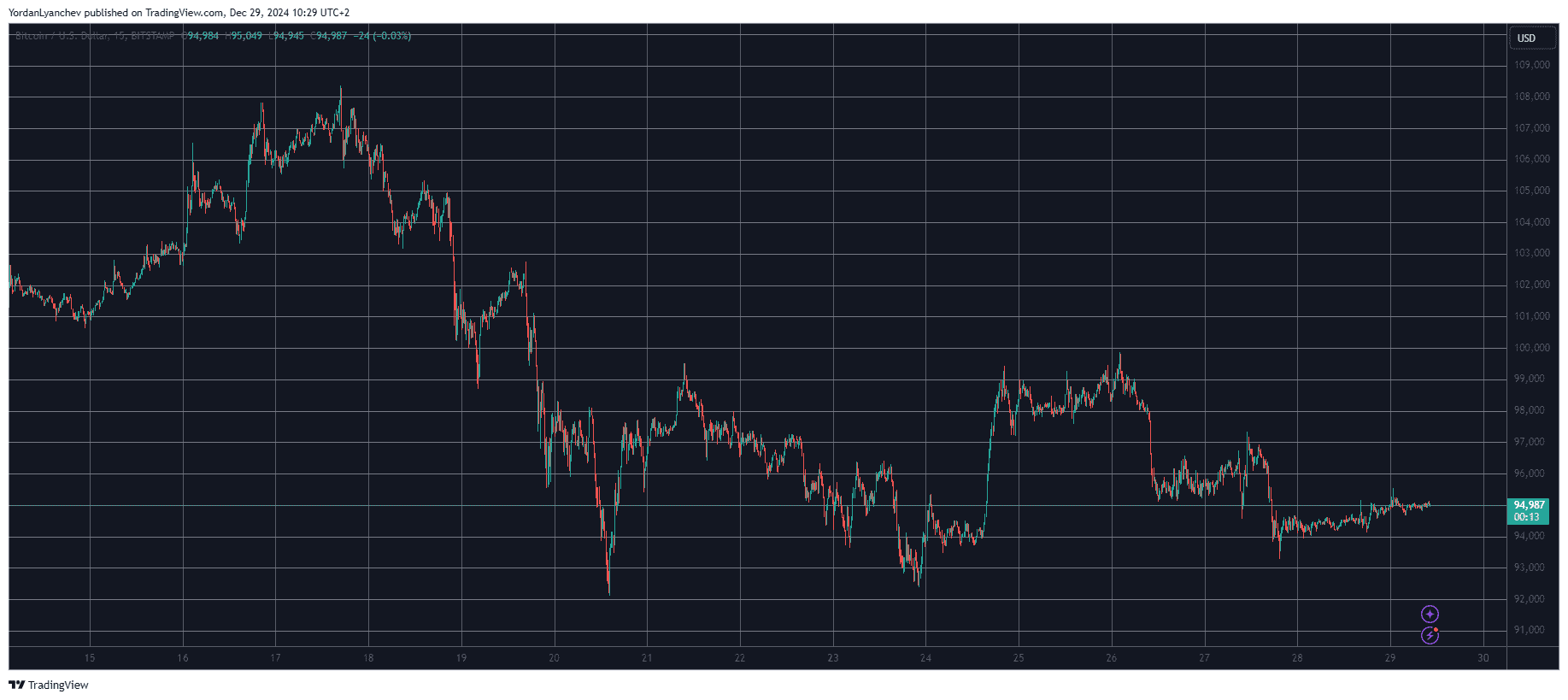

BTC Stalls at $95K

Over the past week, the adjustment significantly reduced the advancements in Bitcoin’s price that were seen in December, causing it to dip down to approximately $92,000 on the 21st of December. However, it quickly regained some ground and attempted to rise towards $100,000 on two different occasions – specifically on the 22nd and 26th – but was unable to maintain that level.

Every effort led to a harsh dismissal, causing the cryptocurrency to plummet by thousands of dollars. This latest decline occurred over the weekend, and Bitcoin dipped towards $93,000.

Or:

After each try, there was a brutal rejection that sent the cryptocurrency tumbling down by several thousand dollars. The most recent slide happened at the end of the business week, pushing Bitcoin close to $93,000.

Yesterday, it reached a level of $94,000 and has since risen to $95,000. This increase, though anticipated due to the recent decrease in trading volumes, could potentially be advantageous for Bitcoin and other assets, as large investors or “whales” might continue to make significant purchases, which could ultimately prove beneficial in the long run.

Currently, Bitcoin’s market capitalization is still significantly less than $1.9 trillion according to CoinGecko, and its influence over the altcoins has diminished to approximately 54%.

SOL, SUI Recover

Yesterday, many alternative cryptocurrencies experienced significant drops, but they’ve managed to post small gains over the last day. Ethereum surpassed $3,400, XRP is hovering just under $2.2, while Binance Coin (BNB) has bucked the trend, rising by 2.5% to reach $718.

The price of Dogecoin has increased by more than 3% and is near $0.33. On the other hand, Solana (SOL) and Suisei (SUI) have both seen gains of around 5-6%. This boost has taken SOL’s price above $195, and SUI’s price beyond $4.25.

Other notable gainers include HBAR, DOT, AAVE, APT, ICP, and PEPE.

The cumulative value of all cryptocurrencies has bounced back by approximately $50 billion compared to yesterday, and it currently hovers around $3.5 trillion, according to CoinMarketCap.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-29 11:48