What to know:

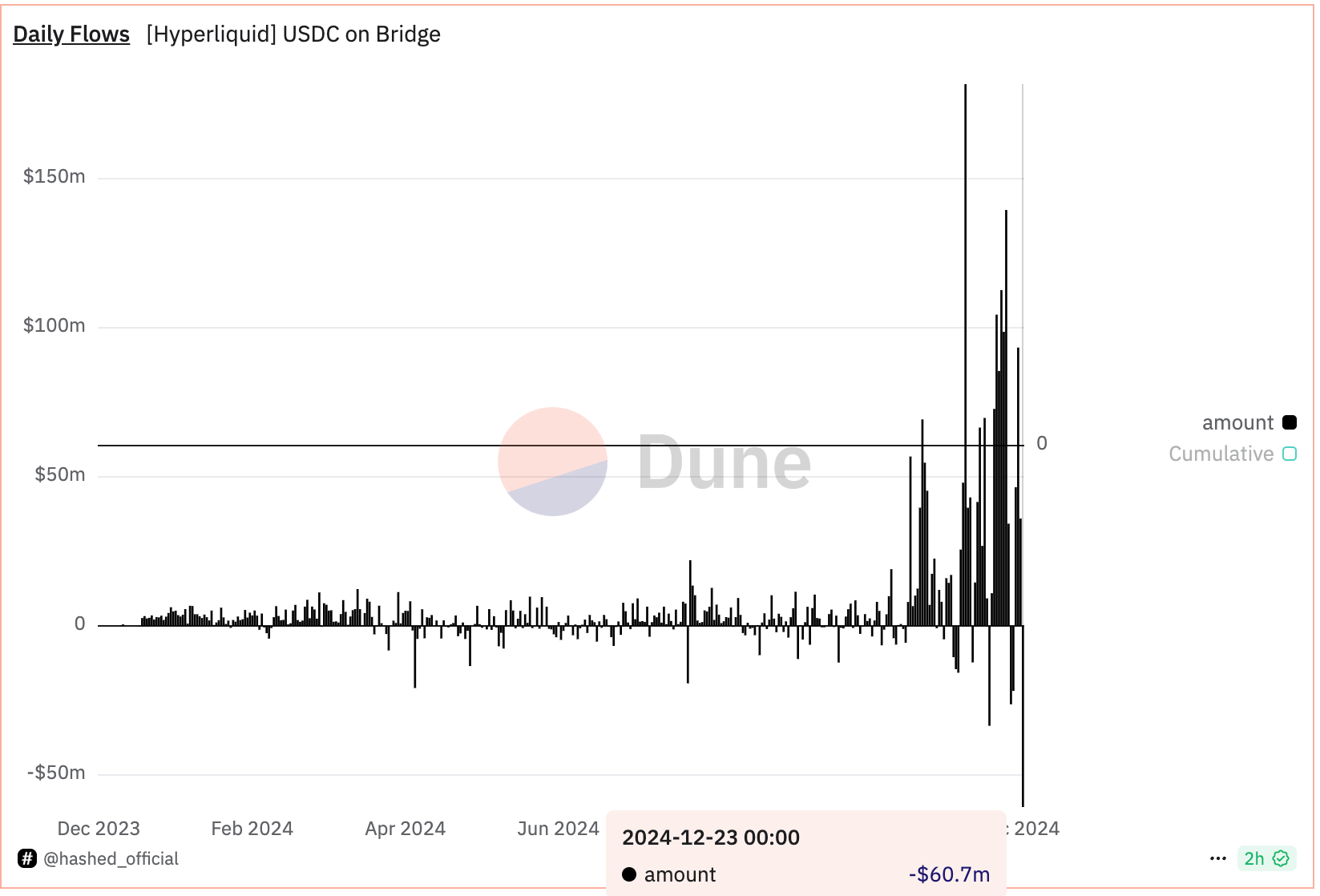

- A record net $60 million of USDC has left HyperLiquid so far on Monday.

- Addresses linked with North Korean hackers have accumulated losses from trading markets on the platform, according to one observer.

- They may be testing for weaknesses, according to a post by hacker watcher Tay on social media platform X.

As a seasoned crypto investor with a knack for navigating the complexities of this ever-evolving digital frontier, I must admit that the recent events unfolding at HyperLiquid have piqued my interest. The massive outflow of USDC, the potential involvement of North Korean hackers, and the platform’s significant market dominance are factors that demand careful scrutiny.

The cryptocurrency platform HyperLiquid, which is a blockchain and decentralized exchange specializing in perpetual futures (long-term investment contracts), has seen a significant decrease in USDC stablecoin holdings. This reduction could be due to speculation that North Korean hackers might be engaging with the platform, as suggested by an anonymous user named Tay on their post. Tay is recognized for monitoring potential threats to crypto protocols originating from North Korea.

60 million USDC (the world’s second-largest stablecoin pegged to the U.S. dollar) left the exchange by 10:00 UTC on Monday, as indicated by Hashed Official’s tracking tool connected to Dune Analytics. Despite this withdrawal, approximately $2.2 billion in USDC remains held by the deposit bridge, which is used within HyperLiquid for collateral purposes.

Hackers believed to be from North Korea (DPRK) have incurred more than $700,000 in losses while using the HyperLiquid trading platform, according to Tay. These transactions suggest that these hackers may be learning about the platform’s operations in preparation for a harmful attack.

“DPRK doesn’t trade. DPRK tests,” Tay said.

I’d rephrase it as follows: We reached out to HyperLiquid to get their thoughts on the recent USDC outflows and any possible risks posed by North Korea.

Two weeks back, Tay contacted the platform expressing their willingness to assist with addressing an impending issue concerning security.

I’d like to underscore that these DPRK threat groups are exceptionally advanced and rapidly progressing. They are remarkably inventive and tenacious, often managing to obtain zero-day exploits, like the one recently patched by Chrome, as mentioned in Tay’s message to the platform.

HyperLiquid stands as the dominant force among on-chain perpetual exchanges, handling more than half of all trades within this category. In the last 24 hours, a staggering $8.6 billion worth of these trades were conducted through it.

On November 29, the platform introduced its token called HYPE. Since then, it has soared more than 600% and reached $28.6. For a short while, this surge placed its market capitalization above $10 billion. Currently, as we speak, HYPE ranks as the 22nd largest digital asset globally, according to Coingecko’s data.

Read More

- SUI PREDICTION. SUI cryptocurrency

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- LDO PREDICTION. LDO cryptocurrency

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Original Two Warcraft Games Are Getting Delisted From This Store Following Remasters’ Release

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- Persona Fans React to the Homelander Artwork: A Unique Blend of Styles

- „I dismissed it out of hand.” Ben Affleck directed a movie that Matt Damon didn’t want to star in because of a bad script

2024-12-23 13:22