As a seasoned analyst with over two decades of market experience under my belt, I’ve witnessed countless market cycles and have learned to read between the lines. Last week’s 15% tumble of BTC was certainly a setback, but it’s important not to let short-term volatility cloud our judgment.

TL:DR;

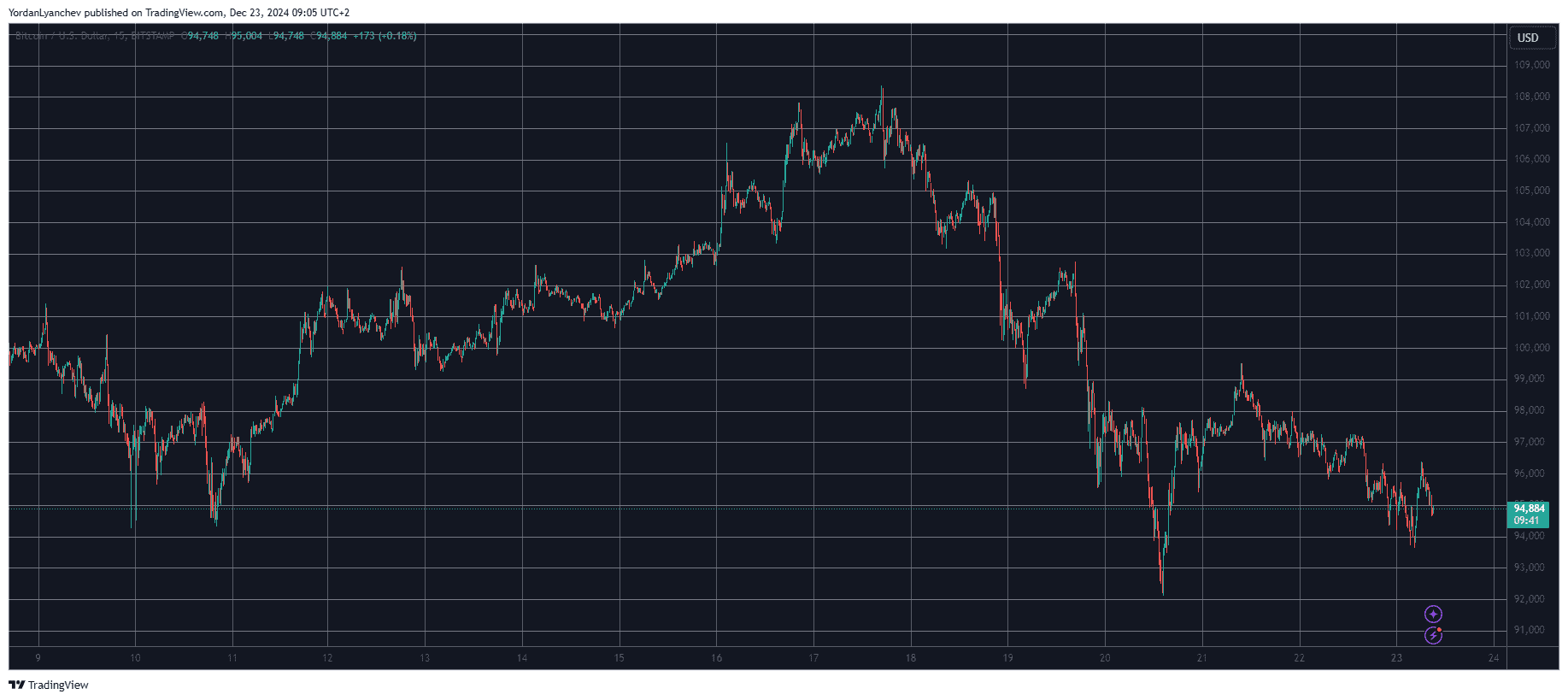

- After several consecutive weeks of charting impressive gains, BTC’s price tumbled by 15% from top to bottom last week and has failed to produce a notable recovery.

- The crowd has gone into a full Fear, Uncertainty, and Doubt (FUD) state, which could actually be beneficial for bitcoin’s upcoming price movements.

Crowd Hints at Recovery?

Six days ago, Bitcoin reached a peak of over $108,000, marking a new all-time high and a 60% increase following Donald Trump’s election victory. But on Wednesday, the situation shifted dramatically when Federal Reserve Chair Jerome Powell indicated that fewer interest rate cuts might be implemented in 2025, causing uncertainty in the market.

Last week saw Bitcoin experience its steepest decline since Trump’s election, with the cryptocurrency plummeting 15% from its high point down to around $92,000. Despite making some gains, it has yet to show the same rebound as previous dips and is currently fighting to stay above $95,000.

Based on data from cryptocurrency analysis platform Santiment, the prolonged correction has sparked fear among investors due to the lowest overall sentiment of the year being reached. Yet, this could potentially be advantageous for Bitcoin, as the asset often moves contrary to the expectations of retail investors, according to the report.

Update: The continued decline in the crypto market has led to a record low in Bitcoin’s overall sentiment this year, with many vocal traders expressing intense fear, uncertainty, and doubt (FUD). However, this is positive news for contrarians who understand that markets often move counter to popular retail expectations.

— Santiment (@santimentfeed) December 22, 2024

BTC Buy Signal?

According to crypto expert Ali Martinez, there may be an opportunity to purchase Bitcoin following its recent drop, as suggested by the TD sequential indicator on the 4-hour chart. This tool helps detect when the market is nearing exhaustion in either direction and often marks the commencement of a turnaround.

On the Bitcoin ($BTC) 4-hour chart, the TD Sequential indicates it’s time to consider buying as it suggests an imminent price increase is likely!

— Ali (@ali_charts) December 22, 2024

Martinez also mentioned a significant level of resistance for Bitcoin that could potentially cause another surge if reached. But if this level is breached in a downward direction, Bitcoin might experience a sharp drop towards approximately $70,000 since there’s limited support between the current and that price point. At present, the cryptocurrency is hovering near the lower boundary of a vital range of support, which spans from around $97,041 to $93,806.

Indeed, the value of the asset dropped below its counterpart last night, yet it has temporarily rebounded as of now.

The crucial region for Bitcoin’s price stability is currently estimated to be between $97,041 and $93,806. If this significant demand area fails to prevent it, we might witness a steep decline towards $70,085, as there’s very little support found at lower levels.

— Ali (@ali_charts) December 22, 2024

Read More

- SUI PREDICTION. SUI cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- WLD PREDICTION. WLD cryptocurrency

- Original Two Warcraft Games Are Getting Delisted From This Store Following Remasters’ Release

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- The ‘Abiotic Factor’ of Fishing: Why Gamers Find It Boring

- Selena Gomez Responds to Eugenio Derbez’s Criticism of Her ‘Emilia Pérez’ Performance: ‘I Did the Best I Could With the Time I Was Given’

- EUR PKR PREDICTION

2024-12-23 10:26