As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of bull runs and corrections. The latest price action of Bitcoin is reminiscent of the dot-com bubble, where exuberant optimism often leads to a harsh reality check.

The current trend in Bitcoin’s value indicates potential concerns, hinting at a more significant drop ahead, since it hasn’t been able to sustain above the $100K mark.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the recent weeks, the price on our daily chart has been steadily increasing, surpassing the $100K milestone for the first time. Lately, though, the market hasn’t sustained its bullish trend, dipping below $100K and reaching a low of around $92,000.

If the market doesn’t regain this level promptly, it might experience a more significant drop towards the $90,000 mark or possibly even the $80,000 area in the near future.

The 4-Hour Chart

On the 4-hour chart, it seems predicting the price movement might be a bit challenging due to its erratic behavior. While it’s been moving within an uptrend channel with higher highs and lows, it has consistently been pushed back from the upper boundary near $108K.

The $100,000 mark has now dropped, and the Relative Strength Index (RSI) is displaying figures lower than 50%, suggesting a change in market direction towards bearish trends.

Despite the current downward trajectory, the support line remains intact, suggesting a swift surge past the $100K mark and an optimistic progression for bulls. But, if this pattern breaks in a negative direction, a fall beneath $90K might ensue.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

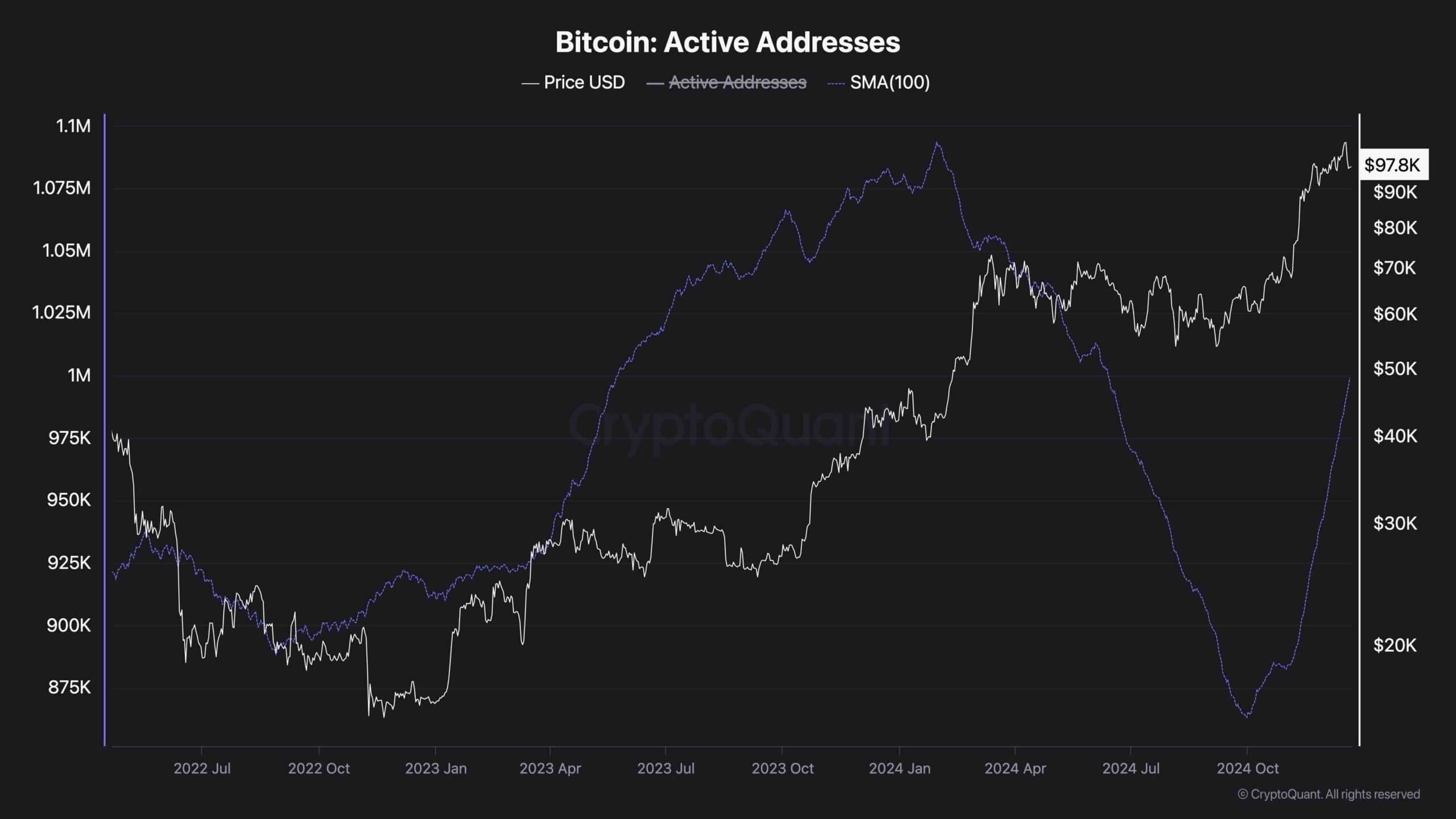

Active Addresses (100-Day MA)

Examining on-chain data provides intriguing and useful insights into the broader market trends. Among these essential indicators, the number of active addresses stands out as a valuable tool for gathering information beyond just price fluctuations.

Bitcoin’s network activity is one of the fundamental factors that can help in BTC valuation. The chart shows that the 100-day moving average of active addresses has been recovering rapidly during the recent uptrend and breakout above the $70K zone.

Even though Bitcoin hasn’t yet hit its peak price, there’s a noticeable gap between the price movement and network usage. If the network activity doesn’t surpass its previous high soon and instead begins to drop, there might be an extended period of correction for Bitcoin.

Read More

- SUI PREDICTION. SUI cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- COW PREDICTION. COW cryptocurrency

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- WLD PREDICTION. WLD cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

- ADA EUR PREDICTION. ADA cryptocurrency

- EUR IDR PREDICTION

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

2024-12-21 19:56