What to know:

- XRP, dogecoin (DOGE) and Cardano’s ADA fell as much as 15% in the past 24 hours, data shows, as selling pressure mounted in late U.S. hours.

- No immediate reason spurred the selling pressure, but it came as internet giant Google announced benchmark tests on its new Willow quantum computing chip.

- Market analysts and traders warned of short-term selling pressure amid an overheated market after a November rally

As a seasoned crypto investor with a decade of experience navigating the digital asset market, I’ve learned to ride the waves and stay calm amidst turbulence. Today’s sudden drop in XRP, DOGE, ADA, and several other tokens has been a stark reminder of the rollercoaster ride that this market can be.

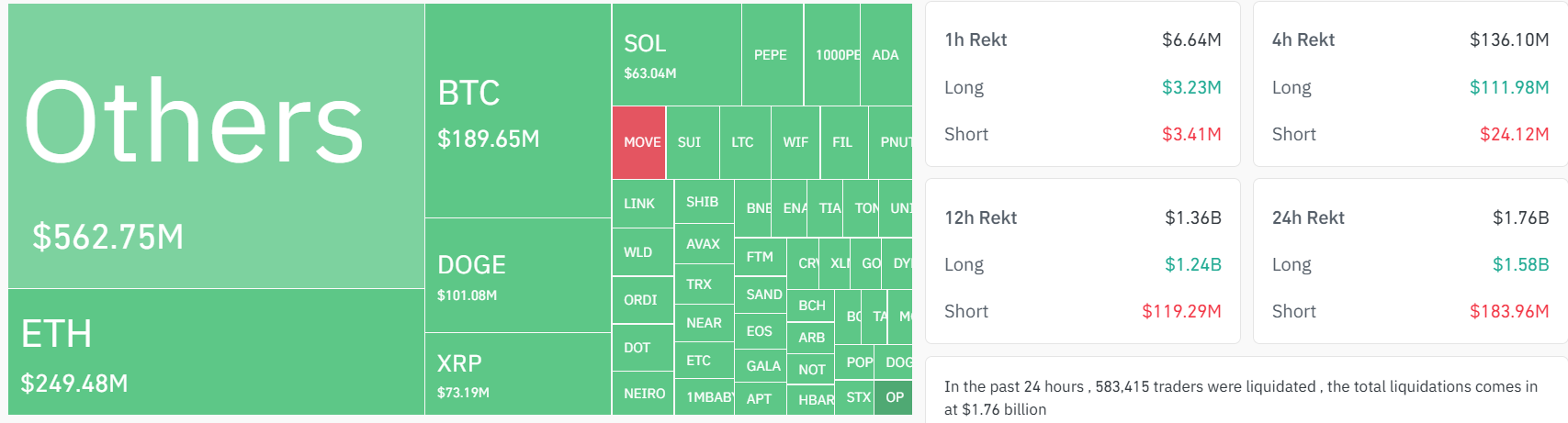

As a crypto investor, I experienced one of the toughest trading days in recent months yesterday, particularly during the early hours of Asian trade on Tuesday, while Bitcoin (BTC) remained relatively stable. Major tokens like Ripple’s XRP, Dogecoin (DOGE), and Cardano’s ADA plummeted as much as 15% in the last 24 hours, according to data, with selling pressure escalating from late U.S. hours into early Asian time. Bitcoin dipped 3%, while Ethereum (ETH) and Solana’s SOL fell 7%, and Tron’s TRX almost erased all of its gains from last week with a 17% decline. The overall market capitalization dropped by 6.5%, the largest drop since October, and the broad-based CoinDesk 20 (CD20) index tumbled 7%.

Some market observers noted an unexpected surge in selling activity originating from Coinbase, significantly affecting XRP and suggesting that traders had taken on too much risk. In simpler terms, a sudden flood of large sell orders, unusual for such a well-established market, caused the market to plummet by more than 5%. The exact cause is unknown, but it’s definitely out of the ordinary.

It appears those selling orders are unusual. There seems to have been some event in the market that we should keep an eye on for the coming days. It’s possible a significant entity had to offload their holdings rapidly, suggesting urgency.

— ltrd (@ltrd_) December 10, 2024

Liquidation refers to a situation where an exchange forcibly ends a trader’s leveraged deal because the trader can no longer fulfill the necessary margin obligations. Massive liquidations may signal excessive market behavior, such as mass selling or buying triggered by fear or greed. A series of liquidations could hint at a significant shift in the market, where a price reversal might be imminent due to an overreaction in market sentiment and psychology.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-10 09:39