As a seasoned crypto investor with over a decade of experience navigating market cycles, I’ve learned to appreciate the ebb and flow of digital assets. The recent XRP rally has been nothing short of exhilarating, with the asset breaking through major resistance levels and gaining significant momentum. However, as I’ve often said, “What goes up must come down,” and current indicators suggest a short-term correction or consolidation phase is on the horizon.

The recent XRP rally has been nothing short of remarkable. The asset broke through major resistance levels and gained significant momentum.

It seems like a short-term pullback or period of stability might be approaching, as the present trends suggest that things are stretched too far.

XRP Price Analysis

By Shayan

The Weekly Chart

As a crypto investor, I’ve been thrilled to witness a remarkable surge in the value of my XRP holdings. Over the past few weeks, it’s soared by an astounding 300%, breaking through the $2 resistance and marching toward the significant psychological level of $3.

This strong upward trend is driven by significant purchasing activity, as evidenced by the clear breakthrough over both the 100-week and 200-week simple moving averages.

As a crypto investor, I’ve noticed that the Relative Strength Index (RSI) has skyrocketed, currently standing at an unprecedented 91. This rarely seen level suggests that the market might be overheating, potentially signaling a need for caution.

Historically, when RSI (Relative Strength Index) reaches such high extremes, it typically signals upcoming phases of consolidation or price corrections. Looking at the larger picture, the $1.80-$2 range is crucial support, and a dip back to these levels would be considered a beneficial correction for the ongoing uptrend.

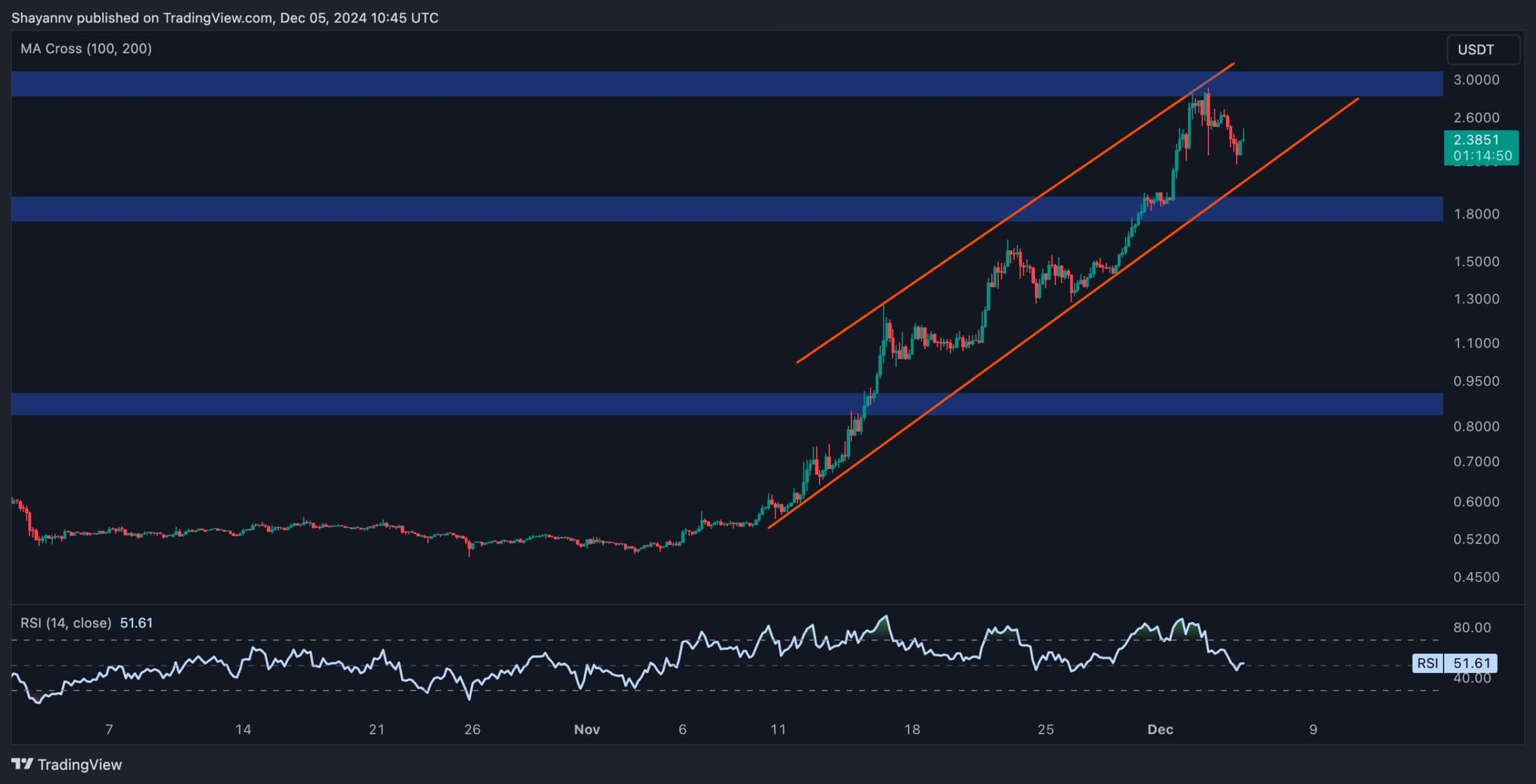

The 4-Hour Chart

Looking at the 4-hour chart, XRP has been holding a robust bullish formation, repeatedly hitting new highs and lows within an upwardly sloping channel. The latest surge above $2.5 suggests that buyers have taken control, although a minor pullback occurred following an encounter with resistance around $3.

It’s worth noting that the Relative Strength Index (RSI) in this time period appears to have displayed a strong bearish divergence, implying a decrease in momentum.

Given the growing number of long positions in the futures market and the resulting congestion, there’s an increased chance of short-term adjustments or corrections. A potential dip toward the $2.40 to $2.50 area, which lines up with the bottom of the ascending channel, might offer a new opportunity for bulls to re-enter the market.

To put it simply, although Ripple‘s long-term prospects look extremely positive, there might be some temporary pauses or slight declines in the near future. These brief setbacks could actually be beneficial, fostering a stronger and more steady expansion in the days to come.

Read More

- SUI PREDICTION. SUI cryptocurrency

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Original Two Warcraft Games Are Getting Delisted From This Store Following Remasters’ Release

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- China Box Office: ‘To Gather Around’ Dethrones ‘Venom: The Last Dance’

- Washington Spirit Owner Michele Kang on Momentum in Women’s Sports as Team Preps for NWSL Championship: ‘You Can Feel the Change’

2024-12-05 15:54