What to know:

As a seasoned observer of the ever-evolving cryptocurrency market, I must say that today’s briefing is a veritable smorgasbord of intriguing insights and trends. The daily net inflows into Bitcoin and Ethereum ETFs, coupled with the impressive holdings, suggest a growing institutional interest in these digital assets.

By Omkar Godbole (All times ET unless indicated otherwise)

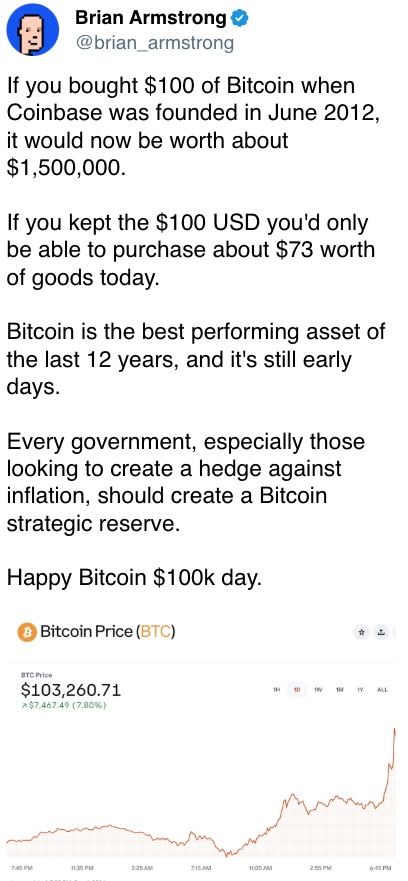

The wait is over. Bitcoin has surged past $100,000, driven by a number of factors, including President-elect Donald Trump’s appointment of supposedly crypto-friendly Paul Atkins to lead the SEC.

The majority of analysts are optimistic, predicting continued growth towards $120,000 and beyond, and it’s easy to understand why. In line with Newton’s first law, an object in motion tends to keep moving at its current speed and direction unless influenced by another force.

As Bitcoin achieves a significant milestone, the broader market stands to gain. Given that a six-digit price point might be prohibitive for numerous individual investors, they are likely to explore other digital currencies as viable options instead.

As a researcher delving into the world of digital currencies, I find it intriguing how the situation is shaping up for Ethereum specifically. The narrowing gap between the yield from Ethereum staking and the return on U.S. 10-year Treasury bonds, which has dropped from 4.5% to 4.2% in just two weeks, seems to be a positive development for Ethereum. However, it’s essential to keep an eye on recent events, such as a significant whale moving 11,753 ETH to exchanges within the last 24 hours. This action could potentially increase price volatility risks in the market.

Moreover, the Stacks’ STX token, operating on the Bitcoin layer-2 network, is garnering significant attention on social media platforms. In fact, someone has likened the SEC-approved token to a “de facto BTC staking service provider.” The STX token has seen a remarkable 56% increase this quarter, though it currently trades at $2.80, still significantly below its all-time high of $3.84. Keep a close watch on this intriguing development.

In conventional markets, the surge of Bitcoin (BTC) has boosted the morale surrounding cryptocurrency stocks. For instance, MicroStrategy, a company self-identified as a bitcoin developer, saw an increase of about 6% in pre-market trading. Similar companies like Semler Scientific and MARA Holdings also experienced growth, with Semler Scientific rising over 7% and MARA Holdings gaining more than 6%.

Still, there are several external forces that may stall BTC’s momentum.

The primary concerns for traders, as stated by Zerocap’s Chief Investment Officer Jonathan de Wet, revolve around intensifying conflicts in Ukraine and the Middle East, as well as significant changes in anticipated interest rates from the Federal Reserve (Fed). De Wet further noted that if the Fed adopts a more aggressive stance next year, it could potentially dampen Bitcoin’s momentum.

Sergei Gorev, head of risk at YouHodler, said risks could emerge from an “overheated” S&P 500.

He mentioned that although the prices might still rise, it’s unlikely they will do so substantially. Various technical signs point towards a possible adjustment, which could lead algorithmic traders to look for suitable spots to open short positions, addressing discrepancies observed on the graphs.

According to Valentin Fournier, a BRN analyst, along with several other experts, they believe that the cryptocurrency market appears overly heated and may be due for a possible adjustment or downturn.

According to Fournier, speaking with CoinDesk, the Fear and Greed Index has spiked above 80, indicating an overwhelming sense of greed among investors. This trend is leading to substantial increases in the value of smaller-cap assets, attracting retail investors who are keen on making profits during this bull market. However, while this approach might bring rewards, it’s important to remember that it also comes with substantial risks, especially given the current uncertain climate.

So, stay alert out there!

What to Watch

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 5, 2 p.m.: French President Emmanuel Macron will deliver a televised speech from the Élysée Palace following the collapse of Prime Minister Michel Barnier’s government.

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

- Nonfarm Payrolls (NFP) Est. 183K vs Prev. 12K.

- Unemployment Rate Est. 4.1% vs Prev. 4.1%.

- Average Hourly Earnings MoM Est. 0.3% vs Prev. 0.4%.

- Average Hourly Earnings YoY Prev. 4%.

- Dec. 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Consumer Price Index (CPI) data.

- Core Inflation Rate YoY Prev. 3.3%.

- Inflation Rate YoY Prev. 2.6%

- Dec. 11, 9:45 a.m.: The Bank of Canada announces its policy interest rate (also known as overnight target rate and overnight lending rate). Prev. 3.75%.

Token Events

- Governance votes & calls

- Mars Protocol to hold community call at 9 a.m. to discuss launch of a perpetual trading product.

- Stellar to upgrade its mainnet to protocol version 22 following validator vote, time unspecified.

- Unlocks

- Solana’s Jito to release 105% of JTO circulating supply on Dec. 7 at 10 a.m., worth nearly $500 million at current prices.

- Token Launches

- StrawberryAI is to launch mainnet on Dec. 5, time unspecified.

Token Talk

By Shaurya Malwa

In the community, it was widely shared that Hailey was found to be dishonest, and it appears she may need to discuss her actions with the judge.

In HawkEconomics:

— Haliey Welch (@HalieyWelchX) December 4, 2024

As a researcher, I’m excited to share that Haliey Welch introduced a new token on the Solana platform yesterday, which I’ve been closely following. Dubbed HAWK, this token is backed by a dedicated management team, a foundation based in the Cayman Islands, and a SAFT agreement with private investors who have all pledged to support its longevity. The theme of this token ties back to Welch’s well-known “hawk tuah” catchphrase.

At first, the value of the token skyrocketed to a market capitalization of $490 million. However, within just 20 minutes, it plummeted drastically and dropped below $40 million.

As an analyst, I’d rephrase that statement as follows:

— De.Fi Antivirus Web3 🛡️ (@De_FiSecurity) December 5, 2024

In simpler terms, the unpredictable market behavior resembled a common scenario known as “pulling the rug,” which refers to a cryptocurrency that quickly increases in value for early buyers, then plummets by over 90% within just a few hours or days after its release.

According to on-chain investigators like Bubblemaps, it is claimed that approximately 96% of the HAWK tokens were stored within one large grouping – either a single wallet or multiple connected wallets – which subsequently offloaded their tokens during periods of price increase.

$HAWK didn’t disappoint

96% of the supply in one cluster

nice 🤡

— Bubblemaps (@bubblemaps) December 4, 2024

As a researcher, I’ve taken it upon myself to address some of the recent accusations. Contrary to these claims, my team and I maintain that no insiders were involved in selling tokens at launch. Furthermore, we’ve asserted that the high initial trading fees were put in place as a strategic measure to deter ‘sniper bots’. These are automated systems that buy large quantities of a token immediately following issuances, with the intention of cornering the supply.

In Asian time zones, several messages sent to Welch’s team concerning the allegations remained unanswered.

Derivatives Positioning

- The market looks overheated and faces pullback risks, with BTC’s perpetual funding rates more expensive than those of speculative tokens such as DOGE.

- Traders are increasingly focusing on ETH, as evidenced by the new high of 6.86 million ETH in ether futures and perpetual futures open interest. BTC’s OI is yet to confirm the new spot-price high.

- BTC calls, however, are more expensive than ETH on Deribit, according to 24-delta risk reversals sourced from Amberdata. Long dealer gamma at the $105,000 strike options suggests potential for range play.

- BTC, ETH options flows mostly leaned bullish, but a large block trade saw an ETH trader sell the December expiry straddle at $3,800, collecting over $2 million in premium. Selling straddle represents expectations for price consolidation and volatility drop.

Market Movements:

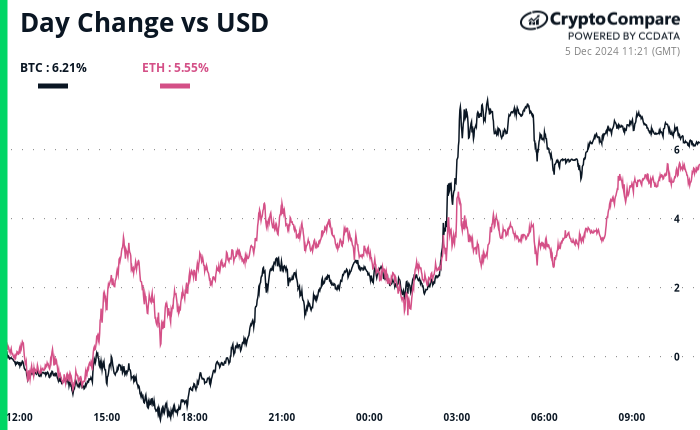

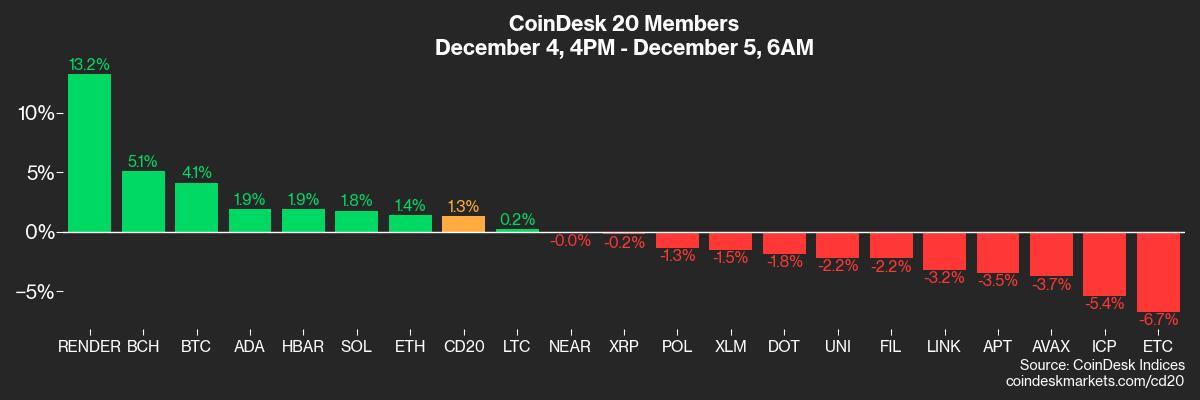

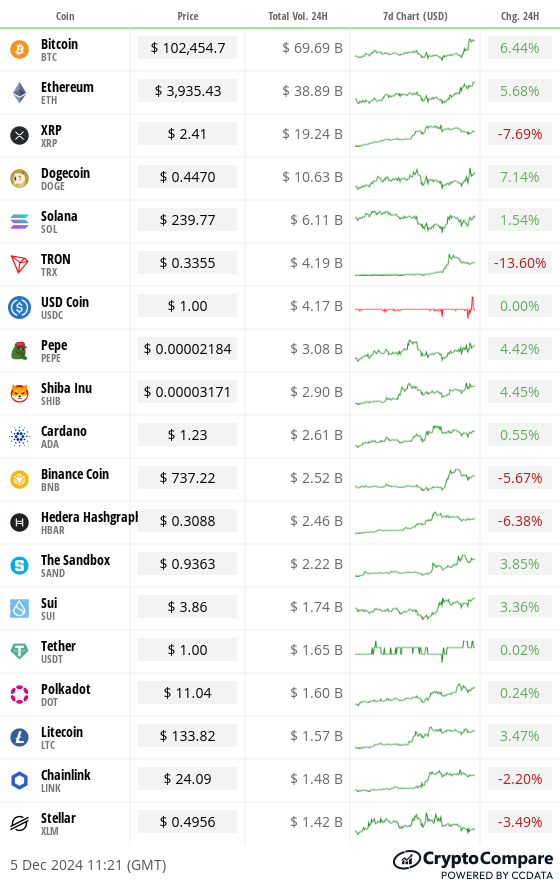

- BTC is up 4.83% from 4 p.m. ET Wednesday to $102,565.99 (24hrs: +6.22%)

- ETH is up 2.36% at $3,935.20 (24hrs: +5.24%)

- CoinDesk 20 is up 1.4% to 3,956.08 (24hrs: +0.21%)

- Ether staking yield is down 19 bps to 3.27%

- BTC funding rate is at 0.045% (49.3% annualized) on Binance

- DXY is down 0.11% at 106.21

- Gold is up 0.69% at $2672.20/oz

- Silver is up 1.14% to $31.86/oz

- Nikkei 225 closed +0.3% at 39,395.60

- Hang Seng closed -0.92% at 19,560.44

- FTSE is unchanged at 8339.32

- Euro Stoxx 50 is up 0.54% at 4,945.57

- DJIA closed on Wednesday +0.69% to 45,014.04

- S&P 500 closed +0.61% at 6086.49

- Nasdaq closed +1.3% at 19,735.12

- S&P/TSX Composite Index closed unchanged at 25,641.2

- S&P 40 Latin America closed +0.38% at 2,336.15

- U.S. 10-year Treasury was unchanged at 4.205%

- E-mini S&P 500 futures are unchanged at 6094.50

- E-mini Nasdaq-100 futures are down 0.14% to 21,505.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 45,069.

Bitcoin Stats:

- BTC Dominance: 56.60% (-0.61%)

- Ethereum to bitcoin ratio: 0.03800 (1.78%)

- Hashrate (seven-day moving average): 741 EH/s

- Hashprice (spot): $61.12

- Total Fees: 14.8 BTC/ $1.4 million

- CME Futures Open Interest: 188,135 BTC

- BTC priced in gold: 39.0 oz

- BTC vs gold market cap: 11.12%

- Bitcoin sitting in over-the-counter desk balances: 423,913

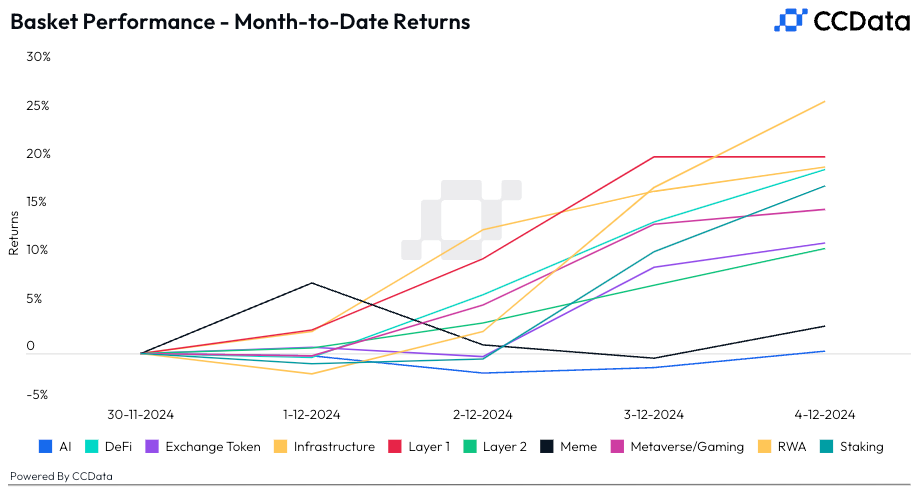

Basket Performance

Technical Analysis

- The chart shows bitcoin’s Mayer multiple, which measures the difference between an asset’s going market value and its 200-day simple moving average (SMA).

- As of writing, the Mayer multiple stands well below the 2.4 threshold that has marked previous bull market tops.

TradFi Assets

- MicroStrategy (MSTR): closed on Wednesday at $406 (+8.72%), up 6.38% at $431.90 in pre-market.

- Coinbase Global (COIN): closed at $330.94 (+6.98%), up 3.04% at $341.01 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.71 (+6.2+5%)

- MARA Holdings (MARA): closed at $25.96 (+3.3%), up 5.51% at $27.39 in pre-market.

- Riot Platforms (RIOT): closed at $12.95 (+6.67%), up 4.72% at $13.56 in pre-market.

- Core Scientific (CORZ): closed at $17.47 (+6.39%), up 2.63% at $17.93 in pre-market.

- CleanSpark (CLSK): closed at $14.68 (+5.23%), up 3.47% at $15.19 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.52 (+7.11%), up 3.15% at $30.45 in pre-market.

- Semler Scientific (SMLR): closed at $63.40 (-0.36%), up 7.37% at $68.07 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $556.8 million

- Cumulative net inflows: $32.26 billion

- Total BTC holdings ~ 1.086 million.

Spot ETH ETFs

- Daily net inflow: $167.7 million

- Cumulative net inflows: $901.3 million

- Total ETH holdings ~ 3.113 million.

Overnight Flows

Chart of the Day

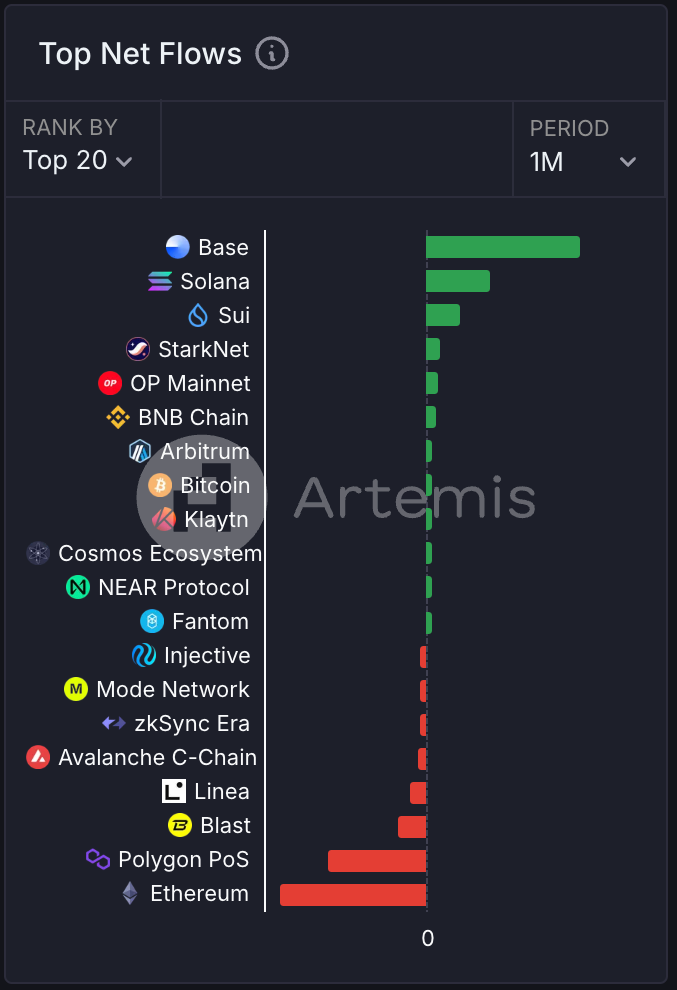

- The chart shows the top 20 chains of the past month in terms of the net volume of assets received using a crypto bridge.

- Coinbase’s layer-2 scaling product BASE and programmable blockchain Solana are the highest recipients. Ethereum is the worst performer.

- The data supports the bull case in SOL and layer 2 tokens.

In the Ether

Read More

- SUI PREDICTION. SUI cryptocurrency

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- LDO PREDICTION. LDO cryptocurrency

- Original Two Warcraft Games Are Getting Delisted From This Store Following Remasters’ Release

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- Selena Gomez Responds to Eugenio Derbez’s Criticism of Her ‘Emilia Pérez’ Performance: ‘I Did the Best I Could With the Time I Was Given’

- Washington Spirit Owner Michele Kang on Momentum in Women’s Sports as Team Preps for NWSL Championship: ‘You Can Feel the Change’

2024-12-05 15:03