What to know:

As someone who’s been navigating the ever-evolving world of crypto for quite some time now, I must say that today’s newsletter feels like a treasure trove of insights!

By Omkar Godbole (All times ET unless indicated otherwise)

It was just a question of when the Bitcoin bull market would rekindle interest in the DeFi sector, and lo and behold, there’s growing discussion about a possible “carry trade” involving the DeFi protocol Ethena’s yield-generating sUSDe (staked USDe) to borrow stablecoins like USDC and USDT from the lending giant Aave.

By converting these stablecoins back into USDe, one can earn a substantial profit from the significant difference in yield between sUSDe’s approximately 30% annual return and Aave’s adjustable lending rates, which are currently below 20%. This return is significantly higher compared to the staking yield of ether, which is less than 4%, as well as the U.S. 10-year Treasury’s yield of 4.24%.

Should the trade gain widespread acceptance, there’s a possibility that the opportunity for arbitrage might narrow over time. This is because borrowing costs could eventually align with the return on stablecoins like sUSDe, as suggested by the anonymous commentator Clouted. It’s worth keeping a close watch on this development.

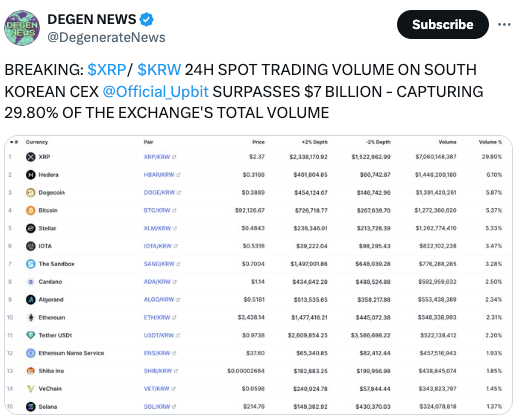

Regarding the top cryptocurrency, Bitcoin, it has regained nearly $97,000 as of this moment, a level that has appeared frequently since mid-November. This recovery comes after a test of demand at roughly $93,500 on Tuesday. Prices on Korean exchanges have now aligned with global markets again following Tuesday’s sudden drop due to the declaration of martial law, which had initially caused a flash crash.

Investors are eagerly looking forward to Fed Chairman Powell’s speech later today and the release of the nonfarms payroll report on Friday, as they anticipate increased fluctuations in Bitcoin prices. The reemergence of a premium for Bitcoin on Coinbase suggests that renewed optimism might be justified, but this could be dampened if Powell lowers expectations for interest rate cuts in December.

In the meantime, be cautious about engagement farming on social media. Some X accounts are generating excitement about short positions in CME’s ether futures, suggesting it’s causing ether prices to drop. However, this may not necessarily be accurate. Many of these shorts could be part of a common price-neutral cash-and-carry arbitrage strategy that involves long positions in the spot market or spot ETFs. It’s no surprise then, that data from Farside Investors indicates a net inflow of $714 million into U.S.-listed ether ETFs over the past seven trading days.

As an analyst, I’ve been closely observing the market landscape, and it’s clear that Aptos has made a significant stride. Their DeFi Total Value Locked (TVL) has reached a monumental milestone of $1 billion, marking a jaw-dropping 19-fold increase year-on-year.

The TRX token from Tron and the GS token from the on-chain perpetual options protocol, GammaSwap, have hit new peaks in value. Meanwhile, a significant investor (often referred to as a ‘whale’) has offloaded an enormous 240 billion PEPE tokens, as per Lookonchain reports. The decentralized exchange, PancakeSwap, has unveiled “PancakeSwap Springboard,” which allows for the creation and listing of new tokens, borrowing inspiration from Pumpfun’s approach. Prepare for increased market speculation and potential bubbles.

In conventional marketplaces, be mindful of indicators suggesting a risk-averse stance. The Japanese yen is showing optimism, and high-ranking Wall Street figures are significantly unloading their stocks. This has caused the number of insider sellers compared to buyers to almost six times more, as stated in the Kobeissi Letter. Therefore, stay vigilant!

What to Watch

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 4, 10:00 a.m.: The Institute for Supply Management (ISM) releases November’s Services ISM Report on Business. Services Purchasing Managers Index (PMI) Est. 55.5 vs Prev. 56.0.

- Dec. 4, 1:40 p.m.: Fed Chair Jerome H. Powell is taking part in a moderated discussion at The New York Times DealBook Summit in New York City.

- Dec. 4, 2:00 p.m.: The Fed releases the Beige Book, an economic summary used ahead of FOMC meetings.

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

- Nonfarm Payrolls (NFP) Est. 183K vs Prev. 12K.

- Unemployment Rate Est. 4.1% vs Prev. 4.1%.

- Average Hourly Earnings MoM Est. 0.3% vs Prev. 0.4%.

- Average Hourly Earnings YoY Prev. 4%.

Token Events

- Governance votes & calls

- Unlocks

- Taiko unlocked 11% of circulating supply, worth over $10 million at current rates, at 5 a.m.

- Token Launches

- StrawberryAI is to launch mainnet on Dec. 5, time unspecified.

Token Talk

By Shaurya Malwa

“Dino coins” from as long ago as 2018 are catching a bid in a refreshing move away from memecoins.

During the time considered as the initial altcoin market surge, various coins have mirrored XRP‘s 400% increase in value over the last month by experiencing price rallies without any obvious immediate explanation.

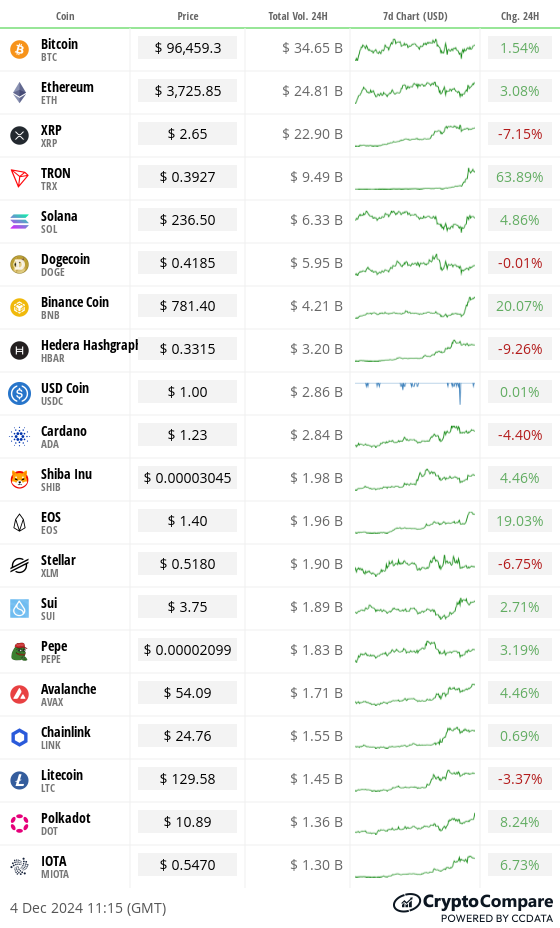

Over the past seven days, CoinGecko data indicates that Stellar (XLM), Bitcoin Cash, EOS (EOS), Tron (TRX), and Hedera (HBAR) have experienced a surge of at least 50%. This growth has outpaced bitcoin and most other tokens that are currently trending or receiving attention on Crypto Twitter.

The phrase “dino coins” signifies a change in perspective where established cryptocurrencies are no longer viewed as antiquated but rather as robust, experienced projects. This transformation can be traced back to their ability to endure various market fluctuations, which lends them a sense of credibility over newer, less-verified initiatives.

Derivatives Positioning

- The bitcoin and ether annualized three-month futures basis on offshore exchanges remain flat at around 15%. On the CME, ETH boasts a slightly higher basis at 17%, with BTC at 14%, offering attractive returns to cash and carry traders.

- Positioning in ETH remains elevated, with global futures and perpetual open interest at a record high of 338,680. The BTC market has cooled, with open interest pulling back to 609,470, down 8% from the peak of 663,710 seen last month.

- On decentralized options protocol Derive, a trader collected $1.66 million in premiums by selling bitcoin March expiry calls at strikes in the $105,000 to $130,000 range.

- Short-term BTC calls are trading at a slight discount to puts, but long-term options continue to show a bull bias. ETH calls are expensive relative to puts across the curve. (Data source: Amberdata, VeloData, Derive, Deribit)

Market Movements:

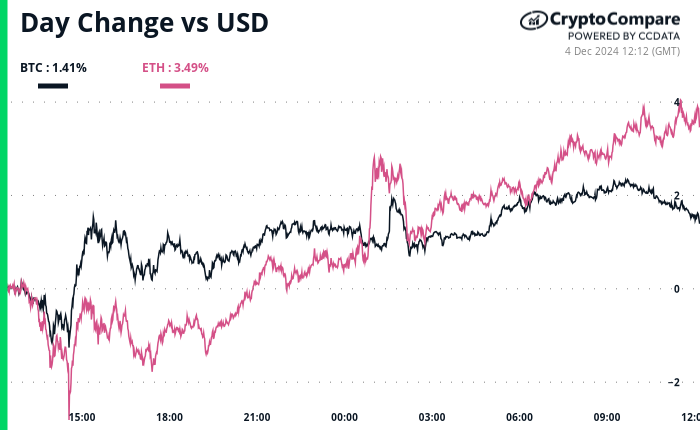

- BTC is up 0.9 % from 4 p.m. ET Tuesday to $96,460.42 (24hrs: +0.64%)

- ETH is up 3.46% at $3,734.92 (24hrs: +3.22%)

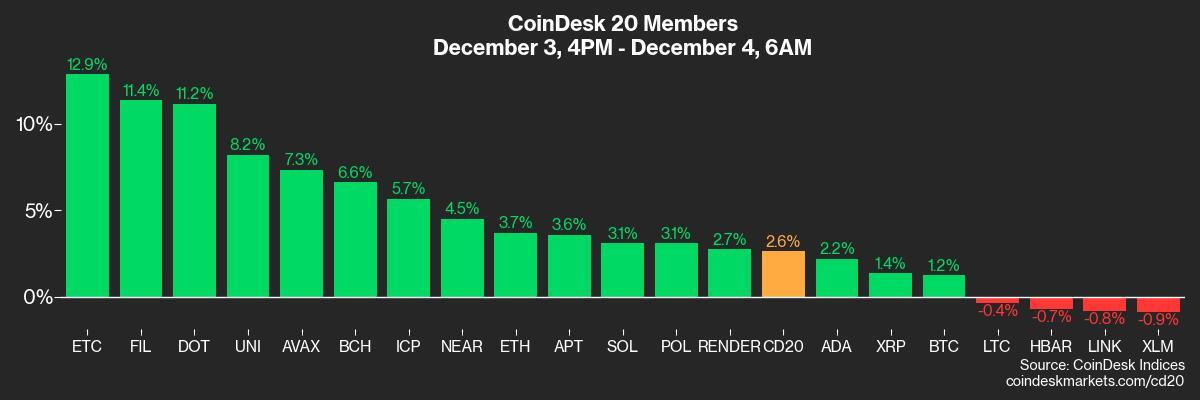

- CoinDesk 20 is up 2.39% to 3,954.73 (24hrs: +2.54%)

- Ether staking yield is up 30 bps to 3.46%

- BTC funding rate is at 0.0264% (28.9% annualized) on Binance

- DXY is up 0.13% at 106.46

- Gold is unchanged at $2,646.45/oz

- Silver is down 0.41% to $30.86/oz

- Nikkei 225 closed unchanged at 39,276.39

- Hang Seng closed unchanged at 19,742.46

- FTSE is down 0.43% at 8,323,87.87

- Euro Stoxx 50 is up 0.4% at 4,897.96

- DJIA closed -0.17% to 44,705.53

- S&P 500 closed unchanged at 6,049.88

- Nasdaq closed +0.83% at 19,480.91

- S&P/TSX Composite Index closed +0.18% at 25,635.73

- S&P 40 Latin America closed +0.44% at 2,327.36

- U.S. 10-year Treasury was unchanged at 4.22%

- E-mini S&P 500 futures are up 0.24% to 6078.50

- E-mini Nasdaq-100 futures are up 0.56% to 21405.00

- E-mini Dow Jones Industrial Average Index futures are up 0.48% at 45016

Bitcoin Stats:

- BTC Dominance: 55.17% (-0.61%)

- Ethereum to bitcoin ratio: 0.0383 (1.78%)

- Hashrate (seven-day moving average): 729 EH/s

- Hashprice (spot): $61.013

- Total Fees: 15.5 BTC/ $1.5 million

- CME Futures Open Interest: 185,485 BTC

- BTC priced in gold: 36.5 oz

- BTC vs gold market cap: 10.40%

- Bitcoin sitting in over-the-counter desk balances: 423,902

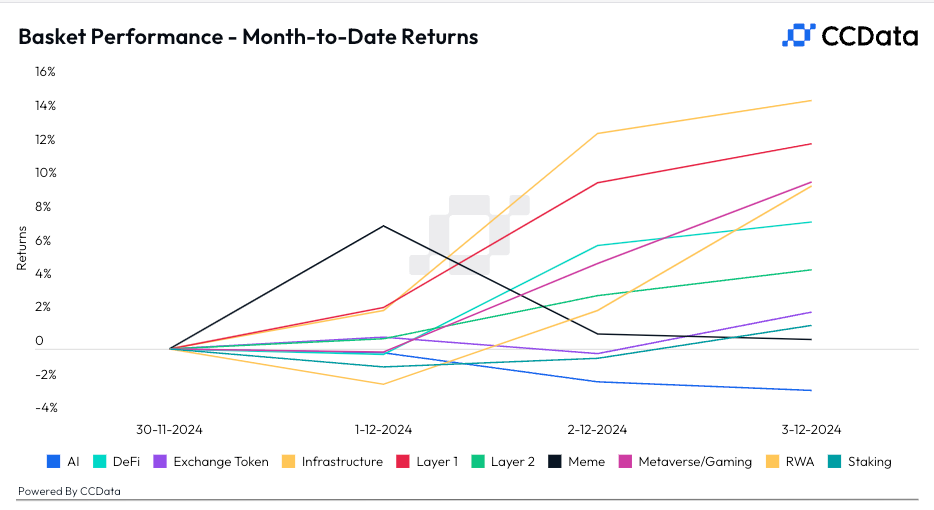

Basket Performance

Technical Analysis

Looking at XRP’s day-to-day price pattern, it’s clear that on Tuesday, prices reached a fresh peak. However, the Moving Average Convergence Divergence (MACD) line, which signifies momentum, failed to align with this rise, instead showing a downward divergence. This suggests that the bullish energy behind the prices has started to wane, potentially leading to a decline in prices going forward.

TradFi Assets

- MicroStrategy (MSTR): closed on Tuesday at $373.43 (-1.81%), up 3.23% at $385.50 in pre-market.

- Coinbase Global (COIN): closed at $309.35 (+2.3%), up 1.62% at $314.36 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.08 (+5.03%)

- MARA Holdings (MARA): closed at $25.13 (-1.95%), up 2.03% at $25.65 in pre-market.

- Riot Platforms (RIOT): closed at $12.14 (+0.33%), up 0.66% at $12.22 in pre-market.

- Core Scientific (CORZ): closed at $16.42 (+2.24%), up 0.53% at $17.67 in pre-market.

- CleanSpark (CLSK): closed at $13.95 (-3.93%), unchanged in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.56 (-0.25%), up 2.58% at $28.27 in pre-market.

- Semler Scientific (SMLR): closed at $63.63 (+4.81%), up 2% at $64.90 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $676 million

- Cumulative net inflows: $31.70 billion

- Total BTC holdings ~ 1.080 million.

Spot ETH ETFs

- Daily net inflow: $132.6 million

- Cumulative net inflows: $733.6 million

- Total ETH holdings ~ 3.077 million.

Overnight Flows

Chart of the Day

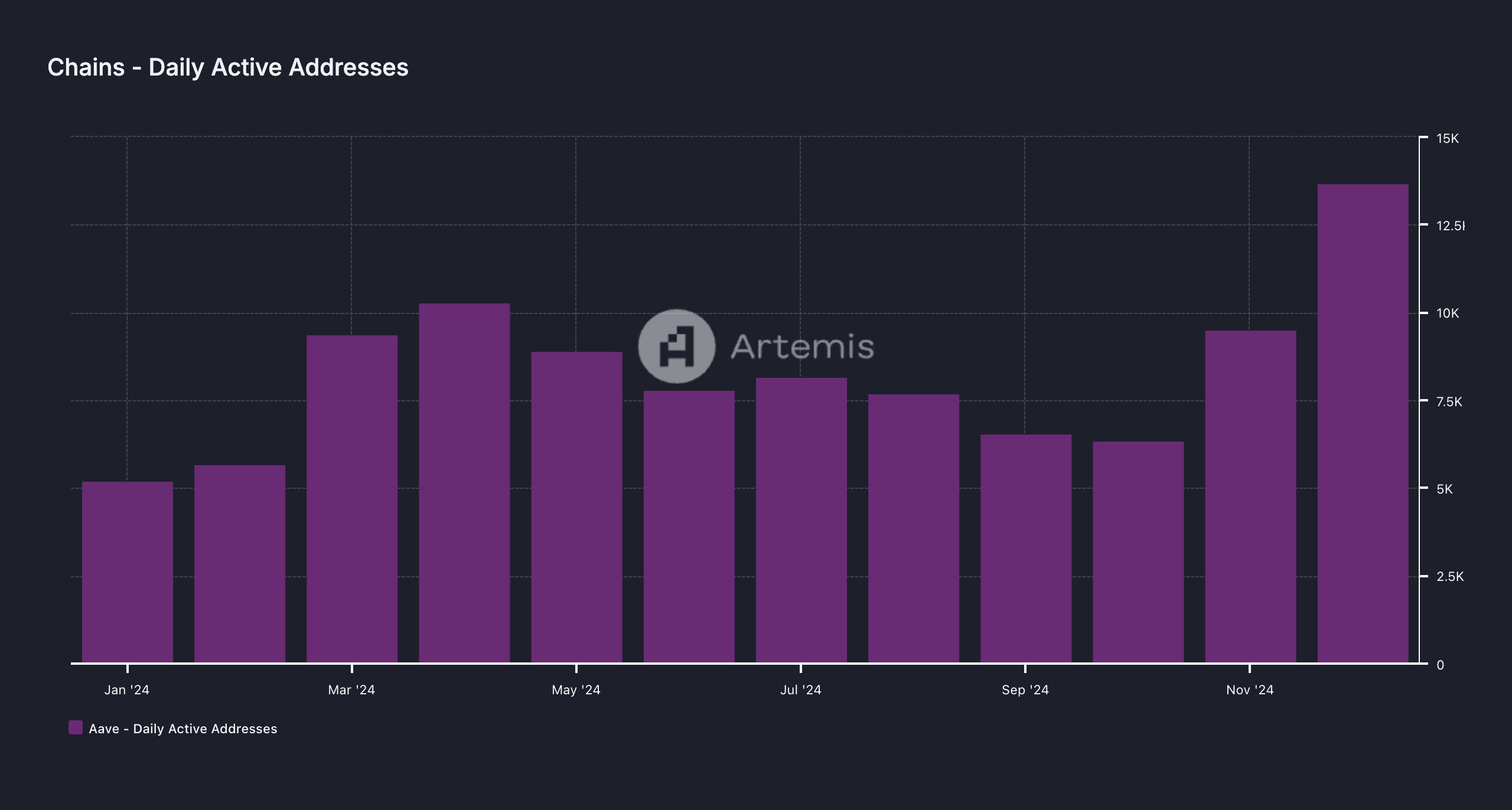

- December’s tally of the daily unique on-chain wallets interacting with AAVE surpassed 13,000, the most since November 2021.

- The increase comes amid increased interest in borrowing stablecoins.

In the Ether

Read More

- SUI PREDICTION. SUI cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- WLD PREDICTION. WLD cryptocurrency

- Original Two Warcraft Games Are Getting Delisted From This Store Following Remasters’ Release

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- The ‘Abiotic Factor’ of Fishing: Why Gamers Find It Boring

- Selena Gomez Responds to Eugenio Derbez’s Criticism of Her ‘Emilia Pérez’ Performance: ‘I Did the Best I Could With the Time I Was Given’

- EUR PKR PREDICTION

2024-12-04 15:18