What to know:

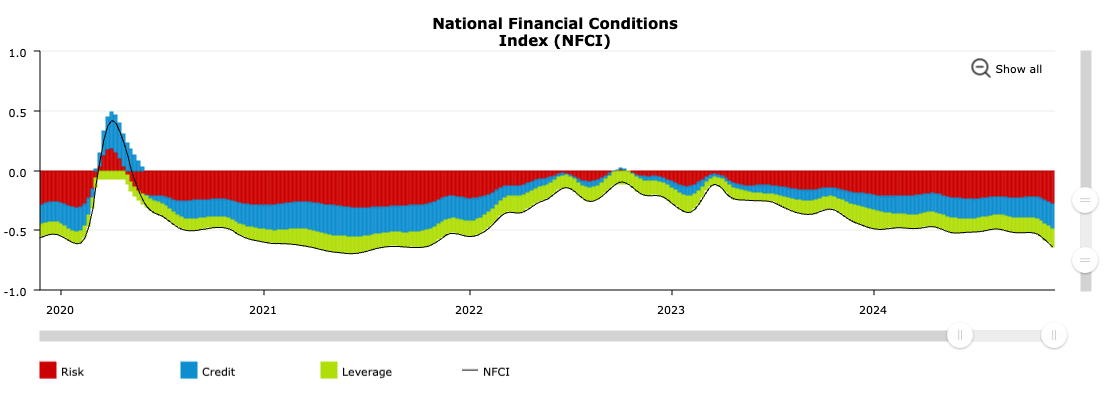

- The Chicago Fed’s National Financial Conditions Index (NFCI) shows financial conditions are the loosest since August 2021.

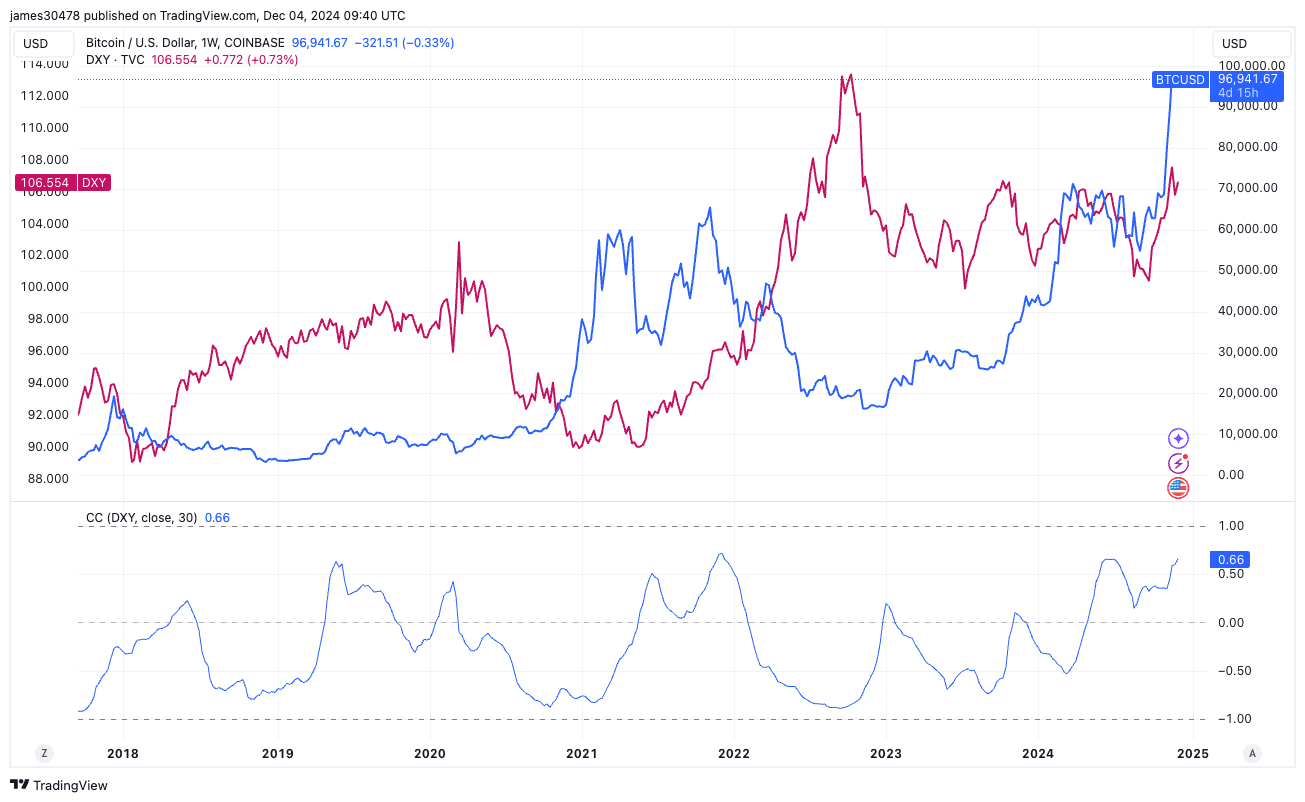

- Bitcoin and the dollar remain joined at the hip, with a 30-day correlation of 0.66.

As a seasoned analyst with over two decades of experience navigating the turbulent waters of global financial markets, I find the current state of affairs both fascinating and concerning. The Chicago Fed’s National Financial Conditions Index (NFCI) reading of -0.64 is a stark reminder of how far we’ve come since the depths of the 2008 global financial crisis, yet how little we seem to have learned from it.

In simpler terms, the Chicago Fed’s National Conditions Index indicates that financial conditions within the U.S. are currently as favorable as they have been in the past three years. This index considers various aspects including borrowing levels, stock markets, and conventional banking systems to arrive at its findings.

The readings offer understanding about three distinct topics: risk, credit, and leverage. During the week ending on November 22nd, the index fell to -0.64, a level that hasn’t been reached since August 2021 in the wake of the Covid-19 pandemic. This new version maintains the original meaning while using more conversational language and simpler sentence structures.

As a crypto investor, I’d interpret a low reading as an indication that the financial climate is more relaxed than usual, suggesting easy access to liquidity. On the flip side, a high reading implies stricter-than-average conditions where securing capital may be challenging, similar to what was experienced during the 2008 global financial crisis.

Looking at the bigger picture, we find ourselves in one of the most economically flexible periods with data available from 1971. Currently, U.S. inflation is running at an annual 2.6%, surpassing the Federal Reserve’s desired 2% level since February 2021. Despite a series of 75 basis point interest rate reductions since September and the current rate standing at 4.75%, there seems to be minimal impact on investors’ desire for risk-taking.

Here’s a possible way to rephrase the given text: This year, the S&P 500 has reached its 55th record high, increasing by 28% from the beginning of January as reported by Zerohedge. Meanwhile, Bitcoin (BTC) has experienced a surge of 118%, and the overall value of the cryptocurrency market has more than doubled, nearly reaching $3.5 trillion, according to data from TradingView.

Bitcoin and DXY rise together

Generally, the value of risk assets often decreases when the DXY index, which represents the strength of the US dollar compared to several significant foreign currencies, is strong. The DXY index has remained above 106 since Donald Trump’s victory in the U.S. presidential election, suggesting a robust US dollar relative to other major currencies.

What’s intriguing about Bitcoin’s surge is that it goes against its usual pattern, as it typically moves inversely. The 30-day relationship between Bitcoin and the DXY index has been exceptionally strong at 0.66 over the last seven years, which is one of the highest levels for this timeframe.

With financial constraints easing and the overall U.S. debt reaching an unprecedented $36.17 trillion, it appears that the most prominent cryptocurrency is flourishing, as its capacity to absorb excess liquidity has proven more potent than a robust dollar.

Read More

- SUI PREDICTION. SUI cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- COW PREDICTION. COW cryptocurrency

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- WLD PREDICTION. WLD cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

- ADA EUR PREDICTION. ADA cryptocurrency

- EUR IDR PREDICTION

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

2024-12-04 14:20