What to know:

- Earlier reports said that Foundry had laid off 60% of its workforce, but a DCG spokesperson put that number at 16% in a statement to CoinDesk.

- Across the industry, miners are looking to cut costs after April’s halving made mining less profitable.

As a seasoned crypto investor with a decade-long journey under my belt, I’ve weathered countless market fluctuations and witnessed the rise and fall of numerous players in this dynamic landscape. The recent news about Foundry, a subsidiary of Digital Currency Group (DCG), trimming its workforce by 16% is an event that, while not unexpected, serves as a stark reminder of the cyclical nature of our industry.

The mining pool owned by Digital Currency Group, known as Foundry, has decided to let go of 16% of their U.S. workforce and a small group based in India.

Our approach is to consistently improve our strategy for sustainable growth and longevity in an ever-changing market. Lately, we’ve chosen to concentrate Foundry specifically on its primary function – running the top Bitcoin mining pool globally and expanding our site operations business – while simultaneously aiding the development of DCG’s latest subsidiaries, such as Yuma and the separation of Foundry’s profitable self-mining operation.” This is how a DCG representative explained it via email.

A representative from the company confirmed that the latest shareholder communication from DCG had previously announced their intentions for this restructuring.

In line with this reorganization, we had to make a tough call and decrease the staff at Foundry, which led to job reductions across several departments. We appreciate the hard work and dedication of every employee, even those affected by these adjustments.

Generally speaking, due to the halving event, miners find themselves in a position where they must reduce expenses because each block now produces half as many new bitcoins, leading to a decrease in profitability for mining activities.

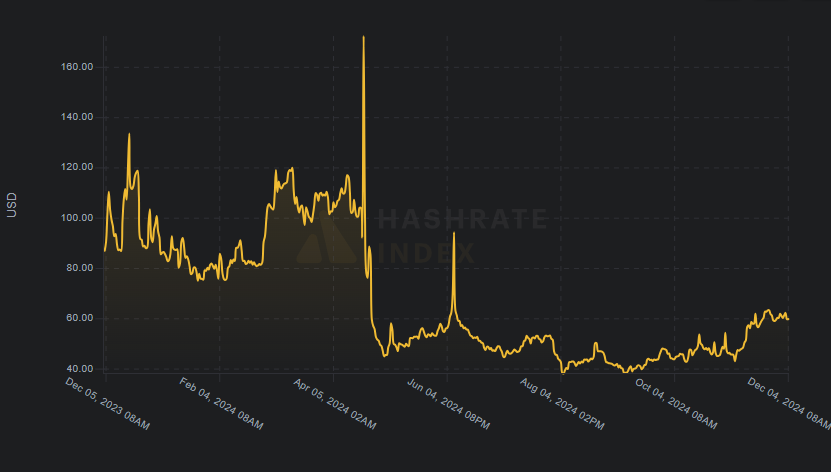

The Bitcoin Hashprice Index, which represents the estimated income a miner gets from a specific level of hashrate, has experienced a substantial decrease over the past year, now approximately $60 per hash per day. This is down from an average of around $100 per day in December. However, it’s worth noting that the price has shown a slight increase in the last three months.

According to a recent analysis by investment bank JPMorgan, the total estimated worth of all yet-to-be-mined bitcoins, considering the current market value, amounts to approximately $74 billion. However, it’s worth noting that the stocks related to mining these bitcoins have been performing below expectations.

Bitcoin is up over 130% in the last year, according to CoinDesk data.

Read More

- SUI PREDICTION. SUI cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- COW PREDICTION. COW cryptocurrency

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- WLD PREDICTION. WLD cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

- ADA EUR PREDICTION. ADA cryptocurrency

- EUR IDR PREDICTION

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

2024-12-04 11:09