What to know:

- The minute-level pricing data suggests more substantial buying pressure on Coinbase than Binance and Upbit.

- Trading volumes, however, are way bigger in Korea.

As a seasoned researcher with a keen interest in the crypto realm and a penchant for deciphering market trends, I find myself intrigued by the recent developments surrounding XRP. The data suggests a fascinating dynamic between Coinbase, Binance, and Upbit – a dance of volumes and premiums that paints an interesting picture.

As a crypto investor, whenever I ponder over the abrupt surge in prices of altcoins such as XRP, my thoughts inevitably lead me to South Korea – a region renowned for its deep involvement with alternative digital currencies.

Although Korean investors have significantly boosted XRP’s price increase by approximately 400% over the past month to reach $2.60, it’s important to note that U.S.-based investors are also actively participating in the market via the Nasdaq-listed Coinbase trading platform.

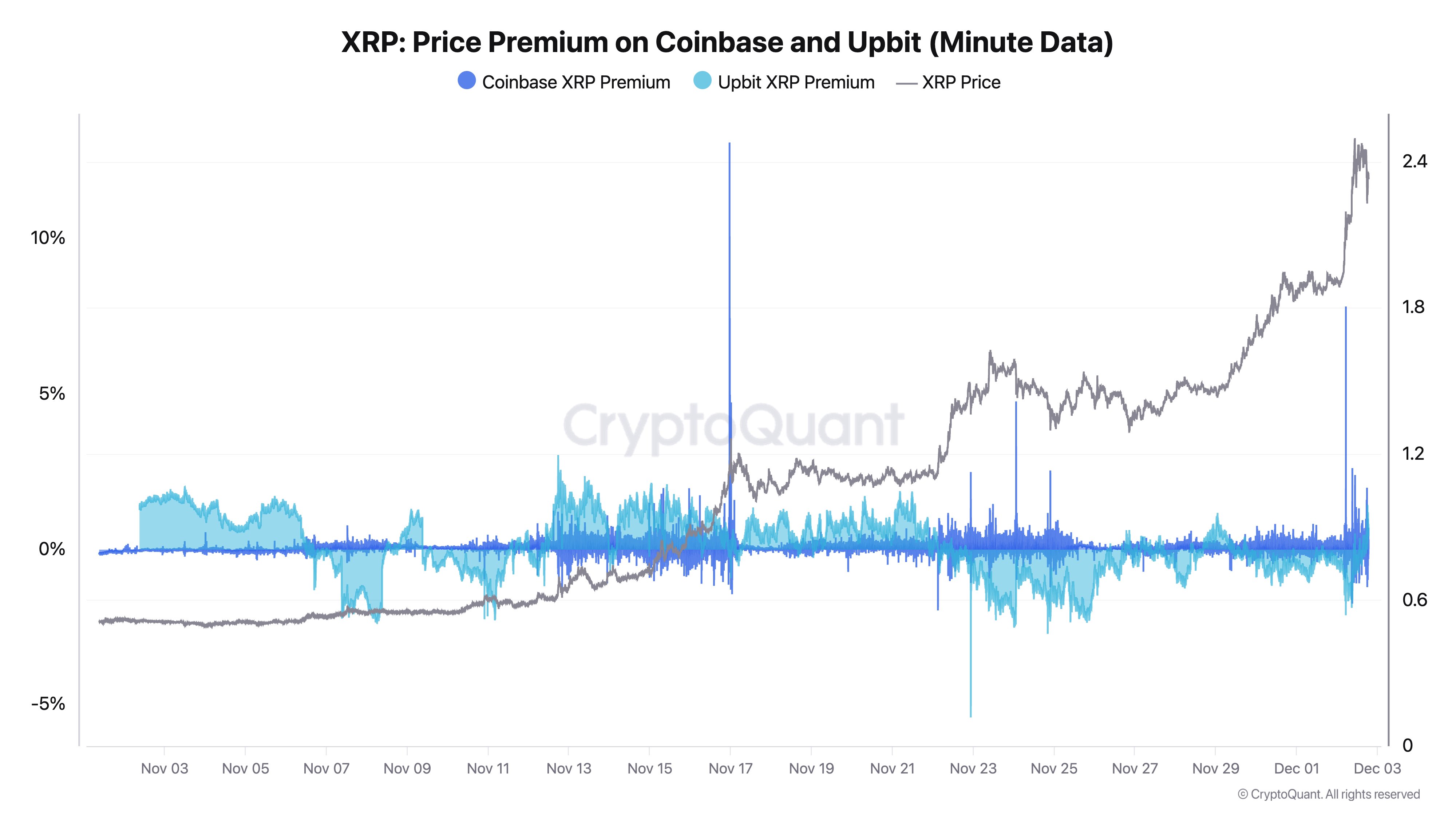

Over the last month, the cost of the XRP/USD pair on Coinbase has generally been higher compared to Binance’s XRP/USDT pair. The difference in price, measured at a minute level, has varied between 3% and 13%, as indicated by data from the analytics firm CryptoQuant.

According to CryptoQuant’s CEO Ki Young Ju, it appears that whales are becoming more active on Coinbase. However, so far, prices haven’t shown any substantial increase on Upbit, South Korea’s primary cryptocurrency exchange.

Stories about cryptocurrency adoption during Trump’s term might be driving the perceived “Coinbase premium,” which refers to the price difference between cryptocurrencies traded on Coinbase and their market value on other platforms.

The Wall Street Journal predicts that if Trump wins a second term, it could mark a fresh era for cryptocurrencies, with fewer regulatory obstacles. In this scenario, dubbed ‘litigation peace,’ XRP could become more accessible to significant financial institutions, serving as a medium of exchange or bridge currency for foreign transactions. According to FRNT Financial’s newsletter published on Tuesday, this is the reason behind the recent surge in XRP value and increased activity on U.S. exchanges.

Trump’s friendly attitude towards cryptocurrencies strengthens the idea that payment-oriented Ripple (XRP) could become a commonly used ‘intermediary currency’ for handling international transactions, according to FRNT.

Coinbase lags in trading volume

Despite some variations, the data suggests that South Korea dominates the XRP market. On Upbit, the XRP/KRW pair has been the busiest in the last 24 hours, with a trading volume of approximately $7.63 billion. This represents around 26% of all activity in the market, as per data from Coingecko.

On Coinbase, the XRP/USD exchange has recorded an astounding trading volume of approximately $1.7 billion in the last 24 hours, making it the busiest pair on the platform. This figure represents more than 17% of the total trading volume for the exchange, which stood at a staggering $9.89 billion, as reported by data provider Coingecko. The BTC/USD pair follows closely behind, with a trading volume of around $1.59 billion.

The international market for XRP has seen greater trading volume, possibly due to its unavailability for trade within the U.S. for an extended period. This was a result of Ripple’s legal dispute with the SEC concerning alleged breaches of securities laws when they distributed XRP to both institutional and individual investors. However, the recent settlement of this legal conflict early in 2021 has led exchanges like Coinbase to once again make XRP available for trading.

Read More

- SUI PREDICTION. SUI cryptocurrency

- COW PREDICTION. COW cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- WLD PREDICTION. WLD cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- EUR IDR PREDICTION

- W PREDICTION. W cryptocurrency

- ADA EUR PREDICTION. ADA cryptocurrency

- GLMR/USD

2024-12-04 09:17