As a seasoned analyst with over two decades of experience in financial markets under my belt, I have learned to never underestimate the unpredictability of the market. Bitcoin’s recent performance has been nothing short of a rollercoaster ride, and it seems that we are currently on a downward slope.

TL:DR;

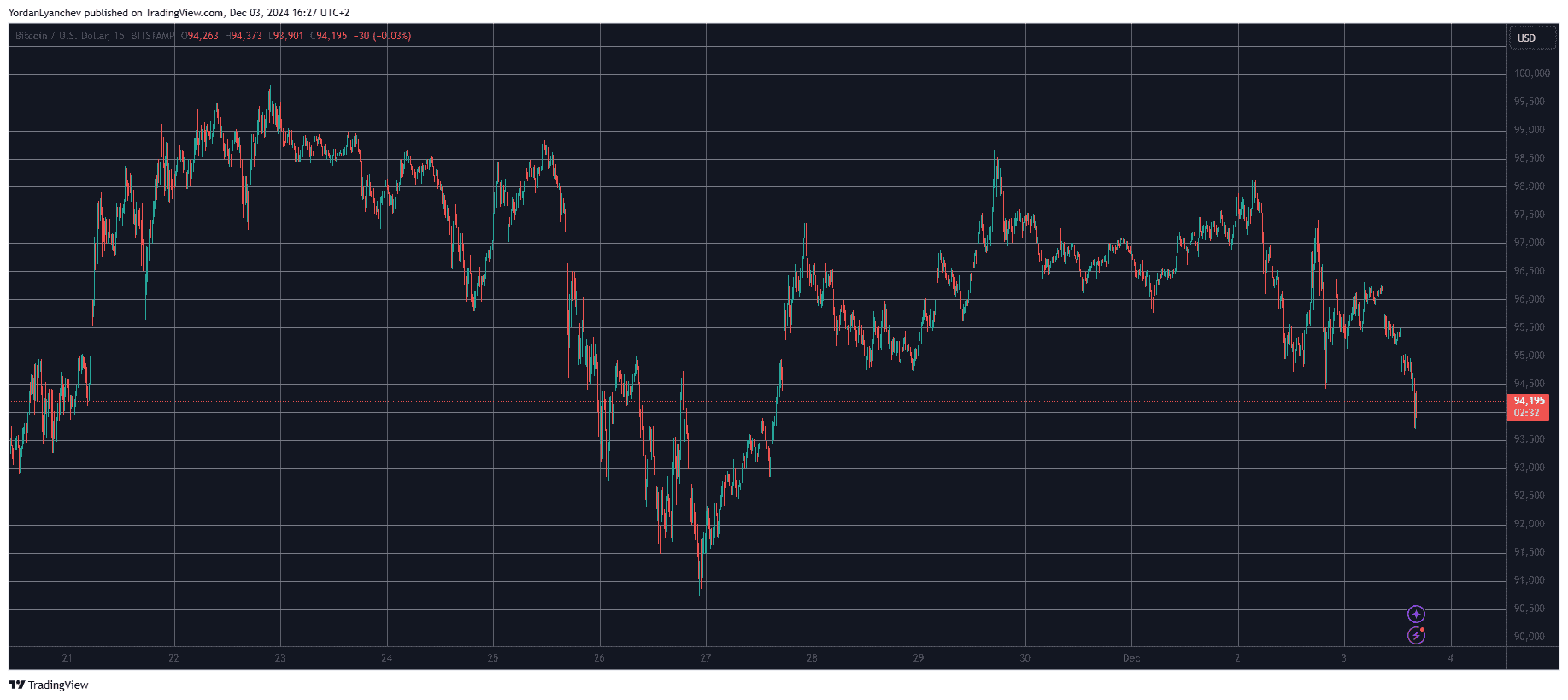

- Bitcoin’s price has seen better days as the asset failed at $97,500 yesterday and has lost nearly four grand since then.

- This comes on the heels of several analysts predicting a further correction that will potentially drive bitcoin to under $90,000.

Sub-$90K Coming Soon?

Almost a month after Donald Trump’s victory in the US elections, the leading cryptocurrency ventured into unprecedented heights, surpassing $74,000. Over the next ten days or so, the asset’s performance was nothing less than breathtaking as it broke through multiple round-numbered barriers and reached an all-time high of $99,800 on November 22. Despite this impressive climb, it couldn’t quite breach the significant six-digit mark and started to decline swiftly soon after.

In a short span of time, it dropped below $91,000, yet the optimistic investors stepped in and managed to recoup much of the losses. Consequently, Bitcoin surged above $98,000 last Friday, however, it could not sustain its upward trend and began a slow decline.

Yesterday, it experienced increased price fluctuations, followed by a fresh adjustment today. Not too long ago, the value of this cryptocurrency dropped below $94,000 for the first time in nearly a week, triggering $580 million worth of liquidations.

As a crypto investor, I’ve been following the predictions of some trusted analysts, and they seem to be pointing towards more turbulence for Bitcoin. Ali, Sheldon_Sniper, and Tone Vays have all issued warnings about a possible dip that could take BTC prices below the $90,000 mark.

Additionally, Tom Lee from Fundstrat and Robert Kiyosaki expect a significant drop that may take Bitcoin’s value to around $60,000. However, they continue to express confidence in Bitcoin’s long-term prospects, with price estimates reaching as high as $250,000.

The Opposite More Likely?

Ali emphasized the Santiment data indicating a growing consensus among the crowd regarding the mentioned cautions, as evidenced by an unprecedented increase in discussions about “BTC pullback.” However, the analyst cautioned that these forecasts should not be dismissed lightly and presented an alternative perspective instead.

In my exploration as a researcher, I’ve observed an intriguing pattern with Bitcoin – it often moves in the opposite direction of what many anticipate. Given this trend, Ali posits that this digital asset could potentially surge significantly higher, reaching figures like $120,000 or even $150,000. However, before such a substantial correction of approximately 30% takes place, he suggests we might witness an extended period of growth first.

Considering that Bitcoin often moves in the opposite direction of public sentiment, there’s a possibility it could climb higher. If historical trends continue, Bitcoin might reach between $120,000 and $150,000 – but a 30% price drop may occur first.

— Ali (@ali_charts) December 2, 2024

Read More

- SUI PREDICTION. SUI cryptocurrency

- COW PREDICTION. COW cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

- WLD PREDICTION. WLD cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

- EUR IDR PREDICTION

- ADA EUR PREDICTION. ADA cryptocurrency

- W PREDICTION. W cryptocurrency

- GLMR/USD

2024-12-03 17:42