As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, but none quite like this one. The recent drop in Bitcoin’s price from its all-time high was indeed a reminder of the volatility that characterizes this nascent asset class. However, the landscape seems to be changing, and I believe we are on the cusp of another rally.

On Monday, Bitcoin failed to surpass its previous record high of more than $99,800, leading to a distressing drop in price which caused the value to plummet from approximately $98,000 down to below $95,000.

But, the situation might shift dramatically, given that investors appear ready to inject new capital into the market.

BTC to Head North Soon?

CrytoPotato recently reported that Bitcoin’s price plummeted, reaching a low of less than $95,000 after a rather tranquil weekend. This sudden drop caused significant financial loss for heavily leveraged traders since total liquidations skyrocketed to nearly $550 million in just one day. The majority of these liquidations were due to long positions.

As a researcher, I’ve been closely observing the Bitcoin market and I must say, there are signs pointing towards the continuation of its remarkable surge that began post Trump’s victory. Beyond the fact that the relative unrealized profit metric remains within acceptable levels, suggesting the market hasn’t quite reached a boiling point yet, a recent CryptoQuant report offers intriguing insights about additional buying power ready to be released.

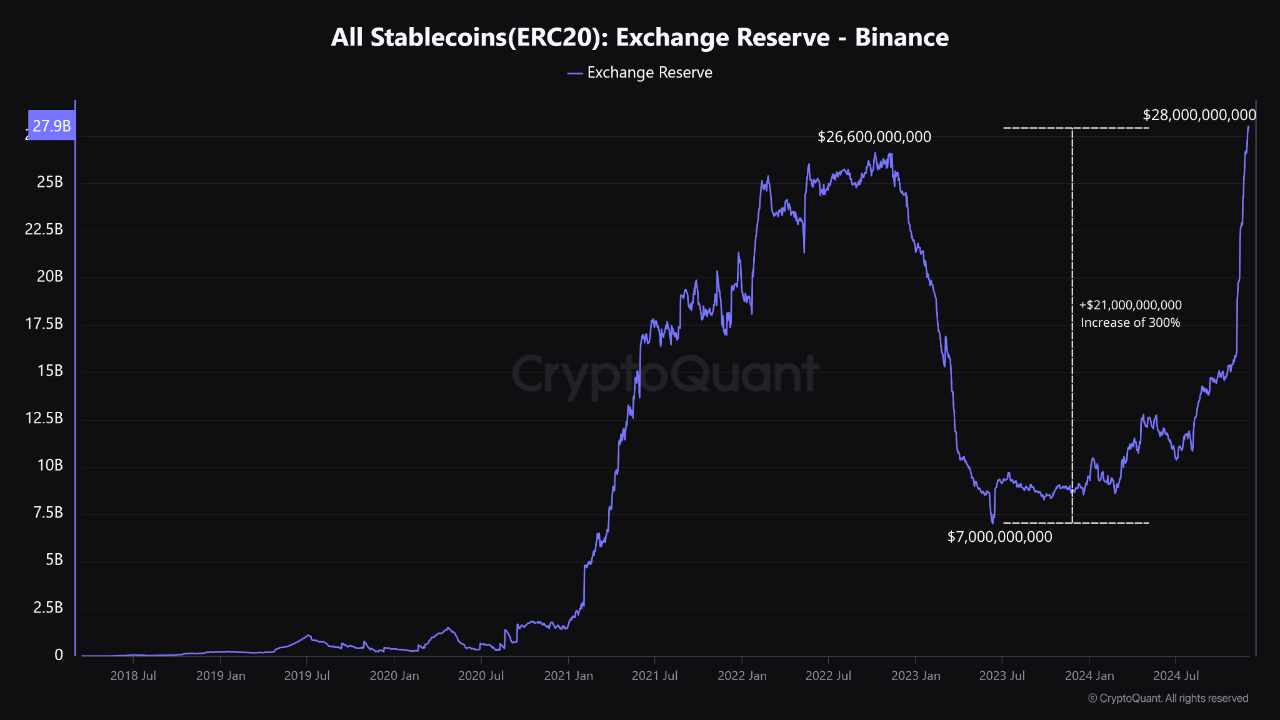

On Binance, the amount of ERC-20 stablecoins in reserve has surpassed a record high of more than $28 billion. In other words, this indicates that an unprecedented amount of capital is currently idle, seeking suitable moments to invest on the world’s largest cryptocurrency exchange.

Binance plays a crucial role in the industry because it is dominant. The report portrays Binance as a “liquidity center,” drawing traders and institutions for stablecoin transactions, storage, and trading. Given this position, the large quantities of stablecoins stored there during a broader market downturn could signal the start of another rally.

The report states: “Increased reserve levels suggest a return of confidence, higher trading volume, and more stakeholding.

$120K Soon?

Known crypto influencer Crypto Rover voiced his opinion about Bitcoin’s possible performance throughout this phase, setting a predicted price of around $120,000 if its upward trend persists.

As an analyst, I’m sharing some intriguing insights about the primary cryptocurrency: At the close of November, it experienced a relatively uncommon event – a monthly breakout. The chart below showcases that such infrequent instances have historically ignited immediate and sustained price escalations from this asset. To put it simply, these price increases often persist for extended periods, as I described it – “the price tends to surge for months on end.

Monthly breakouts don’t come around very often.

When they do, price generally pumps for months on end.

Don’t get shaken out.#Bitcoin

— Jelle (@CryptoJelleNL) December 2, 2024

Read More

- SUI PREDICTION. SUI cryptocurrency

- COW PREDICTION. COW cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- KSM PREDICTION. KSM cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- W PREDICTION. W cryptocurrency

- Clash Royale: Is It Really ‘Literally Unplayable’?

- OKB PREDICTION. OKB cryptocurrency

- Best Strinova Sensitivity Settings

2024-12-02 16:44