As a seasoned crypto investor with a few battle scars and a heart full of scars from the wild rollercoaster ride that is the cryptocurrency market, I must say that the upcoming Bitcoin options expiry on Friday, Nov. 15, has me both excited and cautious. With a notional value of around $3.4 billion at stake, it’s hard not to feel a thrill, but analysts have been warning us of an impending correction for some time now.

Approximately 38,500 Bitcoin options agreements are set to conclude on Friday, November 15th, with an estimated total worth of about $3.4 billion.

This week’s options expiration is quite comparable in scale to last week’s, given that markets have generally stayed robust throughout the current period.

Yet, analysts have warned that a downturn might occur after such a significant rise over approximately the past eight months.

Bitcoin Options Expiry

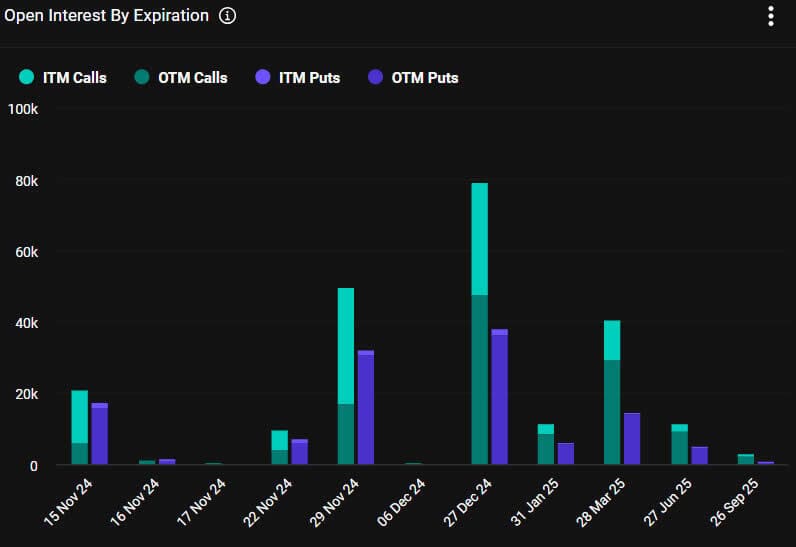

For this week’s batch of Bitcoin options, there are somewhat more open long positions (calls) compared to short positions (puts), with the put/call ratio being 0.84.

As a crypto investor, I’ve noticed that a significant amount of open interest (OI) persists for options contracts at the $80,000, $90,000, and $100,000 price points. Given this week’s surge, these levels seem quite feasible, making them potential targets for my investment strategy.

Just recently, Greeks Live, a crypto derivatives provider, stated that the market’s excitement hasn’t peaked yet in terms of FOMO (fear of missing out). They further explained that investors using options are generally hesitant to create new positions and have amassed significant numbers of option positions, with around 90,000 to 100,000 doing so.

If Bitcoin exceeds $100,000, there’s a strong chance it could spark “fear of missing out” in the options market, leading to an increase in volatility implied value (IV).

Despite speculation, it’s predicted that the ETH breakout price might reach $4,000; however, this level remains distant and for now, is likely to mirror Bitcoin’s movements, as per the observations made by the Greeks. Today, there are approximately 189,000 Ethereum contracts set to expire, along with a substantial number of Bitcoin options.

The total value is approximately $582 million, and the put/call ratio stands at 0.92. This means that the total estimated value for all crypto options expiring on Friday will be roughly $4 billion.

In its weekly crypto derivatives recap, analytics firm Block Scholes commented:

Currently, both Bitcoin (BTC) and Ethereum (ETH) are experiencing a double boost – the increase in their market prices (spot price gains) and a surge in positive derivatives trading (bullish derivatives activity). This suggests that there is strong interest among investors to be part of these cryptocurrencies’ potential future growth.

Crypto Markets Cool

At the close of the week, cryptocurrency markets experienced a pullback, causing a decrease of approximately 3.3% in value for the day. Despite this dip, the overall market capitalization still hovers slightly above the $3 trillion mark.

The price of Bitcoin dropped by approximately 2% and touched a daily low of around $87,000 earlier today. However, it has since shown a slight recovery during the Asian trading hours this morning, rising to $88,000 as of now.

Ethereum has experienced a steeper decline, dropping approximately 4%, bringing its current price to around $3,000 and holding steady as I write this.

The altcoins were mostly in the red, aside from XRP, Cardano (ADA), Near Protocol (NEAR), Litecoin (LTC), and Stellar (XLM).

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- Aphrodite Fanart: Hades’ Most Beautiful Muse Unveiled

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

- Valorant Survey Insights: What Players Really Think

- Why has the smartschoolboy9 Reddit been banned?

- KEN/USD

2024-11-15 09:52