As someone who has been closely following the cryptocurrency market for several years now, I must say that the recent rally of Cardano’s ADA is quite impressive. Having witnessed numerous market cycles and crashes, it’s always refreshing to see such significant gains, especially when they are driven by a combination of fundamental developments and broader market conditions.

TL;DR

- ADA has witnessed a notable rally as of late, driven by a broader crypto resurgence and other essential factors.

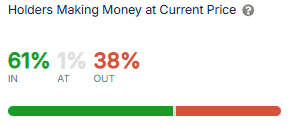

- Over 60% of ADA holders now sit on paper profits, a significant improvement from August’s lows, when almost 90% were underwater.

ADA Keeps Rallying

In recent days, Cardano‘s ADA has been one of the top cryptocurrencies, experiencing a remarkable surge in value, approximately 93%. Interestingly, Dogecoin (DOGE) is the only digital currency from the top 20 list that has seen more substantial growth during this period.

Over the past day, ADA has maintained an upward trajectory and is now being traded approximately at $0.64, a price point not seen since March of this year.

It seems that the primary cause fueling its surge might be the recent statement by Cardano’s founder, Charles Hoskinson. In the past few days, he released a lengthy video, delving into various subjects, such as the forthcoming administration of the newly elected President Trump.

Charles Hoskinson plans to devote a substantial amount of his time next year to partnering with U.S. lawmakers in an effort to establish a thorough and hopefully advantageous regulatory structure for the cryptocurrency sector.

The crypto policy ought to be crafted collaboratively by the American public, the U.S. cryptocurrency sector, and understanding legislators who are open to engaging in discussions.

The second component refers to the recent surge in the cryptocurrency market. Just now, Bitcoin (BTC) reached an unprecedented price of $90,000, propelling the total market capitalization of the sector to a fresh all-time high of $3.12 trillion.

As a researcher examining market caps, I find it interesting to note that giants such as Microsoft, Google, and Amazon, while renowned, actually hold smaller market capitalizations compared to some other companies.

ADA’s rally coincides with the rising total value locked (TVL) on the Cardano ecosystem. On November 12, the figure exceeded $350 million, the highest in seven months.

TVL (Total Value Locked) denotes the combined value of assets held in Cardano’s Decentralized Finance (DeFi) platforms. A surge in TVL often indicates higher usage and interaction within the network, which could be a positive sign pointing towards long-term prospects and potentially attracting more investors.

Recently, the trading volume on Cardano’s on-chain has seen a significant increase. Reaching a remarkable eight-month high of approximately $355 million on November 10.

Profitability Goes Up

The resurgence in ADA’s value has significantly boosted its investors’ returns, as indicated by IntoTheBlock’s data. More than six out of ten holders currently find themselves with a profit on their investment. On the other hand, nearly 38% of them are yet to recoup their initial investment, and an even smaller fraction, just 1%, are at break-even point.

The current profitability for most cryptocurrencies, excluding Bitcoin, Dogecoin, and Tron, is significantly lower than other leading cryptos. At this point in time, investors in these specific coins find themselves with losses instead of profits.

Nevertheless, the image painted a significantly grim picture during the cryptocurrency market downturn in early August this year. At that time, very few ADA holders enjoyed paper profits since the asset’s value plummeted below $0.30.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Dead by Daylight: All Taurie Cain Perks

2024-11-12 12:53