As a seasoned researcher with over two decades of market observation under my belt, I can confidently say that the current surge in Bitcoin interest is reminiscent of the dot-com boom of the late 90s. The parallels are striking: an innovative technology gaining mass appeal, skepticism giving way to acceptance, and a meteoric rise in value that has left even the most hardened analysts scratching their heads.

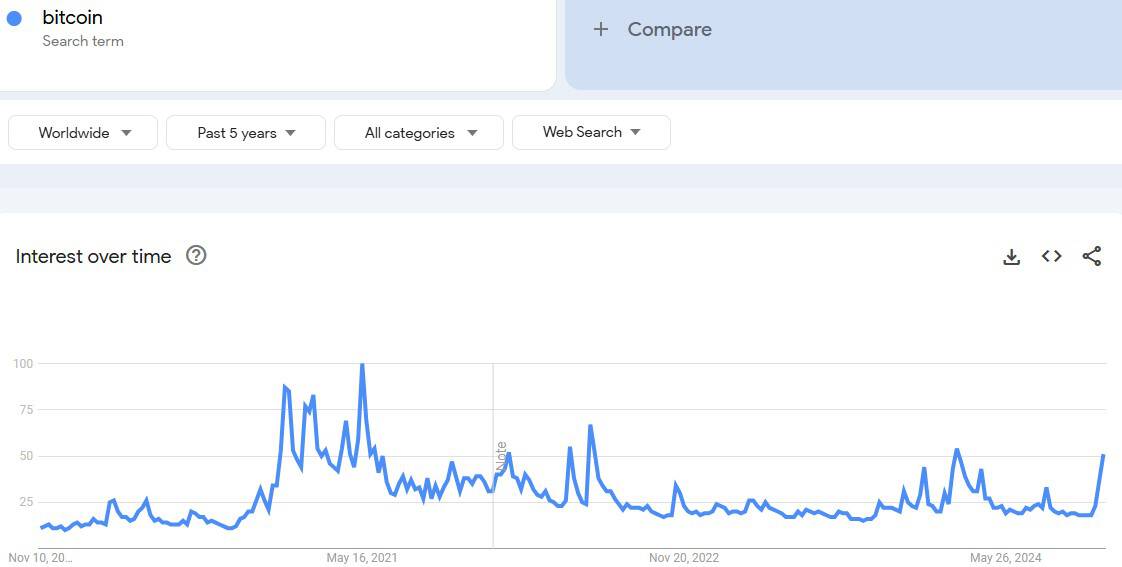

I’ve noticed an impressive spike in Google searches regarding Bitcoin, as its value has soared to unprecedented heights, surpassing $80,000 today – a new record for this digital currency!

As an analyst, I’m observing a significant increase in the level of interest, which indicates a rising global focus, as Bitcoin continues to garner attention not just from individual investors but also from institutions.

Trump’s Win Boosts Bitcoin Interest

It’s worth pointing out that interest in cryptocurrency has significantly increased following Donald Trump’s win in the U.S. presidential election. His victory ignited a massive surge in Bitcoin and the broader market because his campaign expressed support for the sector. Initially skeptical about cryptocurrencies, Trump detailed several crypto-related policies during his campaign, such as proposals for a national Bitcoin reserve and a pledge to cease the battle against cryptocurrency regulation.

Although the establishment of a Bitcoin reserve may necessitate legislative action, delaying its implementation possibly until 2025, the community anticipates that Bitcoin could be transformed into a treasured asset by corporations, governments, and prominent institutions, paving the way for its acceptance in their portfolios.

Indeed, experts are highlighting the surge in search queries and investments as indicators of a renewed enthusiasm among retail investors and a surge of novice traders entering the market.

‘State of Euphoria’

It’s noteworthy that Bitcoin’s remarkable surge is taking place with minimal volatility effects, due to substantial profit-taking on long call options which has muted any strong responses. According to QCP Capital’s recent report, this reduced volatility indicates that the market had anticipated this bullish trend in advance. As Bitcoin has broken out of its prolonged range and surpassed crucial resistance levels, the market is currently experiencing a “buoyant” phase.

As a crypto investor, I’ve noticed that perpetual funding rates are running high, and basis yields have hit levels not seen since seven months ago, suggesting a strong bullish sentiment. Yet, I find myself treading with caution, recognizing the potential for temporary downturns, possibly due to leveraged positions getting liquidated. In the past, such spikes in basis yields haven’t lasted long.

Currently, the cryptocurrency trading firm anticipates that prices will hold steady near their current values in the upcoming days, as market uncertainty subsides in anticipation of significant economic events this week. These include the release of US CPI data on Wednesday, PPI figures on Thursday, and a speech by Fed Chair Jerome Powell on Friday, which may offer further clarity regarding the possibility of a December interest rate reduction.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- How to Handle Smurfs in Valorant: A Guide from the Community

- PENDLE PREDICTION. PENDLE cryptocurrency

- Brawl Stars: Exploring the Chaos of Infinite Respawn Glitches

- Is Granblue Fantasy’s Online Multiplayer Mode Actually Dead? Unpacking the Community Sentiment

2024-11-11 19:32