As a seasoned crypto investor with a decade of experience under my belt, I must say that the current Bitcoin price surge is reminiscent of a rollercoaster ride I took at CryptoLandia back in 2017 – exhilarating, nerve-wracking, and potentially profitable. The daily chart’s bullish trend and the 4-hour chart’s rebound from $68K are clear signs that BTC is ready to soar higher, with the short-term target of $80K looking increasingly achievable.

After a steady rise over the past few months, Bitcoin‘s price has surpassed its previous peak, leaving investors curious about how much higher it might climb.

Bitcoin Price Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Looking at daily charts, it’s clear that Bitcoin has broken its previous record high of $74,000 quite strongly. Given that the market is currently close to its 200-day moving average, there’s potential for BTC to climb even higher within the next few months. As such, a short-term target of around $80,000 could be achievable.

Currently, the Relative Strength Index (RSI) suggests that the market might be overbought, indicating it may soon experience a period of consolidation or temporary correction.

As the market stays above its 200-day moving average, currently at approximately $64K, it suggests a predominantly bullish trend. This position may lead to further price increases.

The 4-Hour Chart

As I analyze the 4-hour chart, it appears remarkably consistent with recent trends. Just a few days ago, we witnessed a swift bounce back from the $68K mark. This substantial uptick triggered a bullish breakout at approximately $74K, reaching a new record high for BTC.

Currently, the Relative Strength Index (RSI) indicates that the price is overbought. This could mean a short-term correction to around $74K is likely before the market resumes its upward trend towards approximately $80K.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

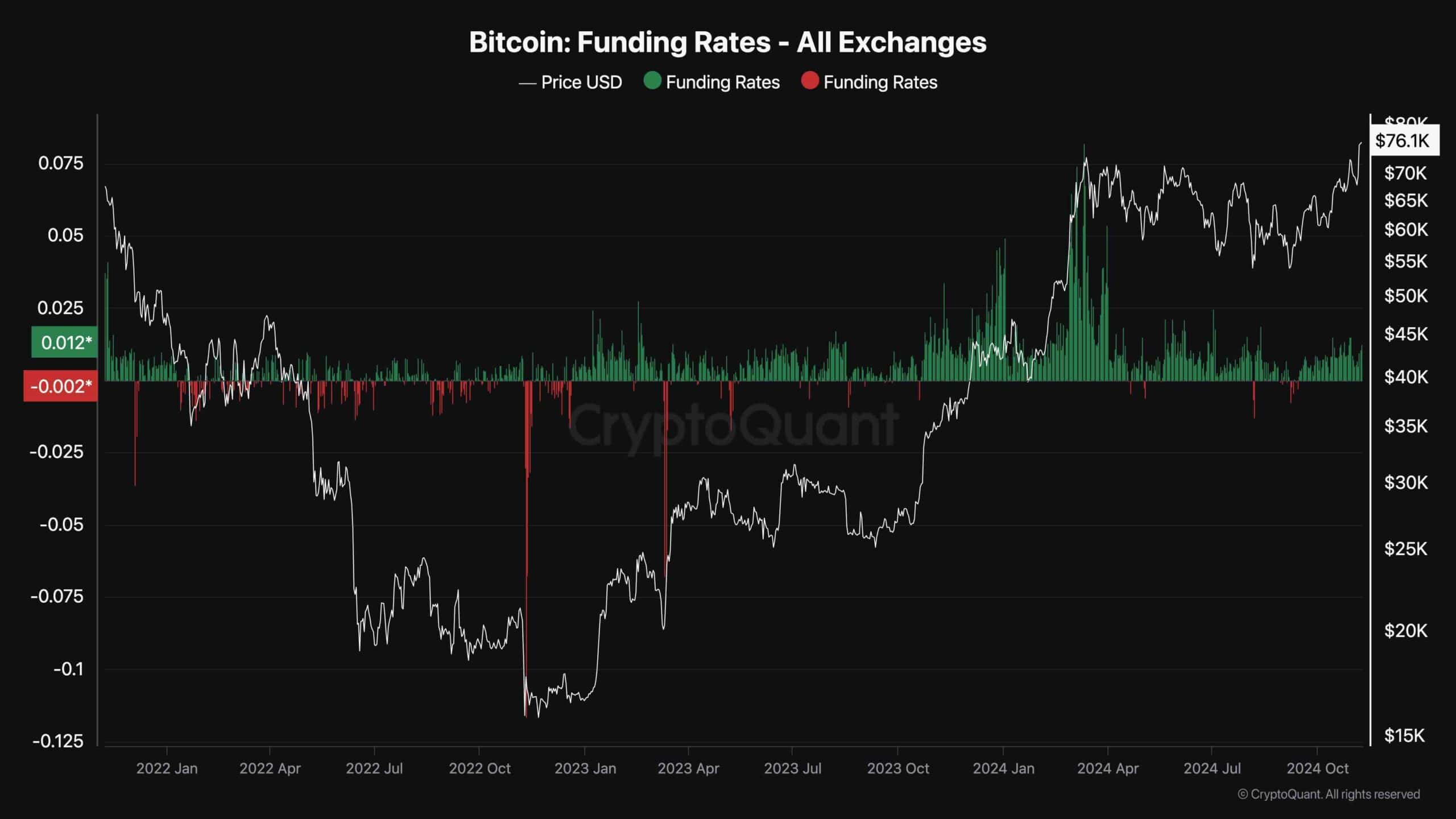

Bitcoin Funding Rates

With Bitcoin reaching an unprecedented peak in its value, investors are optimistic that a fresh upward trend is underway. In such circumstances, scrutinizing the mood of the futures market can prove incredibly valuable, since it plays a substantial role in shaping temporary price swings.

Here’s a simpler way of expressing that: This graph shows the BTC funding rate, a measure that tells us if traders are buying or selling Bitcoin more actively. When the number is positive, it suggests a bullish attitude among traders; a negative value indicates they are more pessimistic, or bearish.

Based on the graph’s indication, Bitcoin (BTC) funding rates have generally been positive for the recent weeks. Despite the market reaching a new peak, the current funding rate figures are significantly lower compared to those recorded during the previous record high earlier this year. This implies that the futures market is not yet showing signs of overheating and there’s potential for Bitcoin to climb even higher in the upcoming months.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- PENDLE PREDICTION. PENDLE cryptocurrency

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- W PREDICTION. W cryptocurrency

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- AAVE PREDICTION. AAVE cryptocurrency

2024-11-08 18:58