As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by this week’s Bitcoin and Ethereum options expiry. The sheer magnitude of contracts, totaling around $4.5 billion, is a testament to the growing maturity and sophistication of the crypto market.

On this coming Friday, the 8th of November, roughly 48,700 Bitcoin options agreements with an estimated total worth of about $3.7 billion will be settling or expiring.

Today’s expiration of options is significantly larger compared to the previous week, due to an escalation in trading volumes and market volatility over this period. This surge has been influenced by two main factors: firstly, the election of Donald Trump as President of the United States, and secondly, the anticipation of a more transparent regulatory environment.

Bitcoin Options Expiry

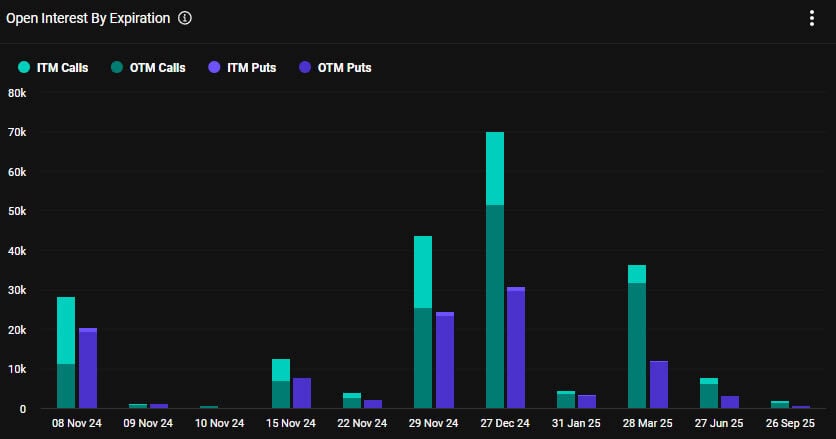

This week’s large selection of Bitcoin options has a higher number of long positions (calls) compared to short positions (puts), indicated by a put/call ratio of 0.72. Moreover, the Deribit platform shows that the most significant open interest, representing ongoing options contracts yet to expire, is concentrated at the $80,000 strike price with approximately $1.7 billion in value.

In simpler terms, according to Greeks Live, the market for derivatives based on elections is quickly losing momentum. Even though Bitcoin and Ethereum have shown significant growth and the crypto industry remains hopeful, there’s a clear trend of investors cashing out their profits in the options market as the election-related trading comes to an end.

As an analyst, I can report that the probability of a Bitcoin catastrophe, as indicated by doomsday options, has dropped below 50%. Moreover, it’s evident that implied volatility (IV) has decreased substantially across all significant terms. Interestingly, today’s massive Ethereum gains have been more pronounced than Bitcoin’s decline, suggesting a relative resilience for ETH in this market context.

Beyond the Bitcoin options available today, approximately 294,000 Ethereum options contracts are set to expire this week. The put/call ratio for these contracts is 0.65, and their total value is estimated at $850 million. With this added to the expiring crypto options for Friday, the total notional value rises to approximately $4.5 billion.

Bitcoin Hits Another ATH, ETH Surging

The cryptocurrency market’s forward thrust persists following the U.S. election results on Wednesday. At present, the total market cap stands at a five-month high of $2.67 trillion.

On November 7th, Bitcoin reached a fresh record high of $76,872 during late trading, with the Federal Reserve’s decision to lower interest rates by 0.25% contributing to this surge. Over the last month, this cryptocurrency has seen nearly a 22% increase in value as reported by CoinGecko.

On a positive note, Ethereum is now advancing, reaching a peak of $2,950 during early Asian trade on Friday mornings. This asset, which has faced negativity lately, has shown significant growth, increasing by approximately 15% over the last seven days.

After recent surges, many alternative cryptocurrencies have cooled down, but Solana (SOL) and Cardano (ADA) stand out, posting daily increases of 5% and 14%, respectively.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- ACT PREDICTION. ACT cryptocurrency

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- W PREDICTION. W cryptocurrency

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- How to Handle Smurfs in Valorant: A Guide from the Community

- PENDLE PREDICTION. PENDLE cryptocurrency

2024-11-08 10:06