As a seasoned crypto investor with over a decade of experience under my belt, I find the recent surge in Bitcoin’s hash rate to an all-time high both intriguing and concerning at the same time. The network’s security has never been stronger, but the rising costs associated with mining one BTC make me wonder if it’s worth it.

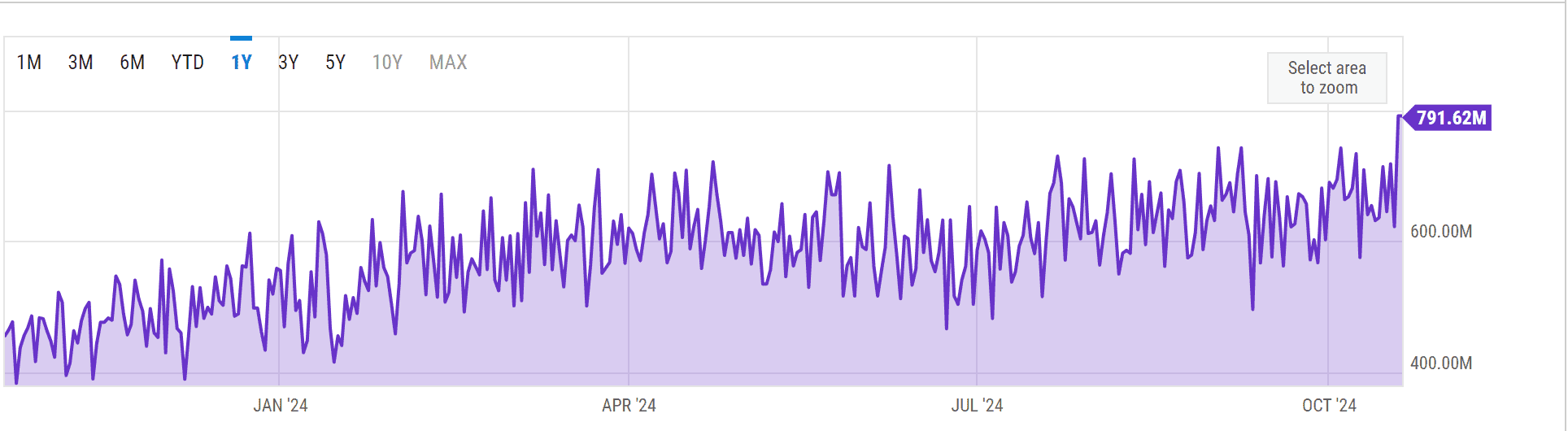

As an analyst, I’ve observed that the computing power, a crucial measure of both security and efficiency within the Bitcoin network, has soared to a new peak level of 791.62 million Terahashes per second (TH/s), based on data from Ycharts.

This new level also shows a remarkable 73.95% improvement on the particular metric from a year ago.

Key Hashrate Milestone

Over the past few weeks, data from Ycharts indicates that Bitcoin’s hash rate has seen a significant surge, varying between 574 million and 742 million around early October. This increase paved the way for Bitcoin to surpass the 791 million mark, a level it has maintained for two consecutive days since then.

The surge, often associated with the progress of superior mining equipment, follows news about the increasing influence of leading U.S. Bitcoin miners, who currently manage almost 29% of the global Bitcoin network’s processing power.

Based on the analysis by J.P. Morgan, approximately fourteen U.S.-based Bitcoin mining companies, including firms like Marathon Digital, CleanSpark, and IREn, have solidified their roles as significant global market contenders.

This increase is due to the public operators’ efficiency and financial benefits, enabling them to handle market volatility and expand their mining operations.

To outside viewers, an uptick in the network’s recorded hash rate suggests growing security. However, this increase in security comes at a higher price, as the expense to mine a single Bitcoin also rises over time.

Bitcoin Difficulty and Revenue Updates

Furthermore, the complexity of mining Bitcoins is nearing an all-time peak. As of block number 866,682, it currently stands at approximately 92.05 trillion, slightly below the record 92.7 trillion set on September 11, 2024. This remarkable achievement followed a brief surge in the Bitcoin hash rate surpassing 700 exahashes per second earlier in the week.

The network is about to undergo a new challenge adjustment, anticipated for October 22nd, which should increase the difficulty by at least 4.17%, bringing it up to approximately 95.88 trillion.

It’s worth noting that even as the mining process becomes more challenging due to increased difficulty and hash rate, miners continue to reap consistent income sources. As of October 20, 2024, daily Bitcoin mining earnings amounted to approximately $38.38 million, representing a minimal decrease of just 1.17% compared to the previous day.

Despite being 33.2% lower than its level at the same time in 2023, the size of the markdown has grown significantly over the past year. Additionally, due to the halving that took place earlier this year and an increase in mining difficulty, there is a general anticipation within the industry for potential consolidation among smaller mining operations as it becomes progressively harder for them to discover valid blocks.

Over the weekend, the value of Bitcoin reached its highest point in three months, momentarily exceeding $69,000, just under $4,000 from a record-breaking all-time high. At present, Bitcoin is being traded at approximately $68,400, representing a 5.6% increase over the past week.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- REF PREDICTION. REF cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- HIFI PREDICTION. HIFI cryptocurrency

- CGPT PREDICTION. CGPT cryptocurrency

- AKT PREDICTION. AKT cryptocurrency

2024-10-21 14:25