As a seasoned analyst with years of experience under my belt, I can confidently say that this week has been nothing short of thrilling for the cryptocurrency market. The total capitalization reaching $2.45 trillion is a testament to the growing acceptance and adoption of digital assets.

This week has been exceptionally favorable for the crypto market, with its current total capitalization reaching a staggering $2.45 trillion – a significant increase of nearly $250 billion compared to a week ago!

Speaking of Bitcoin, our leading market indicator, it’s had a remarkable week, surging over 11%. This digital currency has recently climbed above $68,000 for the first time since July, suggesting it might be aiming for even greater heights.

The cryptocurrency’s surge began on Monday, reaching an impressive peak above $64,000. Since then, it has been mostly on the rise. BTC conquered significant milestones like $65,000 and $66,000, and it appears that $69,000 is the next hurdle. This level seems challenging due to a cluster of technical resistances, but if the bulls manage to surpass it, it could pave the way for another record high.

Currently, it’s significant to point out that Bitcoin (BTC) has surpassed many other assets in the market, as demonstrated by its growing dominance. This dominance is a key indicator used by traders to measure BTC’s share compared to the rest of the industry. As per recent reports, this week alone, it reached an impressive 59% market dominance.

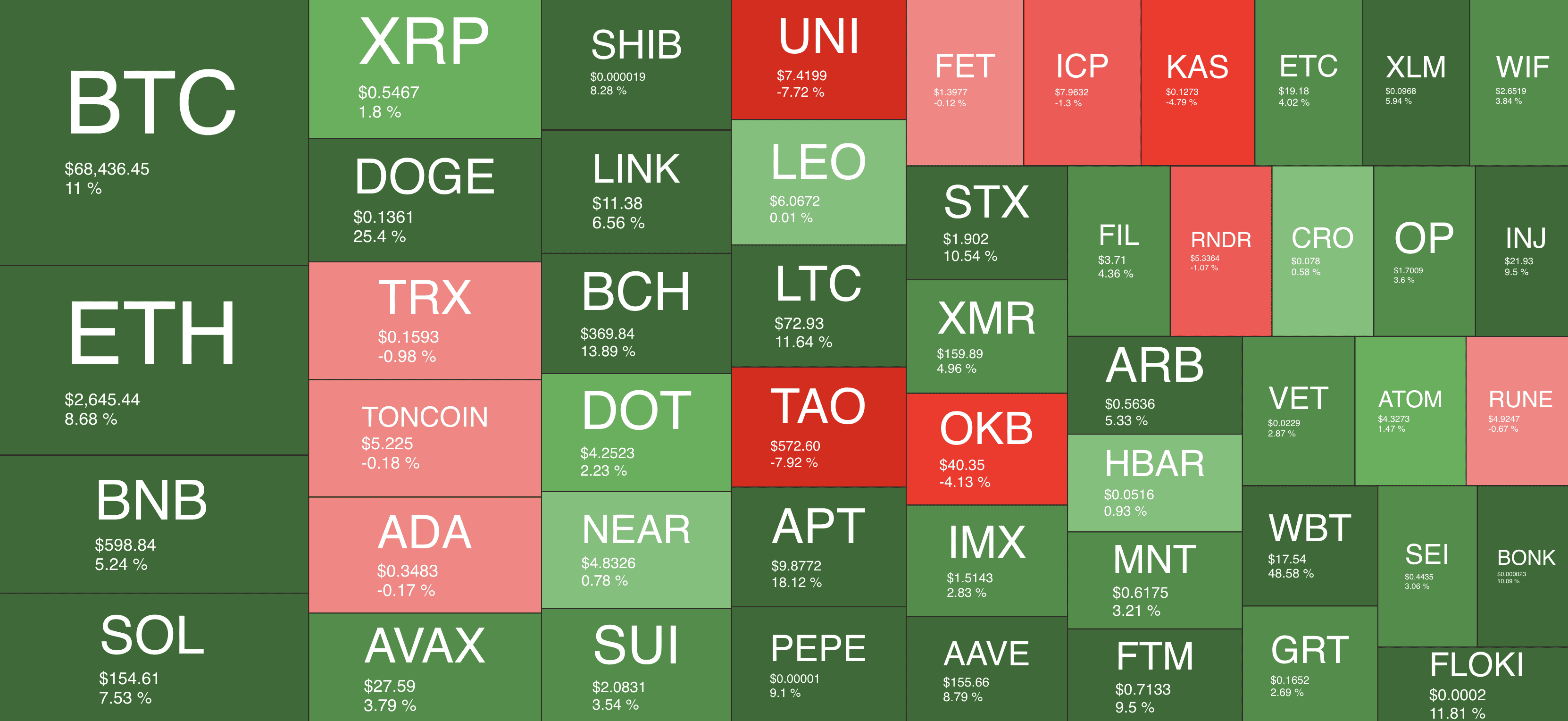

Similarly, you can observe that the top alternative coins are showing some variations in their performance as well. For instance, ETH has only risen by approximately 8.6%, while BNB experienced a more significant increase of about 5.4%. Solana (SOL) saw an uptick of 7.4%, XRP remained unchanged, and the rest have mostly stayed put.

This week’s outstanding achievement was undeniably that of Dogecoin, often referred to as the pioneer of meme coins. In just the past seven days, DOGE saw an impressive surge of 25%, even breaking into the top 10 rankings. This remarkable performance leaves one pondering if we might be on the brink of a meme coin boom.

Bitcoin’s impressive growth appears to be supported by strong underlying factors. The accumulated inflows into U.S. spot Bitcoin ETFs have surpassed $20 billion since their launch – an impressive achievement. Compared to gold ETFs, which took about five years to reach the same level of accumulated funds.

To put it simply, the market is showing strong optimism right now, bordering on excessive enthusiasm. With traders expecting an all-out October rally, the upcoming weeks promise to be thrilling and full of action!

Market Data

Market Cap: $2.45T | 24H Vol: $105B | BTC Dominance: 55.5%

BTC: $68,552 (+11.1%) | ETH: $2,641 (+8.6%) | BNB: $599 (+35.4%)

This Week’s Crypto Headlines You Can’t-Miss

As a crypto investor, I’ve noticed an intriguing trend this week: Bitcoin’s dominance has skyrocketed to a staggering 59%, indicating that it’s gobbling up the market share of altcoins. This essentially translates to Bitcoin growing significantly larger at the expense of other cryptocurrencies. The surge in whale activity might be contributing to this trend, as these large-scale investors tend to favor Bitcoin over altcoins.

A report from Chainalysis highlights a surge in Decentralized Finance (DeFi) activities, particularly in Eastern European nations, with significant growth seen in Ukraine and Russia amidst their ongoing disputes.

Vitalik Buterin, one of the co-founders of Ethereum, recently unveiled some upcoming plans for ‘The Surge,’ which is a phase in the network’s development. His focus is primarily on enhancing the underlying protocol and addressing scalability issues by implementing rollups.

In a recent development, the U.S. Securities and Exchange Commission (SEC) has offered more details about their last-minute appeal in the ongoing Ripple (XRP) lawsuit. The SEC argues that it is appealing the decision made by the federal judge regarding its stance on XRP sales to retail investors on exchanges, stating that these transactions do not violate securities laws.

U.S.-listed Bitcoin Exchange-Traded Funds (ETFs) have surpassed $20 billion in accumulated investments this year alone, with an additional $1.8 billion added just this week. This is a significant milestone that gold took five years to reach.

Monochrome Asset Management is planning to debut Australia’s inaugural Spot Ethereum Exchange-Traded Fund (ETF). They intend to utilize the Cboe exchange for this launch, which comes after Ethereum received ETF approval in the United States earlier in 2021.

Charts

This week, let’s delve into an analysis of Ethereum, Ripple, Solana, Dogecoin, and Sui – follow this link to explore the full price breakdown.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- EUR INR PREDICTION

- USD UAH PREDICTION

- DFL PREDICTION. DFL cryptocurrency

- POND PREDICTION. POND cryptocurrency

- GENE PREDICTION. GENE cryptocurrency

- PERI PREDICTION. PERI cryptocurrency

2024-10-18 18:03