As a seasoned crypto investor with a decade of experience navigating the volatile waters of the digital asset market, I can confidently say that Bitcoin is poised for another bull run. The daily and 4-hour charts both show clear signs of bullish momentum, with BTC consistently making higher highs and lows. However, I’m not entirely convinced about the immediate break above the $69K resistance level, as the bearish divergence on the RSI could suggest a correction toward $64K is imminent.

At present, Bitcoin‘s value finds itself in a crucial region, with just a strong surge beyond this point potentially propelling it towards an unprecedented peak once more.

Bitcoin Price Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

As an analyst, I’ve observed a persistent uptrend in Bitcoin’s price over the past few days, following its rebound from the $60K mark. Currently, BTC is hovering above its 200-day moving average, roughly at the $64K level. This suggests a bullish market scenario once again.

Consequently, it seems increasingly likely that Bitcoin could soon surpass the $69K barrier, potentially reaching new all-time highs.

The 4-Hour Chart

On the 4-hour scale, the market’s bullish trend is evident through consecutive peaks and troughs that are progressively higher. Yet, a potential warning sign has arisen: the Relative Strength Index (RSI) shows a noticeable bearish divergence compared to the latest price highs.

If the market doesn’t manage to surpass the $69K barrier in the near future, there’s a likely possibility it might correct downwards towards the $64K range instead.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

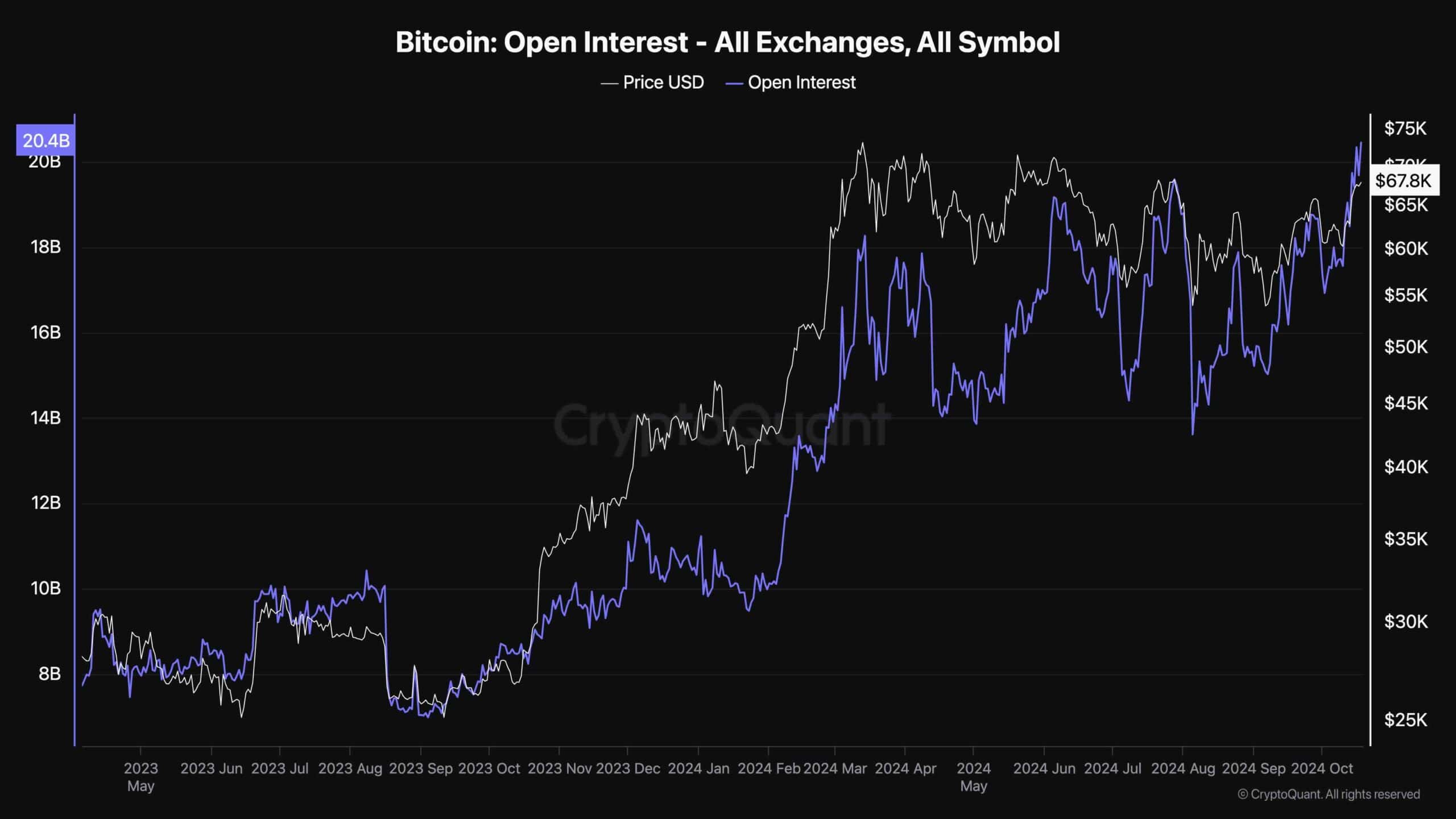

Bitcoin Open Interest

It appears that Bitcoin’s price is on track to set a fresh record high within the next few weeks, nearing the $70,000 mark with growing speed. At the same time, investor optimism is skyrocketing, as they anticipate the start of a prolonged new upward trend.

As a crypto investor, I’m closely watching this chart that illustrates the Bitcoin Open Interest metric. In simpler terms, it reflects the number of ongoing perpetual futures agreements in the market. Essentially, it serves as a gauge for the overall sentiment within the futures market, giving us insights into collective engagement and optimism surrounding Bitcoin.

It’s clear that open interest often drives price movements, as it has consistently demonstrated higher values over the past few years. While enthusiasm is crucial for a bull market, excessive optimism can cause a futures market to become overly heated, leading to a chain reaction of long liquidations. This could eventually culminate in a market crash.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- EUR INR PREDICTION

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- USD UAH PREDICTION

- FUFU PREDICTION. FUFU cryptocurrency

- BNB PREDICTION. BNB cryptocurrency

- ELA PREDICTION. ELA cryptocurrency

- EUR HUF PREDICTION

2024-10-18 17:48